- What Are Large Mortgages of £5 Million or More?

- Who Qualifies for a £5 Million Mortgage?

- Where Can I Get a £5 Million Mortgage?

- What Are Interest Rates & Fees on £5 Million Mortgages?

- How Large of a Down Payment Do I Need?

- How Much Income Should I Have?

- How Much Are the Monthly Repayments for a £5 Million Mortgage?

- Whatâs the Application Process for £5 Million+ Mortgages?

- Should I Use a Broker for My £5 Million+ Mortgage?

- The Bottom Line

How To Get a £5 Million Mortgage in the UK?

Securing a residential mortgage of £5 million or more may seem out of reach for most homebuyers.

But, for high-net-worth individuals and families seeking to purchase high-value properties, large mortgages of this size are obtainable in the UK.

This complete guide provides an overview of £5 million mortgages, including how to qualify, lenders, interest rates and fees, documents needed, down payments, and the application process.

What Are Large Mortgages of £5 Million or More?

In the mortgage industry, loans exceeding £5 million are classified as large mortgages.

These specialised products are structured to finance luxury residential properties typically purchased by high-net-worth borrowers.

While mainstream lenders cap their loans to around £2 million, specialised private banks and other niche lenders accommodate very large mortgage values.

£5 million mortgages fall at the upper limit of what most lenders will offer, even in the large market.

These ultra-high-value mortgages demand substantial down payments and strong applicant profiles to mitigate their outsized lending risk.

Expect heightened eligibility standards, higher interest rates, and additional fees relative to conforming mortgages.

Who Qualifies for a £5 Million Mortgage?

Obtaining mortgage approval for £5 million or greater requires meeting strict eligibility criteria:

- Exceptional Income & Assets. Lenders want income and asset documentation verifying your ability to comfortably repay the loan. Expect to provide years of tax returns, bank/investment account statements, information on any real estate or businesses owned, and more. Underwriters will assess your net worth and liquid assets versus liabilities.

- Large Down Payment. Down payments of 35% to 50% are typical for large mortgages over £5 million. This upfront equity substantially reduces the lender’s risk.

- Excellent Credit Scores. Pristine credit history and payment records are mandatory. Any credit red flags like late payments or collections accounts can jeopardise approval odds.

- Low Debt-to-Income Ratio. Your total monthly debt payments, including the mortgage, ideally should not exceed 36% of your gross monthly income. Lower ratios improve the chance of success.

- Steady Employment History. Consistent and stable employment is crucial. Lenders prefer borrowers with a steady employment history as it suggests a reliable source of income.

- Property Type and Value. The type and value of the property you intend to buy are also considered. Lenders ensure the property’s value justifies the mortgage amount.

In short, underwriters want assurance you can repay the loan and have skin in the game via a sizable down payment. Expect an intensive vetting process.

Where Can I Get a £5 Million Mortgage?

If you’re considering a mortgage above £5 million, it’s unlikely you’ll find options with regular lenders. Instead, specialist lenders who understand the needs of high-net-worth individuals are your best bet.

These lenders are more open to complex income sources and focus mainly on whether you can afford the loan.

To find the right lender, a broker with experience in high-value mortgages can be invaluable. They know the market and can negotiate deals you might not get on your own.

These specialist lenders often set their criteria based on your specific financial situation, which means there’s room for negotiation.

As mentioned, typically, you might need to put down a deposit of 35% to 50%, but sometimes less might be accepted.

It’s important to have a broker who has good relationships with these lenders, as this can greatly influence your loan approval.

What Are Interest Rates & Fees on £5 Million Mortgages?

Given their non-conforming loan amounts and risk profiles, large mortgages have pricing tiers distinct from mainstream offerings:

- Interest Rates. Expect to pay at least one percentage point over conforming fixed and tracker rates for a comparable purchase or remortgage. As of writing, the Bank of England base rate hovers around 5.25%. Mortgage rates depend on the lender, your financial health, and the type of rate you choose.

- Arrangement Fees. Upfront mortgage arrangement fees are generally 1% to 2% of the loan amount. At £5 million, this equates to £50,000 to £100,000 in lender fees to secure financing.

- Early Repayment Charges. Lenders charge substantial ERCs if you exit the deal or refinance during the initial years, often 1% to 5% of the outstanding balance. Carefully consider loan terms in case plans change.

- Solicitor & Valuation Fees. You’ll pay legal fees for conveyancing services plus valuation/survey costs. Usually, this ranges from £500 – £1,150.

- Stamp Duty. This tax on property purchases can be significant for a property worth £5 million. It’s important to factor in this cost when budgeting for your mortgage.

- Insurance. Building insurance is essential for your property, and its cost varies based on the property and cover level. You might also want to consider life insurance linked to the mortgage.

