- What Leads to a Mortgage Decline?

- What To Do If Your Mortgage Application Is Declined

- 4 Tips to Strengthen Your Mortgage Application After a Rejection

- Does Mortgage Rejection Affect Your Credit Score?

- How To Proceed If Declined After an Agreement in Principle

- The Mortgage Underwriting Process and Rejections

- Property Surveys and Mortgage Approval

- The Bottom Line

What Should You Do After Being Declined For Mortgage?

Applying for a mortgage in the UK can sometimes feel like a complicated journey. You might find yourself filling out many forms and waiting anxiously for approval.

But what happens when your application is turned down? It’s not uncommon. There are several reasons why a mortgage application might get rejected.

This article explains why these rejections happen and what you can do if you find yourself in this situation.

What Leads to a Mortgage Decline?

It can be disheartening to have your mortgage application refused. But, knowing the main reason behind your mortgage refusal can help you address these issues for future applications.

Here are some typical reasons for mortgage rejections:

Credit History Concerns

A major reason for rejection is a poor credit history. Missed payments, defaults, or significant debts can make lenders wary.

They might think you’ll struggle with mortgage repayments. If your credit history is the issue, focus on improving it or look for lenders who are more lenient with credit problems.

>> More about How To Get a Mortgage with Bad Credit

Income and Affordability

Lenders need to be sure you can manage the mortgage payments. They look at how much you earn and compare it to how much debt you already have.

This is called your debt-to-income (DTI) ratio. Ideally, your DTI should be below 36%. If it’s higher, lenders might worry that you won’t be able to handle the extra debt from a mortgage.

Lenders also use something called income multiples to decide how much they’ll lend you. Usually, they’ll lend you a sum that’s between three and five times your annual income.

For example, if you earn £30,000 a year, you might be able to borrow between £90,000 and £150,000. But if you ask for more than this, the lender might say no because it seems like too much for you to pay back comfortably.

Different lenders have different ways of working out how much they’ll lend. Some might offer you more than others, depending on their rules and how they judge your financial situation.

If you’ve been refused because a lender thinks you can’t afford the mortgage, you might find another lender who’s willing to offer you the amount you need. Or, you could look at smaller mortgages that fit within the usual lending amounts.

Employment Status

For self-employed people or contractors, getting a mortgage can involve a bit more paperwork. Lenders usually ask for more proof that your income is steady and reliable.

This is because your earnings might change every month, unlike someone with a regular salary. So, what do you need to show?

Lenders often ask for at least two years of accounts verified by a qualified accountant, tax returns (SA302 forms), bank statements, proof of upcoming work for contractors

Having these documents ready can make the mortgage process smoother and improve your approval chances. It shows the lender that your income, even though it might vary, is still reliable enough for you to afford a mortgage.

Existing Debt Levels

High levels of existing debt can be a red flag. Lenders might doubt your ability to manage additional financial obligations. Reducing your debt can help improve your chances.

Electoral Roll Registration

Not being registered on the electoral roll can be a simple yet crucial oversight. This registration helps lenders verify your identity and address.

>> Visit gov.uk to register.

Frequent Credit Applications

Multiple credit applications over a short period can indicate financial instability to lenders. This also affects your credit score, as each application leaves a mark on your credit file.

Payday Loans

Usage of payday loans can be viewed negatively by lenders, as it often signals financial distress.

Most lenders are hesitant to approve applicants who have used payday loans in the recent past.

>> More about Payday Loans

Application Errors

Even small mistakes in your application can lead to rejection. Incorrect personal details or inconsistencies can raise concerns for lenders. Ensure all your information is accurate and consistent.

Property Issues

Sometimes, it’s not about you but the property you’re looking to buy. If the lender finds the property unsuitable or it’s valued lower than the purchase price, they might decline the mortgage.

If you’ve been refused a mortgage, it’s important not to lose hope. Understanding why you were refused allows you to make the necessary changes.

Consider consulting a good mortgage broker who can provide tailored advice and help you find suitable lenders.

Remember, one refusal doesn’t mean you won’t succeed with another lender.

