Why Was My Mortgage Declined After Agreement in Principle?

When you’re stepping into the world of buying a property in the UK, understanding the ins and outs of the mortgage process is crucial.

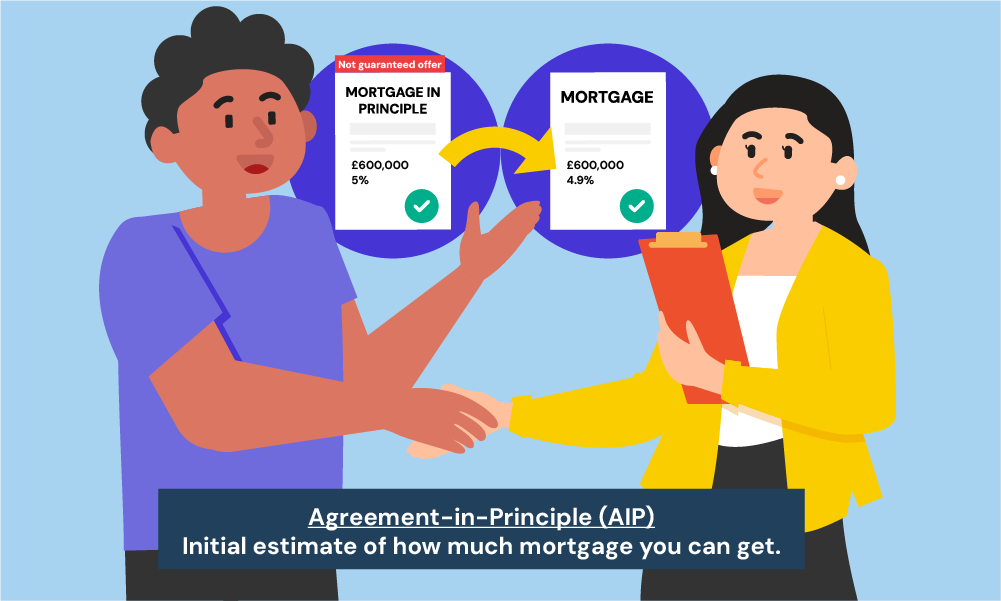

One key part of this journey is the Agreement in Principle (AIP) – a significant milestone in securing a mortgage.

However, sometimes things don’t go as planned, and you might face a decline even after getting an AIP. Knowing why this happens and what it means is essential to navigate these waters smoothly.

This guide aims to shed light on these situations, so you’re better prepared and informed.

What is an Agreement in Principle (AIP)?

An Agreement in Principle (AIP) is a lender’s initial approval for a mortgage. It tells you how much they might lend you to buy a property.

Think of it as a quick check to see if you’re likely to be approved. The lender will look at your income, debts, and credit score to give you this initial yes.

But hold on, it’s not a done deal.

While it suggests you’re financially sound based on initial checks, the lender will do a more thorough review before giving final approval. This includes a detailed look at your credit history and verifying your income and expenses.

In short, an AIP is your first step to knowing how much you can borrow, but it’s not a guaranteed offer. However, it shows sellers you’re a serious buyer.

Why Might Your Mortgage Be Declined After an AIP?

