- What Is a Mortgage Offer?

- Can a Mortgage Offer Be Withdrawn?

- Why Might a Mortgage Offer Be Withdrawn?

- What Happens After a Mortgage Offer is Issued?

- What Can Go Wrong After a Mortgage Offer?

- Can a Mortgage Offer Be Withdrawn After Exchange?

- What Happens If a Mortgage Offer is Withdrawn on the Day of Completion?

- Can a Lender Cancel Your Mortgage?

- Can I Take Out a Loan After a Mortgage Offer?

- What Should I Do If My Mortgage Offer is Withdrawn?

- The Bottom Line

What To Do If Your Mortgage Offer Is Withdrawn?

You spend months searching for your dream home, finally find it, and snag a mortgage offer.

You’re practically unpacking in your head already. Then, out of nowhere, your lender pulls the rug from under your feet.

Your mortgage offer is withdrawn. 😱

This isn’t as uncommon as you might think for homebuyers in the UK. Most people assume a mortgage offer is a done deal, but that’s not always the case.

Whether you’re a first-time buyer, remortgaging, or just moving, understanding mortgage offers is key.

Buying a house is a big financial step, and with things so unpredictable these days, you need to be prepared for anything.

This guide will explain why lenders might withdraw an offer, how to avoid it happening to you, and what to do if it does. 🏡✨

What Is a Mortgage Offer?

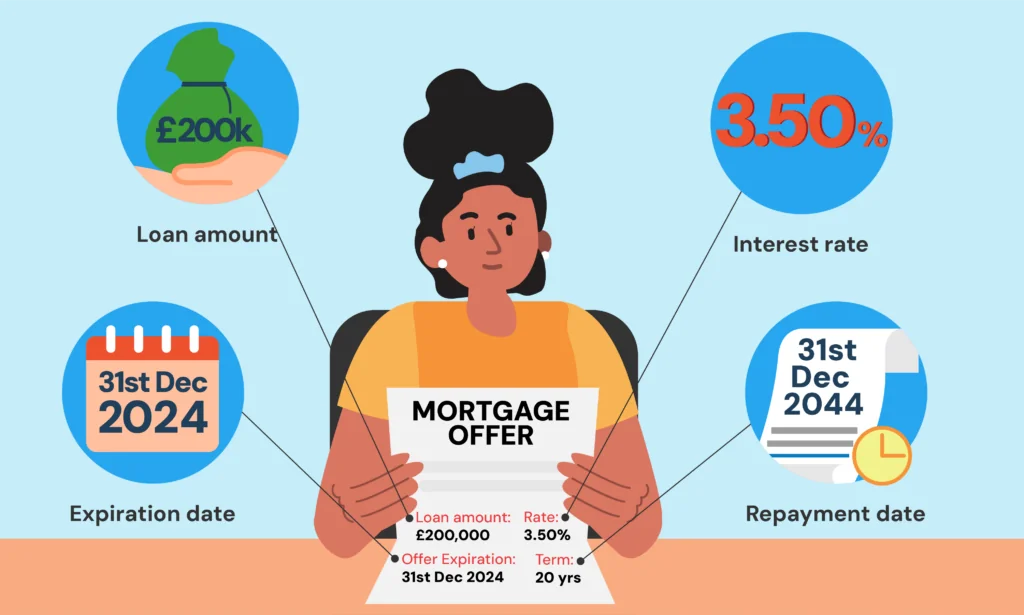

Let’s break it down simply: a mortgage offer is a formal letter from a lender saying they’re ready to lend you money to buy a house, but with strings attached.

Here’s what it usually includes:

- The amount they’re willing to lend you

- The interest rate and whether it’s fixed or variable

- The length of the mortgage term

- Any special conditions or requirements

- Details of any fees or charges

Remember, a mortgage offer isn’t the same as a mortgage in principle or an agreement in principle. Those are just initial signals that a lender might lend you money, based on some basic info.

A formal mortgage offer comes after they’ve dug deep into your full application. It’s detailed and specific.

Receiving a mortgage offer is a major milestone on your journey to homeownership. It means you’re almost there, but not quite.

Until the purchase is complete and the money changes hands, there’s still a chance for changes.

So, stay focused and keep pushing forward. You’re almost at the finish line. 🎉🏁

Can a Mortgage Offer Be Withdrawn?

Yes, a mortgage offer can be withdrawn, even after acceptance. It’s rare, but until you’ve completed the purchase, the offer isn’t guaranteed.