What To Do If Your Mortgage Application Is Declined

First, don’t panic.

Mortgage rejections are not uncommon, and there are steps you can take to improve your chances next time. Here are three steps you can take:

- Learn exactly why you were declined. This information can help you make the necessary changes to your application. Maybe you need to save for a larger deposit, or perhaps you need to work on improving your credit score.

- Look at your spending habits. Lenders examine your outgoings to see if you can afford a mortgage. By reducing your spending, you might increase the amount you can borrow.

- Be cautious about reapplying immediately. Make sure you meet the criteria of the lender you’re applying to. A mortgage advisor can help review your situation and suggest suitable lenders.

Remember, each application impacts your credit file, so it’s wise to choose your next steps carefully.

4 Tips to Strengthen Your Mortgage Application After a Rejection

Getting turned down for a mortgage can be a learning experience. After a rejection, there are several ways you can strengthen your application for the next time. Here are four ways to boost your application:

- Look at your outgoings. These are things like bills, loan payments, and other regular expenses. If you can reduce these, it might help your application. Lenders look at how much money you have going out compared to what’s coming in. The less you spend, the more it looks like you can afford a mortgage.

- Improve your credit score. Pay your bills on time, reduce your debt, and avoid applying for new credit. These actions can help boost your score, making you more appealing to lenders.

- Choose the right lender. Different lenders have different criteria. Some might be more willing to lend to you based on your situation. It’s worth researching or speaking to a mortgage advisor who can point you in the right direction.

- Save a larger deposit. The more you can put down upfront, the less you need to borrow. This can make lenders more likely to approve your application. So, it might be worth waiting a bit longer to save up more.

Does Mortgage Rejection Affect Your Credit Score?

The answer is a bit tricky. The rejection itself doesn’t directly lower your score.

However, every time you apply for a mortgage, the lender does a credit check. This check shows up on your credit report and can slightly lower your score.

If you apply to several lenders in a short time, all those checks can add up. This might make it look like you’re desperate for credit, which can be a red flag for lenders.

So, while the rejection doesn’t change your score, the process of applying can have a small impact.

It’s a good idea to space out your applications and only apply when you’re confident you meet the lender’s criteria.

How To Proceed If Declined After an Agreement in Principle

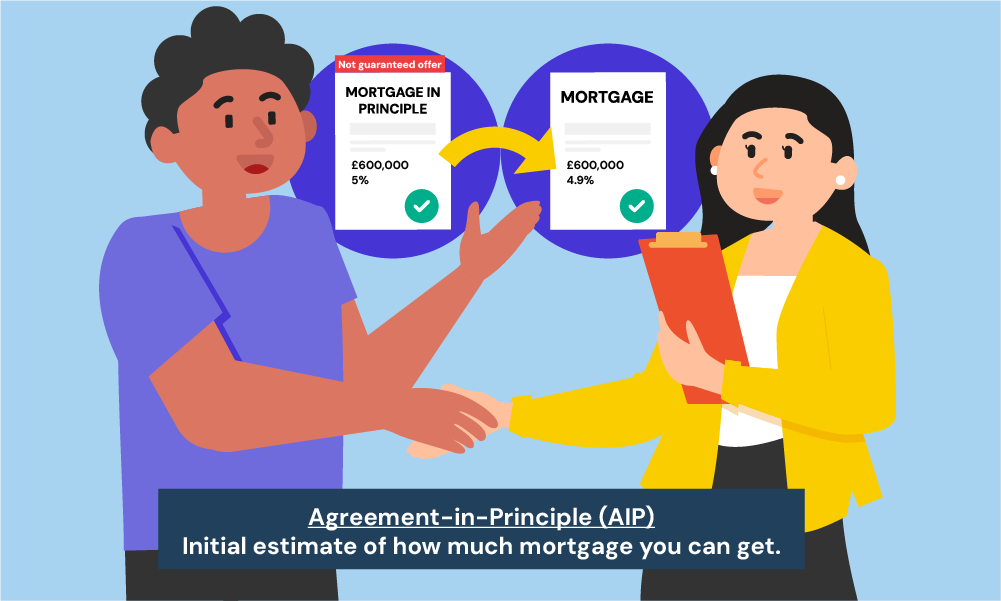

A Mortgage Agreement in Principle (AIP) is like a pre-approval from a lender. They look at your basic financial information and tell you if they might lend you money for a mortgage. It’s a handy tool when house hunting, as it gives you an idea of what you can afford.

