- What is Mortgage Equity Withdrawal?

- What About the UK?

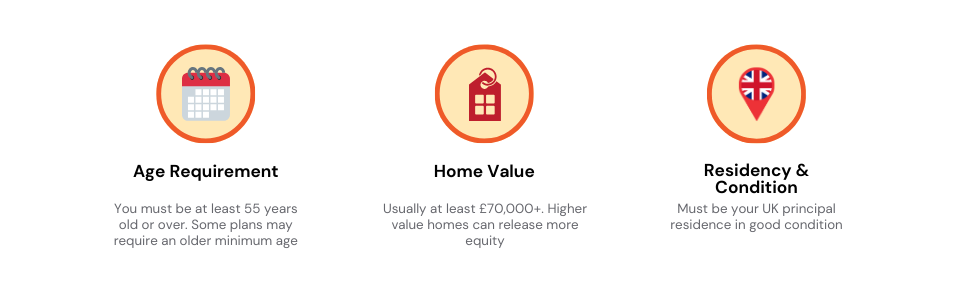

- Eligibility Criteria

- Equity Release Calculator

- What is the Right Equity Release Option For You?

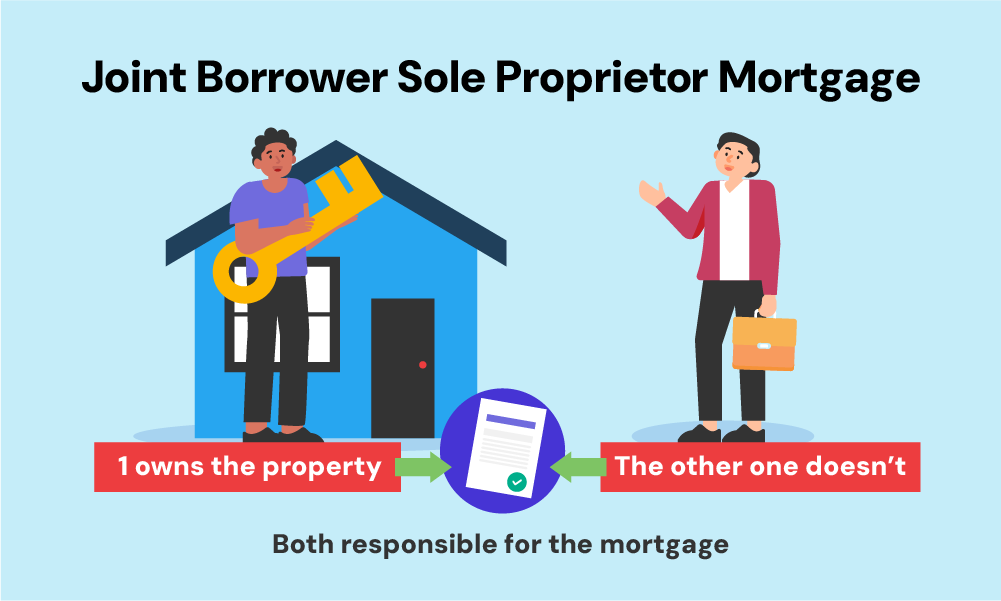

- Additional Options to Consider

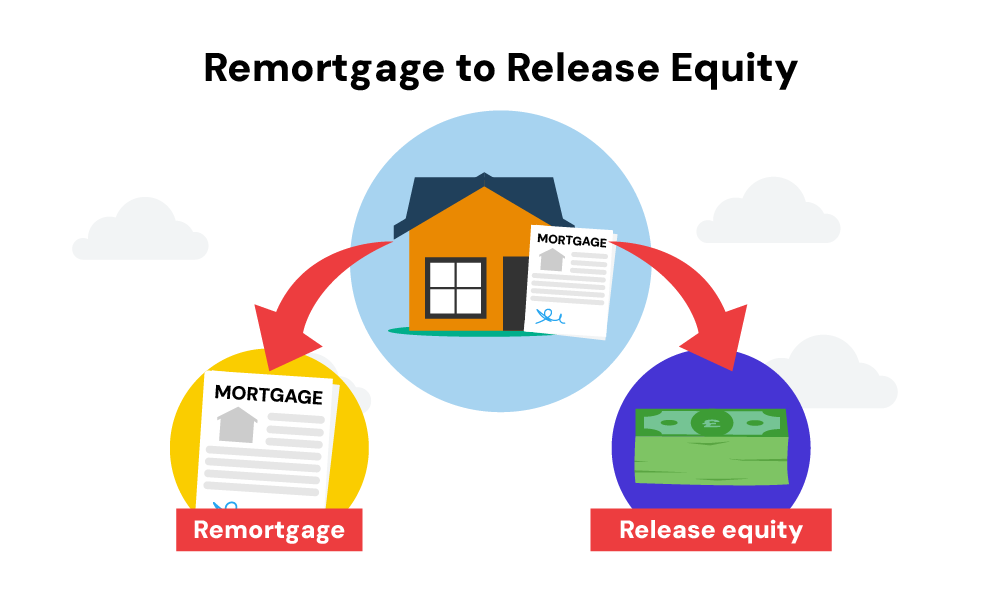

- Remortgaging to Release Equity from Your Home

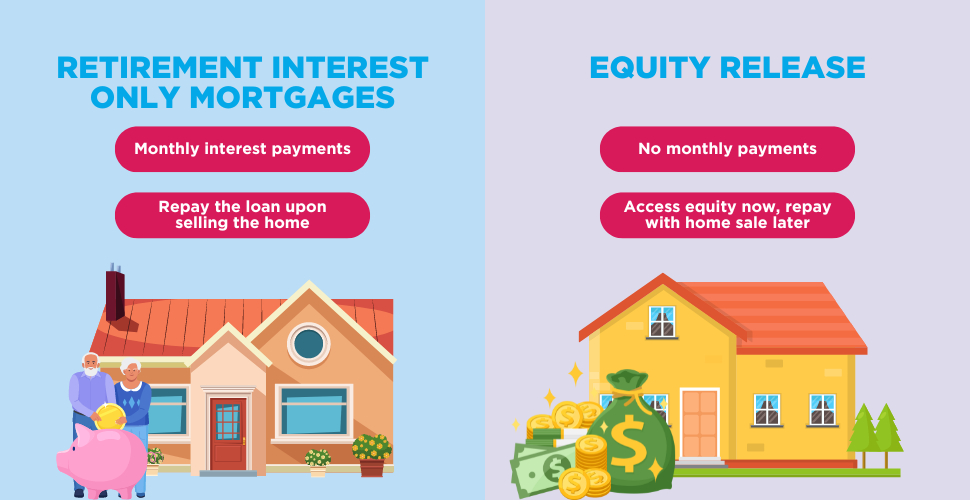

- Retirement Interest-Only (RIO) Mortgage

- Secured Loan

- Bridging Loans

- The Bottom Line

What is Equity Withdrawal? A UK Homeowners’ Guide

Have you ever come across the term ‘Mortgage Equity Withdrawal (MEW)’ and wondered what it is? You’re not alone.

MEW might seem like a complex financial term, but it’s something that could be highly relevant to many UK homeowners. Simply put, MEW allows you to access the value locked in your home, turning it into a financial asset you can use.

So what does this mean for you as a homeowner in the UK? How can you make use of it?

In this article, we’ll explain the concept of mortgage equity withdrawal and show you different ways you can tap into your home’s equity.

Whether you aim to enhance your home, clear debts, or enrich your lifestyle, getting to know MEW could open up exciting opportunities.

What is Mortgage Equity Withdrawal?

Mortgage Equity Withdrawal (MEW) is a financial term that may be more familiar to those in the US property market. But its principles apply to UK homeowners as well.

MEW is a way for homeowners to tap into the part of the property they truly own, known as equity. In some cases, this can lead to a home equity loan or a second mortgage.

But what’s equity? Equity represents the part of your property that you truly own. It’s calculated as the difference between your property’s market value and the remaining balance on your mortgage.

