- Can You Get a Mortgage with a Criminal Record?

- Does a Criminal Record Affect Your Mortgage Application?

- What’s the Difference Between Spent and Unspent Convictions?

- How To Apply for a Mortgage with a Criminal Record?

- Questions Lenders Ask If You Have a Criminal Record

- Will Lenders Investigate Your Past?

- What’s the Penalty for Lying on a Mortgage Application in the UK?

- Which Lenders Consider Applicants with Criminal Records?

- How To Improve Your Chances of Mortgage Approval?

- What About Insurance with a Criminal Conviction?

- Key Takeaways

- The Bottom Line

How To Get a Mortgage With a Criminal Conviction? A Guide

Rent can feel like throwing your hard-earned cash away. That’s why owning your own home is a top priority for many Brits.

But for some, this dream might feel out of reach, especially if you have a criminal record.

Don’t worry, we’re here to tell you it’s not impossible.

There are ways to get a mortgage even if you’ve got a spotty past. We’ll break down everything you need to know

But remember, everyone’s situation is unique.

So while this guide offers general advice, speaking to a mortgage expert is essential. They can provide tailored help and find the mortgage that works for you.

Can You Get a Mortgage with a Criminal Record?

The short answer? Yes, you can. But let’s be honest, it’s not always straightforward.

Having a criminal record doesn’t automatically disqualify you from getting a mortgage, but it can make the process a bit trickier.

Lenders are primarily concerned with risk, and a criminal record might raise a few eyebrows.

However, don’t lose hope – there are plenty of lenders out there who are willing to consider your application.

Does a Criminal Record Affect Your Mortgage Application?

It depends.

Your criminal record’s impact on your mortgage application can vary widely.

It hinges on several factors:

- the nature of your offence,

- how recent it was, and

- whether it’s spent or unspent.

Some lenders might see your criminal record as a red flag, while others may be more understanding.

It’s worth noting that your criminal record doesn’t directly affect your credit score.

However, if you’ve spent time in prison, it could indirectly impact your credit history if you weren’t able to maintain regular payments on existing credit commitments.

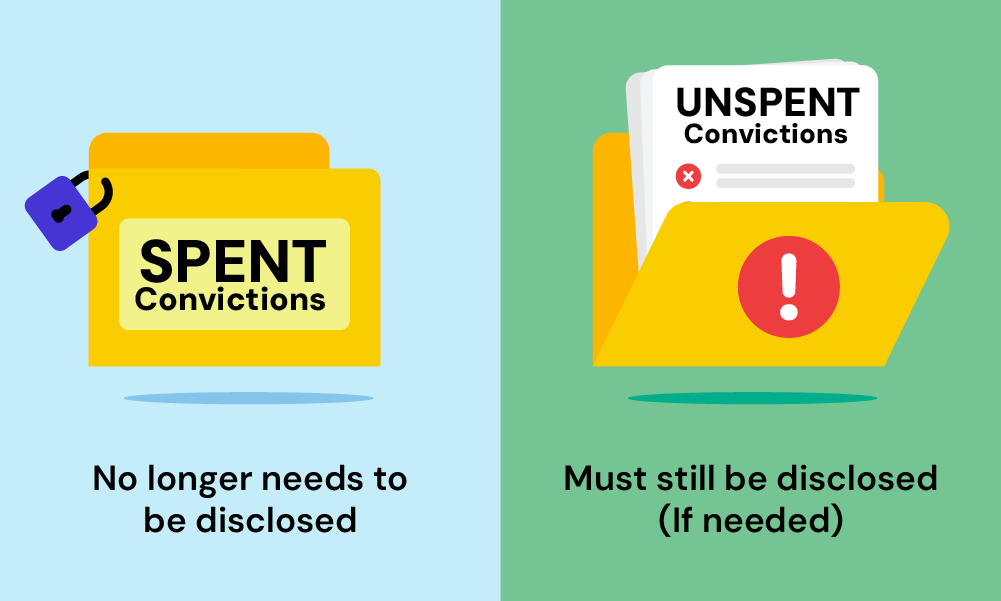

What’s the Difference Between Spent and Unspent Convictions?

This is where things get a bit legal, so bear with me.

