- What is a Lifetime Mortgage?

- How Do Lifetime Mortgages Work?

- Who Can Get a Lifetime Mortgage in the UK?

- How to Apply for a Lifetime Mortgage?

- How Much Can You Borrow with a Lifetime Mortgage?

- Types of Lifetime Mortgages

- Is a Lifetime Mortgage the Right Choice for You?

- Who Offers Lifetime Mortgage Providers?

- How Much Interest Will I Pay on a Lifetime Mortgage?

- Are There Other Costs with Lifetime Mortgages?

- Exploring Alternatives to Equity Release

- Key Takeaways

- The Bottom Line

Lifetime Mortgages Explained: A Comprehensive Guide 2025

Houses in the UK are worth a lot these days—on average, around £292,059 as of October 2024. That’s why many homeowners aged 55 and older are realising their homes could be the key to unlocking extra cash.

With a lifetime mortgage, you could do all sorts of cool things, like upgrading your house, travelling to amazing places, helping out your family, or just enjoying life with fewer money worries.

But what is a lifetime mortgage exactly, and is it the right choice for you?

In this article, we’ll explain everything you need to know: how these mortgages work, their pros and cons, and who they’re right for.

We’ll also share why they’re becoming so popular and tips to help you decide if one is a good fit for you

This guide is here to give you all the information you need to make the best choice for your future.

What is a Lifetime Mortgage?

A lifetime mortgage is a special kind of loan for homeowners who are 55 or older. It lets you take money from your home’s value without having to move or sell it.

You can borrow part of your home’s worth, and how much you get depends on your age and how much property value.

This isn’t like a regular loan which you have to pay back every month. Instead, you pay back everything – the money you borrowed plus the interest – when you die or if you have to move into care.

How Do Lifetime Mortgages Work?

Lifetime mortgages are a bit like regular mortgages because they let you borrow money using your home.

But here’s the twist: with a regular mortgage, you make monthly payments to pay off both the amount you borrowed and the interest.

With a lifetime mortgage, you don’t have to pay anything back each month.

Instead, the interest on a lifetime mortgage builds up over time. This is called “compound interest,” which means the interest gets added to what you owe, and then the next year, you’re charged interest on that bigger amount.

It works differently because you don’t repay anything until later—usually when you pass away or move into long-term care.

Now, here’s where lifetime mortgages give you some control. You can choose to pay off some or all of the interest while you’re still living in your home.

Doing this keeps the loan from growing too big. But if you prefer, you can skip the payments entirely, and the interest will just keep adding up until the whole loan is paid back.

To make this clearer, let’s look at an example:

Suppose you take out a lifetime mortgage of £100,000 at an annual interest rate of 5%.

In the first year, the interest is £5,000, so you owe £105,000. In the second year, the interest increases to £5,250, so you owe £110,250.

| Year | Interest | Total Owed |

|---|---|---|

| 1 | £5,000 | £105,000 |

| 2 | £5,250 | £110,250 |

| 3 | £5,512.50 | £115,762.50 |

This shows how compound interest makes the amount grow over time.

When it’s time to repay the loan, the money usually comes from selling your home. This way, you don’t need to worry about making big payments during your lifetime, and the process is simple for your family.

Who Can Get a Lifetime Mortgage in the UK?

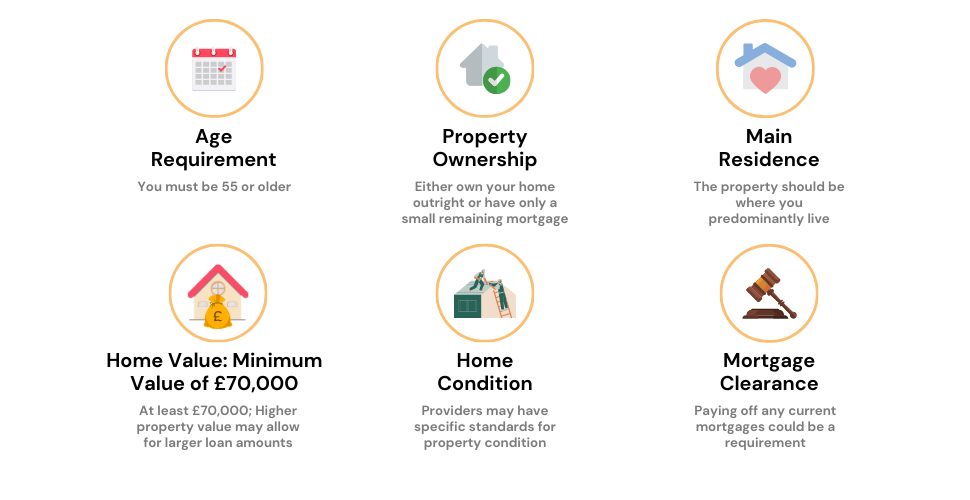

To qualify for a lifetime mortgage, you must meet certain eligibility criteria. These include:

- Be at least 55 years old. Some providers may set a higher minimum age.