- Broker Fees. If you use a mortgage broker, they may charge a fee for their services. This can be either a fixed fee or a percentage of the loan amount

How Large of a Down Payment Do I Need?

You’ll need to put up at least 35% and upwards of 50% of the cost of a £5 million home as a down payment. This upfront equity is crucial for two reasons:

- Risk Reduction. For lenders, large loans are a big risk. By requiring a large down payment, they are protecting their money in case you don’t pay back the loan.

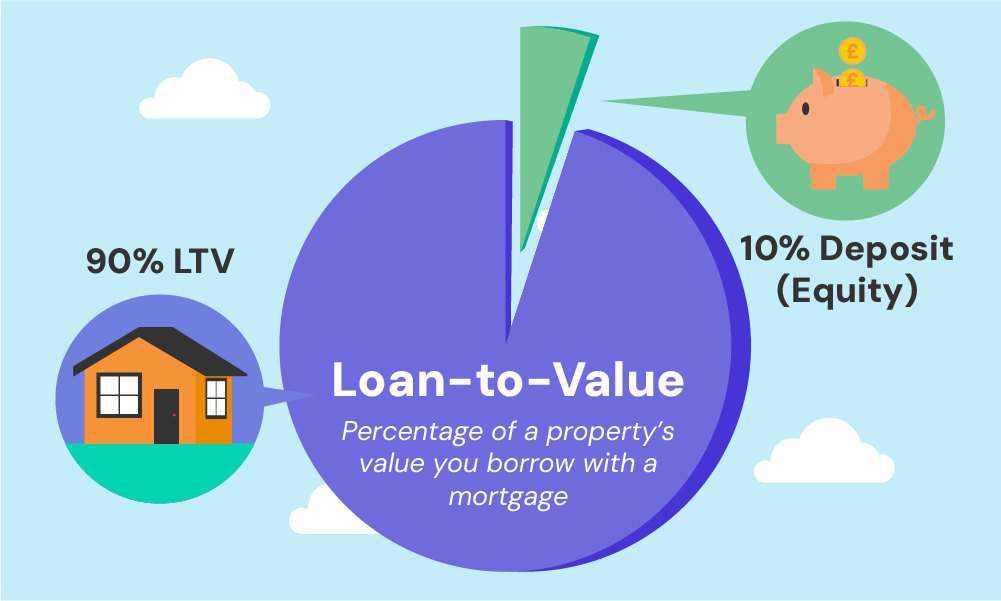

- Loan-to-Value (LTV) Ratio. Most lenders won’t give you a loan for more than 65% to 70% of the property’s value if the loan is over £5 million. This means you need to put down a big down payment to keep the loan amount within the lender’s limits.

Saving up 35% to 50% of the purchase price can be tough unless you already have a lot of cash.

For example, a 50% down payment would be £2.5 million. It’s a good idea to start planning and saving for your dream home well in advance.

How Much Income Should I Have?

Securing a £5 million mortgage hinges largely on your income. Lenders use a formula called ‘income multiples‘ to decide the amount they’re willing to lend.

Here’s how it works: they multiply your yearly income by a specific number to calculate the maximum loan they can offer.

For a mortgage as substantial as £5 million, you’ll need a considerably high income.

As a rough guide, lenders may offer up to 4 times your yearly earnings. Therefore, to be eligible, your annual income should be at least about £1,250,000.

Some lenders may be more flexible, offering up to 5 times, or in exceptional cases, even 6 times your annual income, particularly if you have a solid financial background.

This implies that you would need a minimum yearly income ranging from £833,333 to £1,000,000.

How Much Are the Monthly Repayments for a £5 Million Mortgage?