In the UK, we have something called the Rehabilitation of Offenders Act 1974. This nifty piece of legislation introduces the concept of ‘spent’ convictions.

Essentially, after a certain period (which varies depending on the severity of the offence), your conviction becomes ‘spent‘.

Once spent, you’re not legally obliged to disclose it to most employers or organisations – including mortgage lenders. It’s like a clean slate, at least in the eyes of the law.

Unspent convictions, on the other hand, are those that haven’t yet reached this rehabilitation period.

These are the ones you’ll need to disclose if asked during your mortgage application.

How To Apply for a Mortgage with a Criminal Record?

Applying for a mortgage with a criminal record requires a bit of strategy.

Here’s how you can approach it:

1. Check if your conviction is spent or unspent.

As we’ve discussed, spent convictions mean you’re not legally required to disclose any criminal record, even if asked. This means you’ll be assessed like an applicant without a criminal record.

On the flip side, you have to be honest if you have unspent convictions. You must disclose them if asked. Honesty is the best policy here.

2. Prepare your paperwork.

Gather all relevant documents, including any evidence related to your conviction. The more information you can provide, the better.

Also, include standard documents like proof of income and bank statements.

3. Get professional advice.

Getting a mortgage with a criminal conviction is tough. Many lenders might reject your application if you don’t know who accepts your circumstances.

That’s why consulting a mortgage broker with experience is crucial. They know which lenders are likely to approve your application.

They simplify the process, reduce the stress, and find the best rates for you.

Also, remember to declare your criminal record to your broker. This helps them find lenders specialising in applicants with past convictions, giving you access to the same deals as those without records.

Every lender has different criteria. One rejection doesn’t mean all doors are closed.

Questions Lenders Ask If You Have a Criminal Record

When you’re applying for a mortgage with a criminal record, it’s important to be prepared for the types of questions lenders might ask.

Typically, they’re trying to assess the level of risk you pose as a borrower.

Common questions include:

- Have you ever been convicted of a criminal offence?

- Do you have any pending prosecutions?

- Can you provide a detailed address history?

This last question is particularly important, as gaps in your address history might indicate time spent in prison.

It’s crucial to answer these questions truthfully – remember, honesty is always the best policy when it comes to mortgage applications.

Will Lenders Investigate Your Past?

Mortgage companies don’t usually conduct criminal record checks themselves.

They don’t have direct access to the Police National Computer and typically rely on the information you provide in your application.

However, this doesn’t mean you’re off the hook.

If a lender wants official confirmation, they might ask you to provide a basic disclosure, which would reveal any unspent convictions.

What lenders will definitely do is run credit checks. They’ll also check the CIFAS Register for any issues related to fraud, money laundering, or other financial crimes.

A poor credit rating can be a significant hurdle, as lenders need to be confident in your ability to repay the loan.

They’ll be looking for evidence of:

- Stable employment

- A history of repaying loans

- No significant arrears on mortgage or rent payments

What’s the Penalty for Lying on a Mortgage Application in the UK?

Let’s be crystal clear here: lying on your mortgage application is a big NO-NO. Not only is it unethical, but it’s also illegal.

The penalty for lying on a mortgage application in the UK can be severe. We’re talking potential fraud charges, which could land you in hot water with fines, or even prison time.

Moreover, if your lender discovers you’ve lied after granting the mortgage, they could demand immediate repayment of the entire loan.

That’s not a situation anyone wants to find themselves in.

So, while it might be tempting to keep mum about an unspent conviction, the risks far outweigh any potential benefits.

Always be upfront and honest in your application.

Which Lenders Consider Applicants with Criminal Records?

Surprisingly, some mainstream lenders do consider applicants with criminal records, especially if the convictions are spent.

High street names like Halifax, NatWest, Nationwide, and Barclays allow you to apply for a mortgage in principle, often without asking about criminal records.

But during the full application process, they usually require details of any unspent convictions and assess each case individually.

The nature of the offence is crucial. Financial crimes like fraud or money laundering are viewed more severely than motoring offences.

For unspent convictions or serious offences, it’s wise to consult a mortgage broker.

They have access to detailed lender policies and can guide you to lenders more likely to approve your application, reducing the risk of refusal.

