What Should I Do Next After Kensington Declined My Mortgage?

Have you ever felt down because your mortgage application was turned down?

It’s like hitting a roadblock on your way to getting your dream home. You might feel sad and mixed up, trying to figure out why it didn’t work out.

This guide talks about how Kensington handles mortgage applications.

We’ll show you what they look for when deciding on a mortgage and why they might have said no to yours, especially if you’ve had credit problems or issues with a special kind of property.

How Does Kensington Assess Mortgage Applications?

Kensington has a special way of looking at mortgage applications, especially for people with complicated money histories.

They are more flexible than many usual lenders, even if you have bad credit.

This means Kensington might still think about your application even if you’ve had money troubles before. They look at each case on its own, checking more than just your credit score to get the full picture of your money situation.

But being flexible doesn’t mean they’re not careful. Kensington digs into every part of your application.

This is extra true for people with big credit problems, like recent bankruptcies. Kensington looks at when the bankruptcy happened and what you’ve done since then to get your finances in better shape.

They also have a different view on property types. Kensington knows that not every property is the same and might consider ones that other lenders won’t.

This includes unusual or special properties. But they still need to make sure these properties fit their lending rules.

Steps to Take After a Kensington Mortgage Rejection

If Kensington has declined your mortgage application, it’s important to take thoughtful steps before moving forward.

First, don’t rush to apply with another lender right away. Getting turned down a lot in a short time can hurt your credit score.

Take a moment to figure out why Kensington didn’t approve your mortgage. Knowing the reason is key because it shows what you need to fix.

Talk to Kensington and ask them why they said no. It might be because of your credit history, how much money you can put down, how steady your income is, or something about the house itself.

After you know the reason, start working on it. For example, if it’s about a low credit score, try to get better at handling your debts.

If the issue was with the house, think about looking for different houses that might not have the same problems.

Can You Challenge Kensington’s Mortgage Decision?

Appealing a mortgage decision from Kensington is possible, but it’s important to know when it’s appropriate and how to do it effectively.

If you believe Kensington’s decision was based on incorrect or outdated information, or if there have been significant positive changes in your circumstances since the application, you can consider an appeal.

To start an appeal, you should contact Kensington directly. Be clear and concise in your communication, and provide any new evidence that supports your case.

This could be updated financial information, corrected errors in your credit report, or new developments regarding the property in question.

However, remember that an appeal should be based on new or corrected information that wasn’t available during the initial application.

Simply disagreeing with the decision without providing new evidence is unlikely to result in a different outcome. It’s about presenting a stronger case that addresses the reasons for the initial rejection.

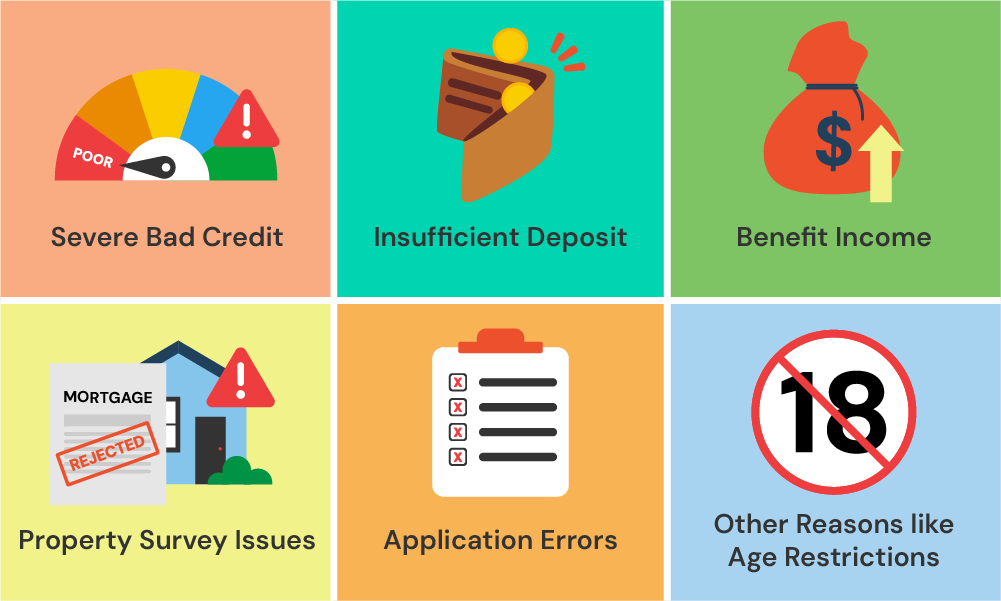

Common Reasons for Mortgage Declinations by Kensington

When applying for a mortgage with Kensington, there are several reasons why your application might not be successful. Understanding these can help you prepare better for your next application or find ways to improve your current financial situation.