Lenders have the right to withdraw under certain conditions detailed in the offer terms.

If this happens to you, don’t panic.

While it’s stressful, it doesn’t mean the end of your home buying journey. There are steps you can take to resolve the situation or find other options. ⬇️

Why Might a Mortgage Offer Be Withdrawn?

A mortgage offer can be withdrawn for several reasons. Knowing these can help you avoid potential pitfalls:

- Changes in Your Financial Situation. If your circumstances change significantly between receiving the offer and completing the purchase, the lender may reassess your application. This includes job loss, reduced income, or taking on new debts.

- Credit Issues. Lenders often perform a final credit check before completion. If they spot new negative items on your credit report, like missed payments or new credit applications, they might withdraw the offer.

- Expired Offer. Mortgage offers typically have an expiration date, usually around 3-6 months from issue. If your purchase takes longer than expected, the offer could expire before completion.

- Property Problems. If issues with the property come to light during surveys or valuations, the lender might view it as too risky. This could include structural problems or a lower valuation than expected.

- Suspicious Activity. Lenders are vigilant about fraud. If they spot anything suspicious in your application or financial history, they may withdraw the offer pending further investigation.

- Inaccurate Information. If the lender discovers you’ve provided incorrect or misleading information on your application, they’re likely to withdraw the offer.

What Happens After a Mortgage Offer is Issued?

Once you receive a mortgage offer, several things typically happen:

- You’ll review and accept the offer if you’re happy with the terms.

- Your solicitor will continue with conveyancing, including property searches and preparing contracts.

- You’ll agree on an exchange date with the seller.

- Final checks may be carried out by the lender.

- You’ll exchange contracts, making the agreement legally binding.

- A completion date will be set.

- On completion day, the funds will be transferred, and you’ll become the legal owner of the property.

However, it’s crucial to remember that the lender can still withdraw the offer at ANY point before completion if they have valid reasons to do so.

What Can Go Wrong After a Mortgage Offer?

Even after receiving a mortgage offer, several things could potentially go wrong:

- The lender could withdraw the offer for any of the reasons mentioned earlier.

- The property survey might uncover issues that affect the property’s value or suitability as security for the loan.

- There could be delays in the purchase process, potentially causing the offer to expire.

- Legal issues might arise during the conveyancing process.

- The seller could pull out of the sale.

- You might experience a change in circumstances that affects your ability to afford the mortgage.

To minimise these risks, stay in touch with your lender, be quick to respond to requests, and collaborate closely with your solicitor. Keep things moving smoothly.

Can a Mortgage Offer Be Withdrawn After Exchange?

Yes, it can happen, though it’s rare.

After exchanging contracts, a withdrawn mortgage offer is a stressful blow since you’re legally bound to buy the property.

If this happens, act quickly.

Contact your solicitor and mortgage broker immediately. They can help you explore your options, such as:

- Negotiating with the lender to reinstate the offer

- Finding alternative finance urgently

- Asking the seller for more time to complete the purchase

- In the worst case, losing your deposit and facing legal action

To avoid this, be completely honest in your mortgage application and keep the lender updated on any changes in your circumstances right up to completion.

What Happens If a Mortgage Offer is Withdrawn on the Day of Completion?

Having a mortgage offer withdrawn on the day of completion is extremely rare but can happen.

This is one of the most stressful scenarios in the homebuying process. If this occurs:

- Inform all parties immediately – Contact your solicitor, estate agent, and the seller’s representatives.

- Understand the reason – Ask the lender for a detailed explanation of why they’ve withdrawn the offer.

- Explore emergency options – Your solicitor or mortgage broker might be able to negotiate with the lender or find alternative finance quickly.

- Consider the legal implications – You’re legally bound to complete the purchase, so failing to do so could result in losing your deposit and facing legal action.

- Negotiate for more time – If possible, try to negotiate with the seller for more time to resolve the situation.

Remember, this scenario is extremely uncommon. Lenders are typically reluctant to withdraw offers at such a late stage unless there’s a very serious issue.

Can a Lender Cancel Your Mortgage?

Yes, a lender can cancel your mortgage. But they can only do so under specific circumstances and usually before completion.

Once your mortgage has been funded and you’ve completed the property purchase, the lender can’t simply revoke the mortgage.

At this point, you have a legally binding agreement with the lender.

However, if you breach the terms of this agreement—for instance, by failing to make payments or breaking other conditions of the mortgage—the lender can take action.