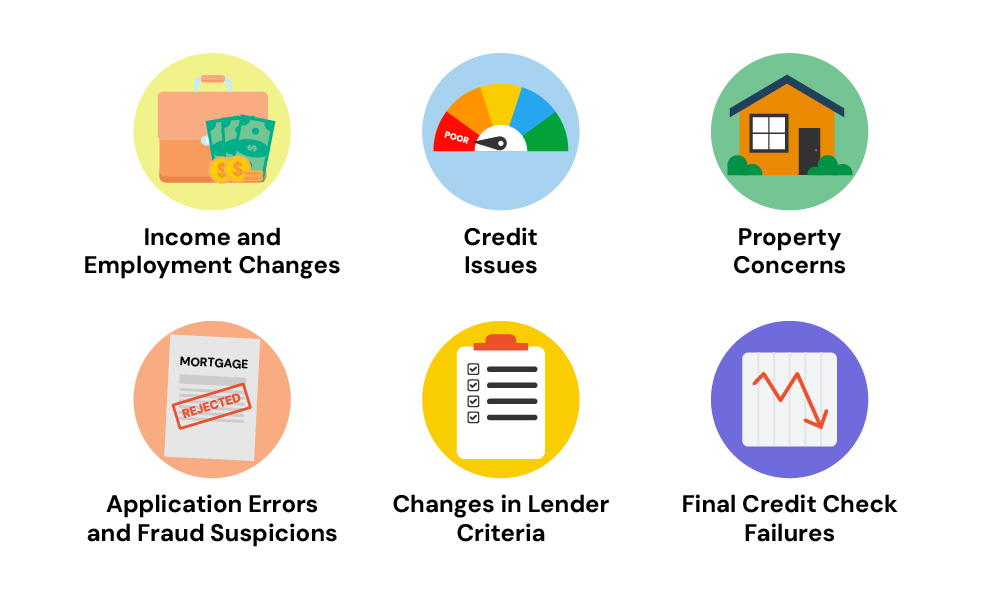

Getting declined after an AIP can be baffling, but it’s not uncommon. Let’s break down some common reasons, including a few additional ones identified in the competitor’s article:

Income and Employment Changes

If your income changes after you get your AIP, the lender might reconsider their offer. This includes changing jobs or losing your job.

Lenders want stability, and a change in employment can raise red flags.

Your AIP is based on a preliminary check of your credit history. If a more detailed check later uncovers issues like missed payments or large amounts of debt, it could lead to a decline.

Lenders are cautious about reliability, and your credit history helps them gauge this.

Sometimes, it’s not about you but the property you’re eyeing. If the lender isn’t happy with the property’s valuation or there are legal issues with it, they might withdraw the offer.

Application Errors and Fraud Suspicions

Mistakes in your mortgage application, whether simple errors or inconsistencies that raise suspicions of fraud, can lead to a decline.

Accurate and consistent information is essential to maintain trust and move forward in the mortgage process.

Changes in Lender Criteria

Mortgage criteria can change. If a lender alters their requirements after issuing an AIP, they may modify or rescind their offer.

Final Credit Check Failures

Some lenders carry out a more detailed credit check before finalising the mortgage. This step is often handled by underwriters – professionals who specialise in assessing financial risk.

The underwriters will closely examine your credit history for any signs of bad credit that might have gone unnoticed during the initial AIP process.

If they find issues such as late payments, significant debt, or other red flags, it could lead to your mortgage application being rejected.

This thorough review is a crucial part of the process to ensure the lender is making a sound financial decision.

In addition to understanding these reasons, it’s also wise to consider the role of a mortgage broker. They can assist you if your application stalls, especially in complex situations like bad credit, changed circumstances, or if you face high-risk assessments.

They can match you with lenders who specialise in situations like yours and ensure your paperwork is error-free, increasing your chances of approval.

Remember, an AIP is a great start, but it’s just the beginning of your mortgage journey. With the right approach and support, you can navigate through these potential hurdles.

What To Do If Your Mortgage AIP Is Declined?

First off, don’t panic. It’s a setback, but not the end of the road. Here’s what you can do:

Find Out Why

Get in touch with the lender and ask why your application was declined. Whether it’s a credit issue or an income verification problem, knowing the exact cause can help you make targeted improvements.

Check Your Credit Report

Request a copy of your credit report from major credit agencies like Experian or Equifax. Look for any discrepancies or errors.

If you find any, you can dispute them with the credit agency. Pay close attention to missed payments or high credit utilisation, which can be red flags for lenders. Work on reducing your debt-to-income ratio by paying off debts where possible.

Start by registering on the electoral roll if you haven’t already, as this can boost your credit score.

Pay bills on time, reduce outstanding debts, and avoid applying for new credit in the short term. Small, consistent actions can lead to significant improvements over time.

Reassess Your Finances

Analyse your budget meticulously. Look for ways to reduce expenses and increase savings. Demonstrating financial discipline can be a strong point in your next application.

Consider a Mortgage Broker

A broker can offer personalised advice and help you find lenders who specialise in cases similar to yours. They can also assist in preparing a strong application, increasing your chances of approval.