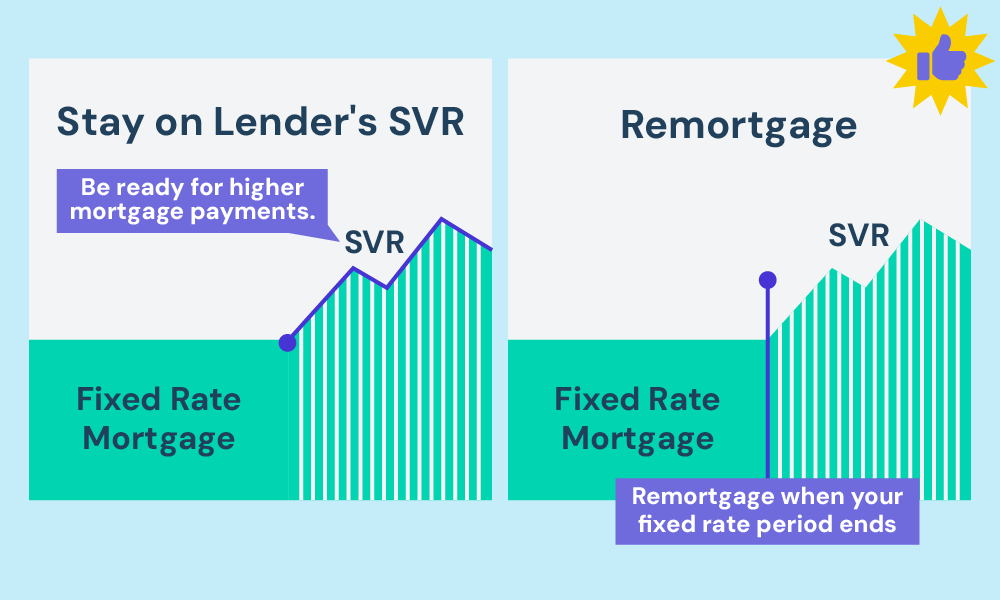

Most UK lenders start with a fixed interest rate for the first few years (usually 5). After that, the loan typically switches to a standard variable rate (SVR), or you could remortgage and lock in a new deal.

Basically, your payments might change depending on what happens after that fixed period.

Before we get into the numbers, here’s a quick heads-up: the example below is just an example. Your actual repayments will depend on your lender’s terms, fees, and interest rates.

Here’s a quick snapshot of what your monthly payments could look like:

Example Monthly Payments for a £5 Million Mortgage (4.5% Fixed for 5 Years)

| Mortgage Type | Monthly Payment (£) | Total Paid Over 5 Years (£) |

|---|---|---|

| Repayment Mortgage | £93,215 | £5,592,906 |

| Interest-Only Mortgage | £18,750 | £1,125,000 |

To clear something up:

- A repayment mortgage chips away at both the loan and the interest, so by the end of the term, you’ll owe nothing.

- An interest-only mortgage only covers the interest for now, leaving the full loan amount (to be paid later.

Want to see how much you’ll repay for a mortgage? Use our mortgage calculator.

What’s the Application Process for £5 Million+ Mortgages?

Securing a £5 million mortgage requires a more detailed approach than a standard mortgage due to the significantly higher amount involved.

Here’s a structured way to go about it:

- Check Your Finances. Start by thoroughly reviewing your income, savings, and any existing debts. Prepare important documents like your recent payslips and bank statements, which are crucial for the application.

- Improve Your Credit Score. A strong credit score is vital for securing a mortgage, especially one of this size. Check your credit report for any inaccuracies and settle any outstanding debts. A higher credit score often translates to more favourable mortgage terms.

- Budget for Extra Costs. Remember, purchasing a property involves additional expenses besides the mortgage. This includes significant stamp duty, legal fees, and possibly surveyor fees. It’s important to include these in your overall budget.

- Choose the Right Lender. Choose between traditional banks and private lenders based on which one suits your financial needs best. Each offers different products and services, so pick one that aligns with your financial situation.

- Apply for the Mortgage. With your preparations in place, proceed to apply for the mortgage. The lender will evaluate both the property’s value and your financial stability. If everything aligns, they will offer you the mortgage.

Should I Use a Broker for My £5 Million+ Mortgage?

In short, yes. Getting a £5 million+ mortgage without a broker is very difficult.

Brokers have the market knowledge and connections to find lenders who can give you these large loans. They also know how to manage the complex application process, which can save you time and increase your chances of getting approved.

Not all brokers specialise in large mortgages, so make sure you work with someone who has experience with high-value lending.

The Bottom Line

This guide has given you a comprehensive overview of the UK’s £5 million+ mortgage market. With such buying power, you can own some of the most luxurious homes and estates in the country.

While the application process is demanding, securing your dream home is well worth the effort.

Given the complexities involved in obtaining a high-value mortgage, it’s wise to consult with a mortgage broker. They can provide personalised advice and guidance, ensuring you navigate the process smoothly and confidently.

To get started, get in touch today. And we’ll set up a free, quick, and no-obligation consultation with your ideal mortgage advisor.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What documents do I need for a mortgage application?

Assembling a complete application package is vital when applying for any jumbo mortgage, especially at £5 million. At a minimum, collect:

- Photo ID (passport, driver’s licence)

- Proof of address (recent utility bill, council tax statement, etc.)

- Bank statements from all current accounts over the past 12+ months

- Documentation of all assets like investment & retirement accounts

- Multiple years of personal and business tax returns

- Information on properties owned and corresponding mortgages

- Records detailing other loans, credit cards, expenses, income sources

This financial picture substantiates your net worth, income streams, and overall ability to meet repayment obligations. Chase down every document on the lender’s checklist to avoid processing delays.