This might include:

- Charging late payment fees

- Reporting missed payments to credit reference agencies

- Starting repossession proceedings

If you’re struggling to meet your mortgage payments, it’s crucial to contact your lender as soon as possible.

Many lenders have programs to help borrowers who are experiencing financial difficulties.

It’s also important to read your mortgage offer carefully and understand all the terms and conditions.

If you’re unsure about anything, ask your solicitor or mortgage broker for clarification.

Can I Take Out a Loan After a Mortgage Offer?

While it’s technically possible to take out a loan after receiving a mortgage offer, it’s generally NOT advisable.

Here’s why:

- Change in circumstances. Taking on new debt changes your financial situation, which could lead the lender to reassess or potentially withdraw their offer.

- Final credit checks. Many lenders perform a final credit check just before completion. A new loan application would show up on this check and could raise red flags.

- Affordability concerns. The new loan payments could affect your ability to afford the mortgage in the lender’s eyes.

- Breach of terms. Some mortgage offers specifically state that you shouldn’t take on new debts before completion.

If you absolutely need to take out a loan during this period, it’s crucial to inform your mortgage lender first. They can advise whether this might affect your mortgage offer and how to proceed.

What Should I Do If My Mortgage Offer is Withdrawn?

If you find yourself in the unfortunate situation of having your mortgage offer withdrawn, here are some steps you can take:

- Don’t panic. While it’s stressful, there are often solutions available.

- Understand the reason. Ask the lender for a detailed explanation of why they’ve withdrawn the offer.

- Consult a mortgage broker. They can help you understand your options and potentially find alternative lenders.

- Consider appealing. If you believe the lender’s decision is unfair or based on incorrect information, you may be able to appeal.

- Look for alternative finance. There may be other lenders willing to offer you a mortgage, even if your circumstances have changed.

- Inform other parties. Let your solicitor and estate agent know about the situation. They may be able to negotiate more time if needed.

- Review your finances. If the withdrawal was due to affordability concerns, you might need to reassess your budget or look for a less expensive property.

- Improve your application. If you need to reapply, think about how you can strengthen your application. This might involve improving your credit score or saving a larger deposit.

Remember, having a mortgage offer withdrawn doesn’t necessarily mean you can’t get a mortgage at all.

Many people successfully secure new offers and go on to complete their property purchases.

The Bottom Line

Having a mortgage offer withdrawn is a setback, but it’s not the end of your home buying journey.

Understand why it can happen, take steps to prevent it, and know what to do if it does.

Be honest with your lender, keep them informed of changes, and seek professional advice when needed.

A good mortgage broker can be your greatest ally.

They understand complex mortgage requirements, have relationships with various lenders, and can foresee and address potential issues.

Working with a skilled broker can save you time, reduce stress, and increase your chances of securing a favourable mortgage deal, even if you face setbacks.

Need a good broker? Get in touch. We’ll connect you with a qualified mortgage broker to guide you and help you succeed.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Do mortgage lenders do final checks before completion?

Yes, mortgage lenders typically perform final checks before completion.

They’re making sure your finances haven’t changed dramatically since they first agreed to lend you the money.

This means they might check you’re still employed, take another peek at your bank accounts, and see if your credit score has taken a nosedive.

Big changes like new debts or a job switch could throw a spanner in the works, so it’s best to keep your finances stable during this time.

Can I change my mind after accepting a mortgage offer?

Yes, you can change your mind after accepting a mortgage offer, but there may be consequences.

The key is to tell your lender straight away if you decide to pull out before the house purchase is finalised.

Depending on how far things have progressed, you might have to pay some fees, like those for the property valuation or legal work already done.

Make sure you read the fine print of your mortgage offer to understand any penalties or charges for cancelling.

Are mortgage funds released before completion?

No, mortgage funds are not released before completion. The funds are typically transferred on the day of completion.

Your solicitor sorts it all out with the lender to make sure the money is there to be sent to the seller’s solicitor on that day.

This way, everything legal is finalised, and the house is officially yours.

How long does completion take after a mortgage offer?

Completion can take anywhere from 4 to 12 weeks after you get your mortgage offer, but it’s not an exact science.

There are a few things that can affect how long it takes, like how complicated the sale is, how efficient your solicitor is, and if any surprises pop up during the final checks.

Talking openly with everyone involved can help things move along smoothly. Your solicitor will keep you updated on the timeline and anything you need to do on your end.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.