Here’s a simple way to look at it:

| Description | Amount | Percentage of Home Value |

|---|---|---|

| Initial house price | £300,000 | 100% |

| Deposit (10%) | £30,000 | 10% |

| Mortgage amount | £270,000 | 90% |

| Mortgage repaid so far | £50,000 | 18.5% of mortgage |

| Remaining mortgage balance | £220,000 | – |

| The current market value of the house | £330,000 | 110% |

| Equity (market value – mortgage) | £110,000 | 33.3% of home value |

This £110,000 is your equity – the amount of your home’s value that belongs to you. It’s like a hidden stash of cash that you might be able to use depending on your circumstances.

Equity doesn’t stay still. If your home’s value goes up and you pay off your mortgage, your equity grows. You can use sites like Rightmove or the Land Registry to know the current value of your home.

What About the UK?

The term ‘mortgage equity withdrawal’ might not be common in the UK, but the idea is the same.

If you’re a UK homeowner, you can use the equity in your property in various ways. The best option depends on your circumstances, the amount you want to borrow, and what you plan to use it for.

Understanding how to manage your home’s equity can unlock new opportunities. It’s not just an option for homeowners in the U.S.

It’s a strategy that might work for you in the UK as well. Whether you want to renovate your house, clear some debts, or start a new business venture, tapping into your home’s equity could be the key.

Eligibility Criteria

These equity release products have specific rules and requirements:

- You must be 55 or older.

- Your property must be worth at least £70,000.

- The outstanding mortgage on your property affects how much you can withdraw.

- Your property and its condition must meet the lender’s standards.

- The property must be your primary residence.

- Other debts and liens on the property could affect eligibility.

- You may be required to attend legal and financial counselling by the lender.

- The use of the withdrawn funds may be restricted by the lender.

These are general criteria and may vary with different lenders and products. Always check with a specific provider for detailed requirements.

>> More about Equity Release

Equity Release Calculator

Thinking about going down this road? Our handy Equity Release Calculator can give you an estimate of what might be available to you. Simply enter your details and get instant insight.

[Equity Release Calculator]

While this can give you an idea of what you could potentially release. It’s best to get professional advice from an equity release broker for a tailored solution and exact figures.

What is the Right Equity Release Option For You?

Equity withdrawal has become a popular solution for many UK homeowners, especially those over 55, but it’s not for everyone. There are multiple paths you can take, and each option must be considered carefully:

- Lifetime Mortgages – A loan secured against your home, with no required monthly payments.

- Home Reversion Plans – Selling a part or all of your home in exchange for a lump sum or regular income.

- Drawdown Lifetime Mortgages – A flexible approach where you can release equity as and when you need it.

Lifetime Mortgages

Lifetime Mortgages are a loan secured against your home, and what sets them apart is that you don’t have to make monthly payments.

The interest accumulates over time and is added to the loan, and you only pay it back when you sell your home or move.

It might sound appealing, but you should be aware of how the interest can add up over time. If you’re considering this option, seeking professional guidance can be helpful.

Home Reversion Plans

With Home Reversion Plans, you have the option of selling part or all of your home in exchange for a lump sum or a regular income.

You still have the right to live in the house, and the portion you sell determines the amount you receive. It’s a way for you to access the equity in your home without moving, but it’s a significant decision, so you might want to think it over and possibly seek professional advice.

Drawdown Lifetime Mortgages

Drawdown Lifetime Mortgages are tailored for flexibility. You can release equity from your home as and when you need it, and interest is only charged on the amount you withdraw.

This gives you control over your costs and allows you to manage your finances more effectively. If you value control and flexibility, this might be the right option for you, but as with all financial decisions, understanding all the details is crucial.

Additional Options to Consider

For those who might not fit the traditional equity release profile, there are other ways to access the value of your property.

If you’re looking to help a family member onto the property ladder, a Joint Borrower Sole Proprietor (JBSP) mortgage might be an option worth exploring.