Severe Bad Credit Issues

Kensington does cater to customers with certain types of bad credit, offering options even to those with previous debt management plans or defaults.

However, more severe credit issues, like recent bankruptcies or defaults less than two years old, often lead to rejection.

If Kensington initially offers a decision in principle but then declines your application, it could be due to such severe credit issues coming to light during their detailed review.

Insufficient Deposit Amounts

Kensington generally looks for a minimum deposit, often requiring at least a 10% deposit based on their maximum loan-to-value (LTV) ratio of 90%. If your deposit falls short of this percentage, your application could be at risk of being declined.

Benefit Income Considerations

While some types of benefit income can be included in your mortgage application, Kensington does not count all.

For example, they might accept Child Benefits and Industrial Injuries Disablement Benefits, but not Universal Credit, working tax credits, or Personal Independence Payments (PIP).

If your application heavily relies on these types of benefits, it might be a reason for decline.

Property Survey Issues

During the property survey, certain issues might be flagged that could affect your application.

Kensington may show flexibility with some non-standard constructions, but deal-breakers like asbestos or Japanese knotweed can derail your application.

Application Errors

Small mistakes in your mortgage paperwork can be significant enough to cause a breakdown in the application process.

It’s crucial to ensure that all information is accurate and to consult with a good mortgage broker if you’re unsure. They can guide you to ensure your application is correct and suitable for your needs.

Other Specific Reasons

There are numerous other reasons why Kensington might decline your mortgage application. These can range from age considerations (being older than 75 at the end of the mortgage term) to having a recent CCJ, being on a temporary employment contract, needing a guarantor, or applying on a joint application sole proprietor basis.

If you face a rejection, it’s important not to lose hope.

A mortgage broker can help you understand these reasons in detail and find other lenders who may be more accommodating to your specific situation.

Remember, each lender has different criteria, and what doesn’t fit one lender’s policies may be acceptable to another.

When Should I Reapply?

Deciding when to reapply for a mortgage after being rejected depends on fixing what went wrong the first time. If Kensington said no because of your credit score, you’ll need to work on it.

This means paying your debts on time and keeping your balances low. Fix any errors on your credit report too. This could take several months or even up to a year.

If you were turned down because you didn’t have enough saved up for a deposit, you’ll need to save more. How long this takes depends on how fast you can save the extra money you need.

If there were mistakes in your application, you could reapply quite soon. Just make sure everything is correct this time.

It’s important not to rush into applying again without fixing these issues. If you apply too soon, you might get rejected again, which could hurt your credit score even more and delay your plans to buy a home.

Take your time to improve your application, so you have a better chance of getting a yes next time.

The Bottom Line

If Kensington turns down your mortgage application, it’s important to find out why. This helps you know what to fix for next time.

An independent mortgage advisor can help in these cases. They give you advice based on your situation and can suggest other options that might work better for you. They’re especially useful if you have bad credit or a special kind of property.

If you didn’t get a mortgage and it’s slowing down your plans to buy a house, don’t worry.

Contact us, and we can connect you with a great broker who can give you advice just for you. This can make buying a house less stressful.

Get Matched With Your Dream Mortgage Advisor...

Frequently Asked Questions

Can I get a Kensington mortgage if I'm self-employed?

Yes, you can. Kensington knows that people who work for themselves earn money differently than those with a regular job. They will check your income, like your tax returns or business records. They mainly want to make sure you can pay for the mortgage you want.

Does Kensington offer mortgages for limited companies looking to buy to let?

Yes, Kensington offers mortgages for small businesses that want to rent out property. This is a good choice if you own a business and want to invest in property. They will look at both the business’s money situation and the financial details of anyone who promises to pay the mortgage if needed.

Will Kensington refund any fees if my mortgage application is rejected?

Usually, you won’t get your application fee back if your mortgage request is denied. But if you think something went wrong or wasn’t fair, you should talk to Kensington. They can tell you more about their rules for giving back fees and check if there’s a way to help.

Knowing these details about Kensington’s mortgages helps you plan better and make smart choices. If you have more questions, it’s a good idea to talk directly with Kensington or get advice from a mortgage advisor who can give you tips for your situation.

Do Kensington mortgages ask for bank statements?

Yes, Kensington usually asks to see your bank statements when you apply for a mortgage. These statements show them how you handle money, how steady your income is, and if you can manage money well. They often want to see statements from the last three to six months. This helps them figure out if you can pay back the mortgage.

Is it easy to get a mortgage with Kensington?

Whether getting a mortgage from Kensington is easy depends on your money situation.

Kensington is more flexible than some lenders, especially for people with different kinds of income or past credit issues. But they have rules you need to meet.

Your chances are better if you have a stable income, a good deposit, and a clear credit history. If you work for yourself or have had credit problems before, Kensington might still work for you, but you’ll need to provide more documents and they’ll look at your situation closely.