Don’t Rush to Reapply

If you reapply too soon, it could harm your credit score. Take time to address any issues first.

Remember, every lender has different criteria. Just because one has said no doesn’t mean they all will. Keep your chin up and focus on improving your situation – there’s still a chance to find the right mortgage for you.

How to Reapply for a Mortgage After a Decline?

Reapplying for a mortgage after a decline isn’t something you should rush into. Here’s how to approach it smartly:

Timing Is Key

Wait until you’ve addressed the reasons for the initial decline.

This might mean improving your credit score, stabilising your employment, or correcting errors in your previous application. Generally, it’s a good idea to wait a few months to show stability and improvement.

Get Your Documents in Order

In today’s digital world, most of the mortgage application process is online, making it easier to gather and submit your documents.

Ensure all your paperwork, including digital records of your income details, bank statements, and identification documents, is current and correct.

A useful tip is to have a mortgage broker review these documents. They can spot any inaccuracies or omissions that might have slipped your notice, significantly reducing the risk of another decline.

Work with a Mortgage Broker

They can be a huge help. A broker understands what different lenders are looking for and can guide you on how to present your application in the best light.

They can also help you find lenders who are more likely to accept your circumstances.

What Are Your Alternatives If Repeatedly Declined?

If you’re facing repeated declines, don’t lose hope. There are other paths you can explore:

Consider Different Types of Mortgages

There are various mortgage products out there. For example, some lenders specialise in lending to people with poor credit histories or complex financial situations.

Think About a Joint Mortgage

Applying with someone else, like a partner or a family member, might increase your chances of approval. Their financial stability could support your application.

Seek Professional Advice:

It’s really important to talk to a mortgage broker. They can offer insights into why you might be facing declines and suggest alternative solutions tailored to your situation.

Remember, every situation is unique, and just because one path didn’t work out doesn’t mean there isn’t another route to achieving your dream of homeownership.

Keep an open mind, explore your options, and stay informed.

Rejected by A Specific Lender

When you’re dealing with a declined AIP, it’s important to remember that different lenders have their ways of handling things.

If you’ve been rejected by a specific lender, reach out to us. We’ll match you with a top mortgage broker to help you with your situation.

However, in the meantime feel free to explore these independent guides we have for each specific lender:

- Mortgage Refused > Refused by Halifax

- Mortgage Refused > Refused by HSBC

- Mortgage Refused > Refused by Kensington

- Mortgage Refused > Refused by Leeds Building Society

- Mortgage Refused > Refused by Nationwide

- Mortgage Refused > Refused by Natwest

- Mortgage Refused > Refused by Precise

- Mortgage Refused > Refused by Santander

- Mortgage Refused > Refused by Skipton

The Bottom Line

In summary, while securing an Agreement in Principle is a significant step towards getting a mortgage, it’s not a definitive guarantee. If your AIP is declined, don’t lose heart. You have several avenues to explore and correct the course.

Using a mortgage advisor can be a real game-changer if you’re declined after an AIP. They’re experts in understanding what different lenders are looking for and can guide you towards the best options for your situation.

Plus, they can help you with the paperwork and make sure everything is for your next application.

If you’re feeling a bit overwhelmed and want to save time and stress, reach out to us. We’ll connect you with an FCA-qualified broker who’s suited to handle your specific mortgage needs.

Get Matched With Your Dream Mortgage Advisor...

Frequently Asked Questions

What are the chances of a mortgage application being declined after an AIP?

It’s not extremely common, but it does happen.

While receiving an Agreement in Principle (AIP) is a positive sign, it’s not a surefire guarantee of a mortgage.

The success of the application can hinge on additional checks conducted by the lender. Especially in more complex or higher-risk cases, lenders might scrutinise the details more thoroughly before giving final approval.

Does a declined AIP impact my credit report?

Generally, no. Most lenders use a ‘soft’ credit check for an AIP, which doesn’t affect your credit report.

This means other lenders won’t see this check, and it won’t harm your chances for future finance applications. So, you can breathe easy on that front.

If my application is declined after AIP, do I need to start from scratch?

Yes, you generally need to start the application process again. But this time, you’ll be more informed about what to focus on. Make sure to address the reasons for the initial decline before reapplying.