- Own your home outright or have a small mortgage.

- Live in your home as your main residence.

- Your home must be worth a certain amount at least £70,000 or more.

- Your home must be in good condition. Some providers may have specific requirements related to construction type or location.

- You may need to pay off any existing mortgages on your home.

Some providers also take other factors into account, such as your health and lifestyle.

For instance, people with certain health conditions may qualify for enhanced plans that let them borrow more.

While income isn’t usually a major consideration, some providers might ask about it to better understand your situation.

Since different providers have different rules, it’s important to shop around and find the one that best fits your needs.

A financial adviser can help you figure out if you qualify and guide you towards the right provider. They’ll also explain how the loan works and answer any questions you might have.

If you’re considering a lifetime mortgage, remember to check for things like a “no negative equity guarantee.” This ensures you’ll never owe more than your home is worth.

It’s also a good idea to talk to your family about your plans so everyone understands how this could affect them.

Meeting these requirements is the first step to deciding if a lifetime mortgage is right for you.

How to Apply for a Lifetime Mortgage?

If you think you qualify for a lifetime mortgage, here’s how the process works:

- Decide Why You Want a Lifetime Mortgage. Start by thinking about why you want a lifetime mortgage. Do you need money for home improvements, a holiday, or helping your family? It’s also important to check if you qualify—you’ll need to be at least 55 years old and own a property. Think about how this might affect any inheritance you plan to leave or benefits you receive, like Pension Credit.

- Get Professional Advice. Talk to a mortgage adviser who knows about lifetime mortgages and equity release. They’ll look at your situation and help you decide if it’s the best choice. A good adviser can also explain how the loan works and what it means for your future.

- Compare Different Options. There are different types of lifetime mortgages to choose from. A drawdown option lets you take smaller amounts as needed, while a lump sum gives you all the money at once. If you have certain health conditions, an enhanced plan might let you borrow more. Take a close look at the interest rates, fees, and features to pick the option that works best for you.

- Pick a Trusted Provider. Choose a provider that follows the rules set by the Equity Release Council. This group makes sure lenders treat customers fairly and follow strict standards.

- Apply for the Mortgage. Fill out the forms with your adviser or directly with the lender. They’ll ask for details about you and your property.

- Get Your Property Valued. The lender needs to know how much your home is worth. They’ll send a professional surveyor to check your property. This helps them decide how much they can lend you.

- Work with a Solicitor. You’ll need a solicitor to handle the legal bits. They’ll explain the terms of the mortgage and make sure you understand everything before you sign.

- Review and Accept the Offer. Once your application and property valuation are done, the lender will give you a formal offer.

- Take your time to read it carefully. If you’re unsure about anything, ask your solicitor or adviser to explain.

- Sign and Finalise the Deal. When you’re happy with the offer, sign the papers to complete the process. The lender will then release the money to you or your solicitor.

- Manage the Loan (If Needed). Depending on your mortgage type, you might have to make some decisions later. For example, you can choose to pay off some of the interest or take more money if you’ve chosen a drawdown option.

How Much Can You Borrow with a Lifetime Mortgage?

The amount you can borrow with a lifetime mortgage depends on a few key factors: your age, your property’s value, and even your health and lifestyle. Here’s what you need to know:

- Older people can usually borrow more. This is because the lender expects the loan to be repaid sooner, either when you pass away or move into long-term care. If you’re younger, the amount might be smaller since there’s more time for interest to build up.

- The higher the value of your property, the more you can borrow. For example, a house worth £500,000 will usually allow for a larger loan than one worth £150,000.

- Some providers look at your health and lifestyle. If you have certain health conditions or habits (like smoking), you might qualify for what’s called an “enhanced” lifetime mortgage, which could let you borrow more.

- Interest rates also play a role. When rates are lower, you might be able to borrow a bit more. On the other hand, higher rates can reduce the amount available to you.

If you’re curious about how much you could borrow, the fastest way to find out is to use an equity release calculator.