However, an AIP is not a guaranteed mortgage offer. It’s just the lender saying you could be approved based on what they know so far.

When you find a property and make a full application, they’ll look more closely at your finances and the property details. That’s when a mortgage can still be declined, even if you had an AIP.

If you get turned down after an AIP, don’t lose heart. Go back to the lender and ask why it was declined. This information can help you fix any issues before applying elsewhere.

Also, consider checking your credit report again for any changes or errors. Remember, an AIP is a good first step, but it’s not a final guarantee.

The Mortgage Underwriting Process and Rejections

The underwriting stage is a crucial part of getting a mortgage. It’s where the lender looks in detail at your finances and decides whether to lend you the money.

Sometimes, mortgages decline at this stage.

Why does this happen?

Underwriters, the people who review your application, check everything carefully. They make sure all the information you provide is correct and that you can afford the mortgage.

If they find anything that doesn’t add up or seems risky, they might say no. This could be things like gaps in your employment history or unusual bank transactions.

To get through this stage, make sure all your documents are accurate and complete. This includes your income details, bank statements, and any other financial information.

If the underwriters have any concerns, they might ask for more information. Answering their questions quickly and clearly can help your application go smoothly.

Property Surveys and Mortgage Approval

When you apply for a mortgage, the property you want to buy also has to pass an inspection.

This is called a property survey. It’s done to check the condition and value of the property. The survey can affect whether you get your mortgage.

Sometimes, the surveyor might value the property at less than what you agreed to pay (this is called down-valuation).

If this happens, the lender might worry that they won’t get their money back if they need to sell the property in the future. They might lend you less money or even decline the mortgage.

Other times, the survey might find problems with the property. Maybe it’s in poor condition or has some unusual features.

Some lenders have strict rules about the types of properties they’ll lend money for.

If you face issues like down-valuation or property problems, you have a few options.

You could renegotiate the price with the seller, look for a different property, or try a different lender who might be more flexible.

Remember, the property is as important as your finances in the mortgage process.

>> More about Mortgage Refused At Valuation

The Bottom Line

If you’ve been turned down for a mortgage, don’t lose hope. This isn’t the end of your journey to owning your dream home. One smart move you can make is to consider using a good broker.

A good broker can guide you through the whole mortgage process. They understand the ins and outs of getting a mortgage and can help you find the right lenders. They’re also great at negotiating and can make sure your application is presented in the best possible light.

If you want a faster and hassle-free way to find the right mortgage advisor, just get in touch with us. We’ll connect you with an FCA-qualified broker who specialises in cases like yours.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

How soon can I apply for a mortgage after being rejected?

It’s best to wait a bit before applying again. Use this time to understand why you were turned down and fix any issues.

This might mean improving your credit score or saving for a bigger deposit. If you apply too soon without making changes, you might get rejected again.

A good rule of thumb is to wait at least six months, but it depends on your circumstances.

Will a low credit score always lead to mortgage rejection?

Not always. Your credit score is important, but it’s just one part of your application. Some lenders might still consider you, especially if there are strong parts of your application, like a stable job or a big deposit.

It’s also worth knowing that different lenders have different rules about credit scores. If one lender says no, another might say yes. Improving your credit score can increase your chances, though.

What should I do if I'm refused a mortgage in principle?

Being refused a mortgage in principle can be disappointing, but it’s not the end of the road.

First, find out why you were refused. This can give you clues on what to improve. Maybe you need to work on your credit score, or maybe the lender’s criteria just weren’t a good match for you.

Once you know the reason, you can work on fixing it. Then, you can either try again with the same lender or look for a different one that might be a better fit.

Remember, a mortgage in principle is just an indication – it’s not a final decision.