Think Before You Leap

Your unique circumstances, such as age, health, property value, and future financial plans, will heavily influence your choice. Always consider the size and duration of any additional debt and how it will affect your future financial stability.

Seek Professional Advice

Consulting a qualified mortgage advisor who specializes in equity withdrawal can guide you through these complex decisions. They can help you understand the nuances and make an informed choice that fits your life.

Remortgaging to Release Equity from Your Home

Remortgaging for equity release is like getting a new mortgage, but this time, you’re borrowing more against the value of your home. It’s turning part of what you’ve already paid off into accessible funds.

Now, here’s the thing: doing this might increase the overall loan-to-value (LTV) of your mortgage. And that could mean more interest on your monthly payments.

But before you dismiss the idea, consider this: it could still be cheaper than other borrowing options like secured loans. It’s all about the numbers, so it’s worth sitting down with your mortgage broker and going through the figures.

But wait, there’s more you should know:

- Negative Equity. If house prices take a sudden nosedive, your equity could plummet, too. This has the potential to leave you owing more than your home is worth, known as negative equity. It’s a risk to be aware of.

- Early Repayment Charges. Before taking the plunge, always check for any early repayment charges or exit fees on your current mortgage. It’s those little details that could turn a good idea into an expensive one.

Remortgaging to release equity is a handy tool, but it’s not one to use without careful thought. It might offer a lower-cost way to borrow, but there are risks and costs to weigh up.

Like anything to do with money, professional advice can make all the difference.

Retirement Interest-Only (RIO) Mortgage

RIO mortgages are unique products designed for retirees, letting you release equity from your home or possibly reduce your monthly payments.

There’s no set term for these mortgages. They only become repayable when everyone named on the mortgage has passed away or entered long-term care.

This offers a way to access the value you’ve built up in your property without the usual constraints of traditional mortgages.

Secured Loan

If you’re a homeowner, secured loans might be available to you. They often get arranged faster than other financial products.

Essentially, these loans are like secondary mortgages, using the equity in your home as collateral. This debt would be secondary to your main mortgage, meaning the lender has a second priority for repayment if your home were repossessed.

Interest rates tend to be higher compared to primary mortgages, but the terms are usually shorter, so you might end up paying less in total.

Bridging Loans

Though often used for business, bridging loans can sometimes be an alternative to equity withdrawal. This could be the case if remortgaging or equity release isn’t suitable for you. They’re quick to set up but are short-term and come with substantial interest rates and costs.

Exit Strategy: With a bridging loan, you’ll need a solid plan for repaying it if you’re not selling your home to cover the cost. Different lenders will have different requirements for this.

The Bottom Line

Retirement should be a time of enjoyment, not financial stress. Yet, venturing into equity-release financial agreements without guidance can be risky. The path may seem unclear, but it doesn’t have to be.

This is where a mortgage broker comes in handy. With expert knowledge in the market, a good broker offers you personalised service tailored to your unique situation.

They’ll fully explain the benefits of products within equity release, remortgages, bridging loans, or retirement mortgages, ensuring that you’ve considered all options. They turn the complexity of equity withdrawal into a manageable task.

Imagine the time you’ll save with a broker doing the legwork for you. Consider the potential savings they might find through better interest rates or lower fees.

So why go it alone? With an expert broker at your side, there’s no need to stress over the fine details of equity withdrawal. They make the process simple, transparent, and tailored to you.

Simply fill out this quick form today, and we’ll link you with a top mortgage broker specialising in equity release

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

How much equity can I withdraw from my property?

This depends on various factors such as the value of your property, the outstanding mortgage, and the lender’s terms. Generally, it can range from a small percentage to up to 60% of the home’s value.

Is equity withdrawal right for me?

An engaging question and one without a straightforward answer. It’s best to consult with a financial expert or a broker, as your personal circumstances will determine the suitability of equity withdrawal for your needs.

What are the costs associated with equity withdrawal?

Expect to face legal and valuation fees, potential broker fees, and possibly higher interest rates. These costs can vary widely, so it’s crucial to get a clear picture from your lender or broker.