Mortgages for Doctors: A Guide to Getting the Best Deal

The stats are clear: nearly half of UK doctors have experienced burnout and stress during COVID-19.

Still, you’ve stayed on the frontline. You’ve shown great resilience and dedication to save lives and care for patients. Now, it’s time to focus on something just as important: getting the best mortgage for your dream home.

You deserve a smooth, stress-free process, and the best deal to finance your home. But, where do you start?

Here in this guide we’ll shed light on the mortgage available to doctors and walk you through your options. We’ll also provide you with valuable insights to be successful in your mortgage process in the UK.

So whether you’re a new or seasoned doctor, this guide will equip you with the knowledge to make wise decisions about mortgages.

Do Doctors Get Better Mortgage Deals?

Yes, doctors often get better mortgage deals than other borrowers. This is because you are in high demand and have a very low risk of unemployment in the UK.

As a doctor, there are no special mortgages for you. You can get a standard mortgage like everyone else. But because of your profession, you’re in a good position to get a good deal.

Lenders look for stability, so they are more likely to offer you flexible underwriting and better terms. Your dedication to completing years of study to get qualified is seen as a sign of reliability.

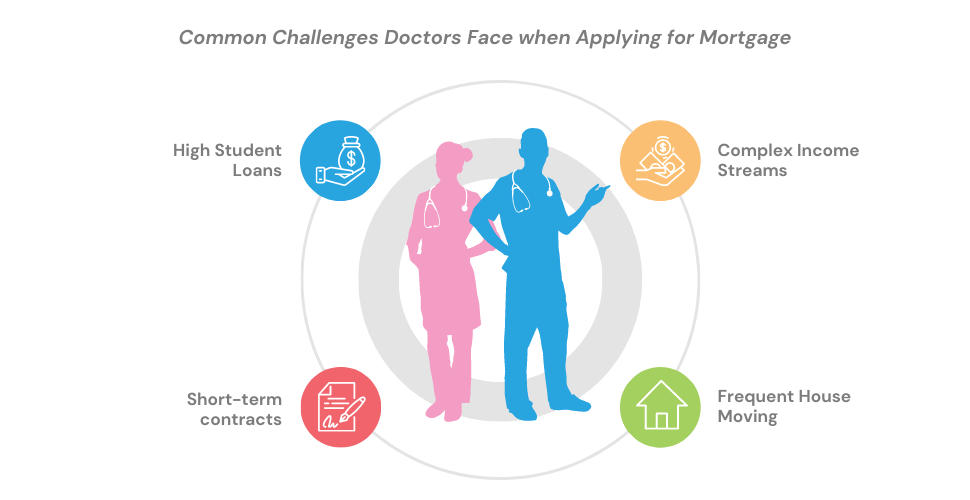

However, even doctors can have trouble getting a mortgage. So here we’ve noted four reasons why you might struggle to get a mortgage, and what you can do to improve your chances.

4 Reasons Why Doctors Might Struggle to Get a Mortgage

1. Frequent job moves

Doctors often have to move for work, whether it’s for a training rotation or a better job opportunity. This can make it difficult to build up a good credit history, which lenders use to assess your eligibility.

If you’re a frequent mover, you might want to consider getting a portable mortgage, which allows you to transfer your mortgage to a new property without having to start the application process from scratch.

2. High student loans and low starting salaries

Medical school is expensive, and student doctors often graduate with a lot of debt. In the UK, this can be between £50,000 and £90,000 loan (Marsh and Nelson, 2023). Junior doctors also have a low starting salary. This can make it difficult to afford a mortgage.

If you’re struggling to get a mortgage, you might want to consider saving for a larger deposit first. You can also look for lenders who take your future earning potential into account when assessing your application.

3. Short-term contracts

Doctors who are just starting usually have short-term contracts. This can make lenders nervous, as they’re more likely to lend to people with stable incomes and long-term jobs.

To improve your chances, you could provide lenders with contracts or documents that prove your income and job stability. You must show them that you can afford the monthly repayments.

4. Complex income streams

Some doctors have complex income streams, such as self-employed or locum doctors. This can make it difficult for lenders to assess your finances.

They may be reluctant to lend to you. That’s why you need to be prepared before you apply for a mortgage.

