Mortgages for Dentists: Your Guide to Owning a Home

Fancy owning a house and getting a mortgage for dentists?

Well, you’re in luck, because we’re going to show you how to get a mortgage, even if you’re self-employed or a newly-qualified dentist.

In the UK, dentists usually have a smooth experience when applying for a mortgage. Lenders see you as a safe and reliable borrower, so you’re likely to get a better deal than other borrowers.

You might be thinking, “If that’s the case, why should I read this guide?”

Three reasons.

First, you might struggle to find a lender who understands your unique position as a dentist.

Second, you must understand the different mortgage deals available to you to make informed decisions.

Finally, see what lenders look for beyond your professional status, so you can make your application stand out.

This guide covers everything you need to know about getting a mortgage as a dentist. So, if you’re ready to start your journey, read on.

Can You Get a Better Mortgage Deal as a Dentist?

Yes, you can. Dentists are seen as safe bets, so lenders are usually happy to lend you more money than other borrowers.

There’s no such thing as a “mortgage for dentists“. You’re most likely eligible for a professional mortgage, which often has lower deposit requirements, flexible underwriting, and better rates and fees.

Unfortunately, the old scheme for Key Workers ended in 2019 but you still have other options to get on the property ladder.

When you’re looking for a mortgage, you might find that some high-street lenders have strict lending criteria for dentists. This could make it difficult to find a good deal, or even find a lender who will lend to you.

Below, we list down some common struggles you may face when getting a mortgage, and how you can overcome them.

Common Struggles of Dentists in Getting a Mortgage

Dentists often face challenges when getting a mortgage, due to:

- Significant student loans. Dentists often have a lot of student debt, which can affect their borrowing power. Find a lender who understands your long-term earning potential as a dentist and is willing to look beyond your current debt levels.

- Short-term contracts. Newly qualified dentists often start their careers on short-term contracts. This can be a red flag for some lenders, so it’s important to build up a good credit history and show that you have a stable income.

- Complex income streams. Self-employment is a popular option for dentists, but lenders may be reluctant to lend to you without 2 or more years of accounts. Make sure you understand your income and have enough proof of it before applying for a mortgage.

- Moving house often. Frequent address changes can result in low credit scores, which can lead to rejection from traditional lenders. Check your credit score before you start your application. It’s also a good idea to choose a lender that offers mortgages without early exit fees. These fees are charged when you end your current mortgage, so avoiding them can save you money in the long run.

Ideally, you have two ways to get better mortgage deals.

First, find a specialist lender who understands the dental profession. They’re more likely to have a flexible approach and offer better terms.

Second, speak to a good mortgage broker who knows the market and can increase your pool of lenders and options.

Choosing the Right Mortgage as a Dentist

Getting a mortgage as a dentist is easy, as lenders are keen to work with you. There are mortgages available for newly qualified, trainee, and self-employed dentists.

If you’re a first-time buyer, you can take advantage of government schemes. These include:

- First Homes – you can get a discount of 30% to 50% on new-build homes in England. This scheme replaced the Key Workers Programme in 2019 and aims to help first-time buyers and key workers get on the property ladder.

- Shared Ownership – allows you to buy a part of your property and rent the rest. You can then buy more of the property over time until you own it all.

- Right to Buy – allows you to buy your council home at a discount price.

If you want to spread your earnings, you could get a buy-to-let mortgage. This lets you buy a property to rent out to tenants, giving you rental income. It could also provide an extra investment for your retirement.

It’s worth it to get professional advice from a good mortgage broker. They can help you assess your financial situation, determine what is right for you, and realistically work out the amount you can afford.

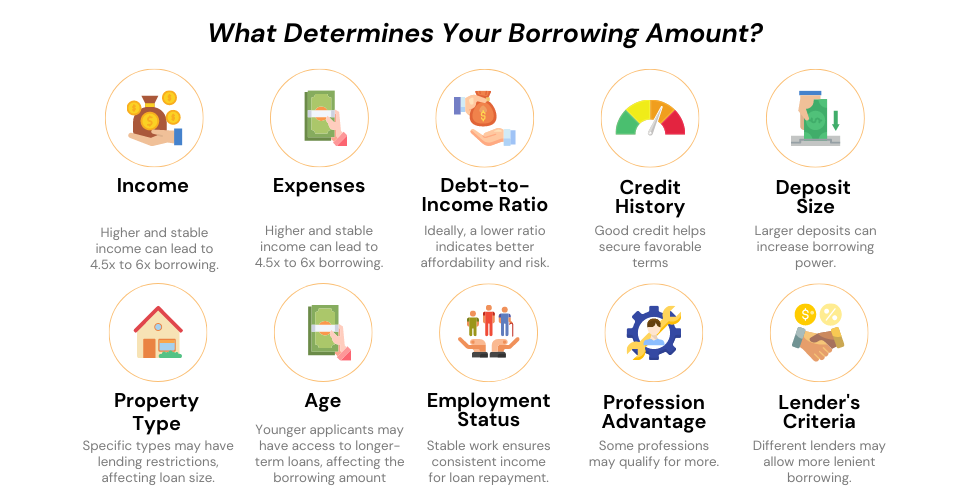

How Much Can I Borrow?

In the UK, lenders use income multiples to decide how much to lend you. As a dentist, you can borrow at least 4.5 times your annual salary.