This tool gives you an estimate based on your details, but remember, it’s not financial advice—it’s just a guide to help you get an idea.

For an exact figure and to fully understand your options, it’s best to speak to a professional adviser who can give you personalised advice.

Types of Lifetime Mortgages

There are four main types of lifetime mortgages:

Roll-up lifetime mortgage

This type allows you to receive a lump sum of money without having to make any monthly payments. Similar to what we’ve discussed above, the interest on the loan is added to the outstanding balance. This is then repaid when you sell your home, usually when you die or go into long-term care.

This type allows you to withdraw money from your home gradually, rather than receiving a lump sum. Interest is only charged on the money that you withdraw, which can be a good option if you don’t know how much money you’ll need in the future.

Flexible lifetime mortgage

This type allows you to make voluntary payments towards your loan. This can be a good way to reduce the amount of interest that you pay, and it can also give you more control over your finances.

This type is specifically designed for people with certain medical conditions. It can allow you to unlock more equity from your home and may offer improved interest rates.

The best type of lifetime mortgage for you will depend on your circumstances and needs. It’s important to speak to an equity release advisor to get advice on which type of mortgage is right for you.

Is a Lifetime Mortgage the Right Choice for You?

To decide if a lifetime mortgage is right for you, you need to carefully consider your financial needs, long-term plans, and property value trends.

In a growing property market, a lifetime mortgage could allow you to capitalize on the appreciation of your home.

But, market trends can change. So it’s crucial to evaluate both the advantages and disadvantages in the context of your unique situation.

Pros:

- Flexibility. You have a range of repayment options, giving you more control over your finances.

- Stay in your home. You can stay in your home for as long as you want.

- No monthly repayments. You may not have to make regular payments, which can reduce your financial burden.

- Access to tax-free cash. You can release tax-free cash from your home without selling it.

- Peace of mind. Features like negative equity guarantees give you peace of mind that you won’t leave a debt burden on your loved ones.

- Fund your dreams. Whether you want to travel, support your family, or pursue hobbies, a lifetime mortgage can help you make them happen.

Cons:

- Interest accumulation. Interest compounds on both the initial amount borrowed and previously accrued interest.

- Impact on benefits. Releasing equity could affect your eligibility for means-tested government support, leading to unexpected reductions.

- Reduced inheritance. This choice may reduce the value left in your property, affecting your beneficiaries.

- Restrictions on moving home. Some lifetime mortgages may limit your ability to relocate or require lender approval.

- Additional costs. There are various fees to consider, including arrangement and valuation charges, legal expenses, and early repayment penalties.

- Limitations on future choices. A lifetime mortgage could restrict your future financial decisions, such as downsizing or moving into care.

By understanding both the advantages and disadvantages of a lifetime mortgage, you can better assess if it’s right for you. This is a complex financial product, so it’s important to seek professional advice before making a decision.

Who Offers Lifetime Mortgage Providers?

Lifetime mortgages are primarily offered by specialist equity release providers who understand the unique needs of older homeowners.

These providers have tailored products designed for those interested in lifetime mortgages. Here’s a list of some leading lifetime mortgage providers:

- Aviva

- Legal & General

- More2Life

- Canada Life

- Pure Retirement

- Just

- Standard Life Home Finance

- Scottish Widows

- LV

Each lender has unique features, so make sure to find the one that fits your needs and situation best. Consulting with an equity release adviser can help you make the right choice.

How Much Interest Will I Pay on a Lifetime Mortgage?

The interest rate on a lifetime mortgage can vary depending on the specific plan you select and its duration. Currently, the average equity release interest rate, as reported by the Equity Release Council, stood at 5.74%.

There are two main types of interest rates on lifetime mortgages:

- Fixed-rate lifetime mortgages. With a fixed-rate lifetime mortgage, you know the interest rate that will be applied to your loan for its entire duration. This provides stability, but the initial rate may be higher than a variable rate.

- Variable-rate lifetime mortgages. The interest rate on a variable-rate lifetime mortgage can fluctuate based on market conditions. This means that your interest could go up or down over time, following specific indexes or market trends.

Are There Other Costs with Lifetime Mortgages?