Getting a mortgage can be challenging, but it’s not impossible. Here’s what you can do to increase your chances of getting a mortgage and buying a home:

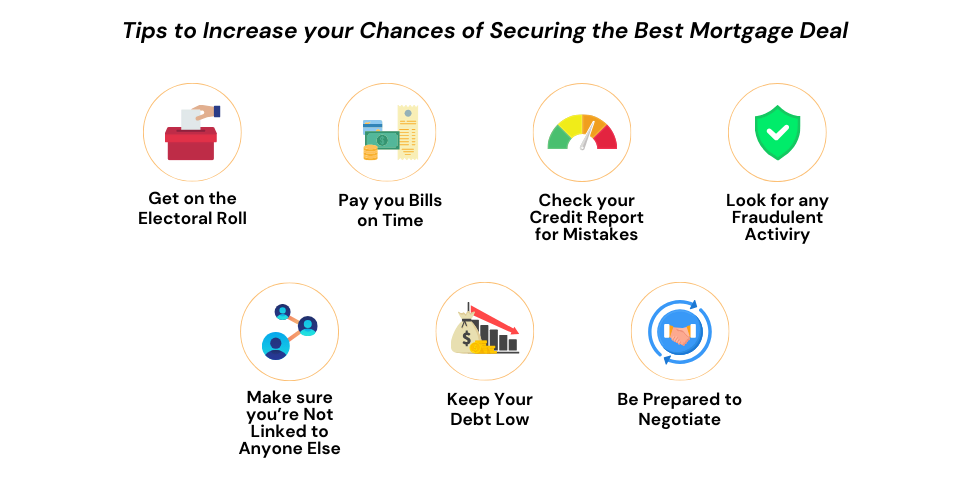

7 Ways to Increase Your Chances to Get the Best Mortgage Deal

In addition to your career and qualification with the General Medical Council (GMC), it’s important to get your finances in order.

Lenders will look at your income, expenses, and credit history to assess your creditworthiness, which is crucial for your mortgage application.

Here are a few things you can do to improve your chances of getting the best mortgage deal:

- Get on the electoral roll. To show lenders that you’re a settled member of the community.

- Pay your bills on time. So lenders see that you’re reliable and trustworthy.

- Check your credit report for mistakes. Anything from a wrong address to a missed payment, always check it before your lenders do.

- Look for any fraudulent activity. If someone has opened a credit card in your name, it could damage your credit score.

- Make sure you’re not linked to anyone else. This is someone you’ve had a joint account or shared financial obligations with. If they have bad credit or have moved abroad, it might be best to cut financial ties with them.

- Keep your debt levels low. The more debt you have, the less likely you are to be approved for a mortgage.

- Be prepared to negotiate. Don’t be afraid to negotiate with the lender to get a better deal. You may be able to get a lower interest rate, a longer repayment period, or a lower monthly payment.

How much can Doctors Borrow?

As a low-risk borrower, you can borrow up to 6 times your annual salary. This is especially true for experienced doctors with high earnings. But this might be lower for junior doctors.

Lenders will usually offer mortgages of up to 4 or 5.5 times your annual salary. To get an idea of the potential amount you can borrow, have look at the table below:

| ROLE | *ANNUAL SALARY | 4 TIMES | 5 TIMES | 6 TIMES |

|---|---|---|---|---|

| Foundation Training | £34,012 | £136,048 | £170,060 | £204,072 |

| Specialist Grade Doctor | £91,584 | £366,336 | £457,920 | £549,504 |

| General Practitioners | £98,194 | £392,776 | £490,970 | £589,164 |

| Consultants | £119,133 | £476,532 | £595,665 | £714,798 |

Note though, that the exact amount you can borrow will depend on your circumstances, including your affordability assessment, deposit size, and credit history.

Mortgages for Trainees and Junior Doctors

Doctors in Training

As a trainee doctor, it can be tough to get a mortgage. You’re often on the move, with a big student loan, a lower starting salary, and a short-term training contract. This can make you look risky to lenders.

You might think you can’t get a mortgage as a trainee, and some lenders might agree. But it’s not always the case.

There are specialist lenders who will consider your future income as a doctor. So it’s important to meet the right lender to get a better mortgage deal.