How To Improve Your Chances of Mortgage Approval?

Even with a criminal record, there are several steps you can take to boost your chances of mortgage approval:

- Wait until your conviction is spent. If possible, delay your application until your conviction becomes spent.

- Build a strong credit score. Pay bills on time, reduce existing debt, and avoid taking on new credit.

- Save a larger deposit. The more you can put down, the less risky you appear to lenders.

- Maintain stable employment. A steady job and income can work wonders for your application.

- Be prepared to explain. If asked, be ready to discuss your conviction and how you’ve moved forward since then.

- Consider a guarantor. A guarantor with a strong financial profile might help secure your mortgage.

Remember, lenders are primarily interested in your ability to repay the loan.

Demonstrating financial responsibility can go a long way in offsetting concerns about your criminal record.

What About Insurance with a Criminal Conviction?

It’s not just mortgages you need to think about – home insurance matters too if you have a criminal record.

Legally, you must disclose unspent convictions when asked during an insurance application, including those of anyone living on the property.

If you don’t, you won’t be covered, and it could affect your future premiums.

This applies to all insurance types, including home, life, and critical illness coverage. Some insurers might refuse cover, increase premiums, or impose special terms based on your record.

However, there are specialist insurers who cater to individuals with criminal convictions.

A specialist broker can help you navigate these requirements and find the best deals. They can guide you to insurers more likely to offer coverage.

Some mortgage providers offer insurance alongside their mortgage product, but you’re not required to take it. It might be beneficial to source your cover separately.

Honesty and professional advice are key to getting the best insurance despite your criminal record.

Key Takeaways

- You can still get a mortgage with a criminal record, but it might be more challenging.

- Spent convictions don’t need to be disclosed to lenders; unspent convictions must be declared if asked.

- Lying on your mortgage application is illegal and can lead to serious consequences.

- Some mainstream lenders will consider applicants with criminal records, especially if the conviction is spent.

- To improve your chances, wait until your conviction is spent, build a strong credit score, save a larger deposit, and maintain stable employment.

- For insurance, you must disclose unspent convictions. Specialist insurers and brokers can help you find suitable coverage.

The Bottom Line

Getting a mortgage with a criminal record isn’t impossible. But it does require careful planning.

Be honest, be prepared, and don’t hesitate to seek professional help.

A good broker offers you:

- Access to a wider range of mortgage products

- Expert knowledge of the mortgage market

- Assistance with paperwork and documentation

- Tailored advice for your financial situation

- A faster and smoother application process

- Potential to secure better interest rates

- Support throughout the entire application process

Remember, your criminal record doesn’t define you, and it doesn’t have to derail your homeownership dreams.

With the right approach and a bit of patience, you can find a lender willing to look beyond your past and focus on your future as a responsible homeowner.

Need a broker? Get in touch. We’ll pair you with a qualified mortgage broker to help with your mortgage application and get you the best deal.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can I get a mortgage if I'm currently on probation?

It’s more challenging, but not impossible. Specialist lenders might consider your application, especially if you have a strong financial profile.

Factors such as stable employment, a good credit history, and a substantial deposit can improve your chances.

Consulting a mortgage broker who has experience with such cases can also be beneficial in finding a suitable lender.

Will my partner's criminal record affect our joint mortgage application?

It could, especially if the convictions are unspent. Both applicants’ histories are typically considered in joint applications.

The nature and severity of the offence, along with the time elapsed since the conviction, will play a significant role. Specialist lenders might offer more flexibility in such situations.

Can I remortgage with a criminal record?

Yes, the process is similar to applying for a new mortgage. Your current lender may be more amenable if you’ve maintained a good payment history.

What if I'm declined a mortgage due to my criminal record?

Don’t lose hope. Seek advice from a specialist mortgage broker. They can guide you to lenders more likely to approve applications from individuals with criminal records.

Improving other aspects of your financial profile can also enhance your chances in future applications.

Can I check the information lenders know about me?

Absolutely! Under the Data Protection Act, you have the right to request all the information a lender holds about you.

This is known as a subject access request and typically costs £10.

It can be a useful way to understand exactly what information lenders are basing their decisions on.