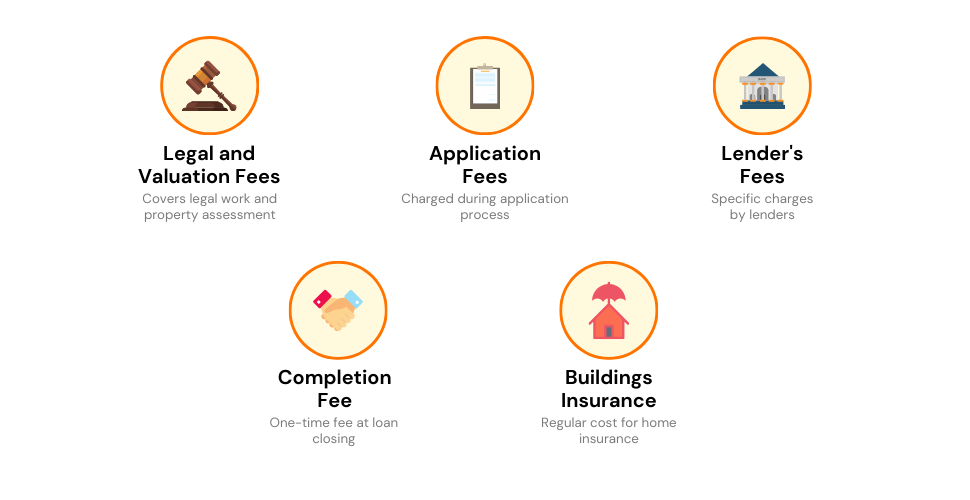

Releasing equity from your home with a lifetime mortgage can come with additional costs, including:

- Legal and valuation fees – These fees cover the costs of legal work and the assessment of your property’s value.

- Application fees – These fees are charged during the application process.

- Lender’s fees – Some products may include specific fees charged by the lending institution.

- Completion fee – This is a one-time fee paid at the closing of the loan process.

- Buildings insurance – This is a regular expense to ensure coverage for the physical structure of your home.

It is important to understand the full extent of costs associated with equity release before you commit to a plan.

Exploring Alternatives to Equity Release

A lifetime mortgage may be a good option for many, but it’s not the only way to access your home equity in retirement. Here are some other options to consider:

Downsizing

If you want to move to a smaller home, you can sell your current property and use the proceeds to fund your retirement.

This can be a good option if you no longer need a large home or if you want to free up some cash. But, it’s important to factor in the costs of moving, such as stamp duty and estate agent fees.

Loans or Remortgaging

Another option could be securing an unsecured loan or remortgaging your property.

This would allow you to repay the loan over time, which can be a more manageable option than a lifetime mortgage. But, it’s important to make sure you can afford the repayments.

Key Takeaways

- Lifetime mortgages allow homeowners 55 or older to access the value of their home without selling it. There are no monthly repayments, and the loan is repaid upon death or moving into care.

- There are different types of lifetime mortgages, such as roll-up, drawdown, flexible, and enhanced. Interest accrues over time, and repayment is often managed by selling the home.

- To qualify for a lifetime mortgage, you must be at least 55 years old, own your home outright, and live in the property as your main residence. The property must also be in good condition.

- Lifetime mortgages offer flexibility, the ability to stay in your home, access to tax-free cash, and more. But, you need to consider interest accumulation, impact on benefits, reduced inheritance, and restrictions on moving home.

- Lifetime mortgages are not the only way to access equity. You can also downsize, take out an unsecured loan or remortgage. The best option for you will depend on your circumstances.

The Bottom Line

Releasing equity from your home is not a decision to be taken lightly. It can have a significant impact on the future value of your estate and reduce the inheritance you leave behind.

Plus, there are many different types of lifetime mortgages with different rates and features, making it difficult to choose the best one for you.

That’s why it’s important to speak with a lifetime mortgage adviser. They can help you understand your options and choose a product that meets your needs and financial goals.

Lifetime mortgages offer flexibility, security, and control. But they also come with specific concerns and responsibilities.

Are you considering this option? Simply fill out this quick form. We will match you with a top lifetime mortgage adviser who help you make the most informed decision for your future.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can I pay off a lifetime mortgage early?

Yes, but it may come with early repayment charges, depending on the terms of the agreement.

Can I rent out my home or sell it?

Usually, renting out or selling a home is not allowed without the provider’s consent, as it might violate the terms of the mortgage.

Who are the providers of lifetime mortgages?

Many reputable banks, building societies, and specialist lenders offer lifetime mortgages. It’s crucial to seek professional advice to find the provider that best fits your needs.

A practical tip when choosing a provider is to ensure they are members of the Equity Release Council and authorised by the Financial Conduct Authority. These affiliations provide an added layer of security and assurance that the provider adheres to high standards of conduct and ethics.