You could also get a guarantor or apply with a joint partner. A guarantor is someone who’ll pay your mortgage if you can’t.

A joint applicant is someone who’ll apply for the mortgage with you. Both can make lenders more likely to approve your mortgage.

Junior Doctors or Newly-Qualified Doctors

Most lenders will need at least three months of proof of steady income, such as payslips or employment contracts, to assess your affordability.

If you’re a newly-qualified doctor, you might not be able to get a mortgage straight away. But specialist lenders will consider your case if you can prove you’re a reliable borrower.

Mortgages for Locum Doctors and Self-Employed Doctors

Locum Doctors

As a locum doctor, you might be wondering if you can get a mortgage. After all, you work irregular hours, have long periods of unemployment, and your income is variable and unpredictable.

Some lenders might be hesitant to lend to you because of your unconventional employment situation. But don’t lose hope!

It’s best to be prepared and gather all the necessary documents. Lenders typically evaluate your accounts, employment commitments, and other income sources to determine if they can offer you a mortgage.

Self–Employed Doctors

As a self-employed doctor, you’ll likely have variable income.

Most lenders will want to see at least 3 years of accounts approved by a qualified accountant and SA302 tax returns, which are official summaries of your annual income reported to the UK’s HM Revenue & Customs (HMRC).

This makes it easier for you to secure a better mortgage deal. But if you have less than 3 years of accounts or no accounts at all.

There are specialist lenders who may be willing to lend to you. They’ll assess your income based on your current earnings and expected earnings.

Commercial Mortgages for Doctors

A commercial mortgage can be a good option if you’re a doctor looking to buy or expand your own practice. It’s a loan specifically designed for commercial purposes, such as buying or renovating a medical practice.

With this, you can secure the loan against the commercial property itself. This means you don’t have to mix up your personal and business finances – they stay separate and organised.

Generally, medical practices are seen a low-risk investments. But lenders will still assess if you’re practice is profitable, and you’re financially stable.

They’ll check on many factors including:

- Your credit score

- Your income and deposit size

- Proof of qualification and doctor’s experience

- The amount of the loan

- The term of the loan

- The value of the property

If you’re thinking of getting a commercial mortgage, it’s best to consult with a mortgage advisor to see what your options are and if you’re eligible.

The Bottom Line

There you have it. Mortgages for doctors are easier to get than you might think. In fact, with a bit of planning and preparation, you can buy your dream home, even if you’re still in training.

As low-risk borrowers, lenders are often willing to offer you good rates and terms.

To get the best deal, make sure your income, credit score, and employment history are all in order. A large deposit can also help you get a better deal.

There’s a lot of great options on the market. But you need a good mortgage broker to find them.

They’ll be your personal shopper for mortgages as they know the market inside out. They can also help you find the perfect deal for your needs and budget.

If you’re taking the next step towards homeownership – don’t hesitate to reach out to us. Simply, fill out this quick form. And we’ll connect you with a qualified mortgage broker who specialises in mortgages for doctors.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can doctors get special mortgage rates in the UK?

Generally, yes. Especially, if you’re a senior doctor with high earnings. Lenders usually will offer you lower interest rates and more flexible terms than they do to other borrowers.

What mortgage options are available to doctors in the UK?

The best type of mortgage for you depends on your circumstances and needs. But, in general, here are some types of mortgages available to doctors in the UK:

- Repayment mortgages are the most common type of mortgage. With this, you pay back both the interest and part of the loan each month. This can be the best way to build equity in your home over time.

- Interest-only mortgages are a type of mortgage where you only pay back the interest on the loan each month. The principal is not repaid until the end of the mortgage term. This type can be risky, as you could end up owing more money than the value of your home.

- Fixed-rate mortgages have an interest rate that stays the same for a set period, usually 2 or 10 years. It gives you peace of mind, as you know how much your monthly payments will be for the duration of the fixed rate period.

- Variable-rate mortgages have an interest rate that can go up or down over time. So your monthly payments may also go up or down. It can be a good option if you think interest rates are going to fall, but there’s still uncertainty involved as they could go up.

As a doctor, you may be able to get a mortgage with a lower interest rate than someone in another profession. If you’re a first-time buyer, read this guide to make informed decisions when you buy your first home.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.