If you’re an established dentist or have been in the industry for many years, you might be able to borrow up to 6 times.

But other factors affect how much you can borrow, such as:

- Income and outgoings – Lenders will want to see that you have enough income to cover your monthly – mortgage payments and other living expenses.

- Deposit size – The larger your deposit, the less you’ll need to borrow, which will lower your monthly payments.

- Credit history – Lenders will want to see that you have a good credit history, which shows that you’ve made your payments on time in the past.

- Employment type and professional status – Lenders will look at your dentistry experience and the evidence of your qualification.

- Age and number of dependents – Lenders will consider your age and whether you have any dependents, as this will affect your ability to repay the loan.

- Property type – Lenders will consider the type of property you’re buying, as some properties are more risky than others.

Mortgages for Dental Students

As a dental student, you’ve got a few mortgage options. Lenders are wary of lending to people without a steady income. And with the high cost of dental school, students are often on a tight budget.

But if you have a large deposit, are nearly graduating, and have a job offer, you’ll have more luck. Lenders will consider your future earnings when assessing your mortgage.

You can also opt for a guarantor mortgage. This is where a family member or friend with good credit agrees to pay your mortgage if you can’t. This can be a good option if you don’t have a large deposit or a high income.

It’s best to wait until you’ve graduated and are in a strong financial position before taking out a mortgage.

It’s a big decision and could get you into serious financial trouble. But if you want to get onto the property ladder sooner and safer, speak with an expert mortgage broker.

Mortgages for Newly Qualified Dentists and Foundation Dentists

Newly Qualified Dentists

After five years at university, you might be keen to get on the property ladder. If you’ve just started a job and have one month’s payslip, some lenders will accept your NHS associate-principal agreement instead.

As newly qualified dentists in the UK, you will earn around £36,288 a year (HealthCareers, 2023). Lenders will use this to work out how much you can borrow.

There are many options out there, like Clydesdale Bank, who’ll let you borrow 5.5 times your salary. It’s best to check on them and weigh all the risks before jumping to conclusions.

Foundation Dentists

Foundation dentists are salaried employees. This means lenders will assess you like other professionals using income multiples. The amount they lend you will depend on the factors mentioned above and the specific criteria of your chosen lender.

Dental trainees can earn up to £58,398, and NHS dentists can earn up to £96,154 (HealthCareers, 2023). And if you’ve passed your probationary period and you’re on a permanent contract, you can borrow up to 4-6 times your salary.

Mortgages for Self-Employed Dentists

Self-employed dentists, like associate and principal dentists who are directors of limited companies or partnerships, need to prove their income when applying for a mortgage.

This is because some lenders might be hesitant to lend you money, as being self-employed can raise questions about your ability to make monthly repayments.

Luckily, there are specialist lenders who know your profession and can offer you better deals. They’ll consider all of your income when assessing affordability. In general, you’ll need to prepare the following:

- At least 2 years of certified accounts, preferably prepared by a qualified accountant.

- 2 to 3 years of SA302 forms, which are official summaries of your annual income reported to the UK’s HM Revenue & Customs (HMRC).

It’s important to check that your accounts and tax returns match up. If they don’t, it could be a red flag for lenders.

But some might be willing to overlook a mismatch if you can provide a good explanation. For example, if you recorded income but didn’t report it to HMRC until you received it.

Commercial Mortgages for Dentists

If you’re thinking of buying or renovating your dental practice, a commercial mortgage could be the way to go. It’s a loan secured against commercial property, which can help keep your personal and business finances separate.

Dental practices are generally seen as low-risk investments, but lenders will still want to see that you’re financially stable and that the practice is profitable. They’ll look at many factors before approving a loan, including:

- Your credit score

- Your income and deposit size

- Proof of qualification and dentist experience

- The amount of the loan

- The term of the loan

- The value of the property

If you’re considering a commercial mortgage, it’s important to speak to a financial advisor to discuss your options and make sure you’re eligible.

The Bottom Line

As a dentist, you’re in a good position to get a better mortgage deal. Your high earning potential and steady job make you attractive to lenders.

But, you must know that there’s no one-size-fits-all mortgage for dentists. Your situation will affect how much you can borrow, including your deposit size, income, debts, and credit score.

It’s important to find a lender who understands the dental profession. This is where a good mortgage broker can help.

They act as your financial therapist, helping you work through your financial issues and find the best solution for your needs.

Still unsure where to start? Simply, fill out this quick form. We’ll match you with a good mortgage broker who specialises in mortgages for dentists and can get you the perfect deal for your needs.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can I still get a mortgage for dentists with bad credit?

Yes, you can. Even with bad credit, lenders will still consider your career, income, and deposit amount when assessing your borrowing power.

While it’s good to build up your credit score before applying for a mortgage; speaking to a good mortgage advisor can help you present yourself in a better light to lenders and get a better deal.

Does my 5 years of student loan affects my ability to get mortgages for dentists?

Yes, but it doesn’t mean you can’t get a mortgage. Lenders will check your student loans to see if you can afford the monthly repayments. They’ll look at how much you’re paying each month, not the total amount of your student loan.

Is it better to use a mortgage broker or a bank?

A mortgage broker can save you time and give you access to a wider range of mortgages. They can also give you personalised advice based on your situation.

As a dentist, you might find it difficult to find a specialist lender who understands your needs due to your busy schedule. A good broker can help you navigate the mortgage process and get you the best deal.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.