Mortgages for Nurses: A Simplified Guide in 2025

Most high-paid professionals can get mortgages easily. But what about nurses?

As a nurse, you’re on the front lines, tirelessly caring for others.

You’ve faced the challenges of long hours and immense pressure. Especially during the COVID-19 pandemic. But when it comes to getting a mortgage, does your hard work go unnoticed?

The truth is, as a dedicated nurse, you may encounter hurdles in getting a mortgage. Here’s why:

- Irregular working hours and short-term contracts make it tough to prove stable income to lenders.

- Rising interest rates can make it harder to save for a large deposit on a lower salary.

- Finding a lender who understands your income as an agency, bank nurse, or self-employed can be a challenge.

If this sounds like you, don’t worry! There’s light at the end of the tunnel.

Lenders specialising in nurses’ mortgages exist and there are schemes designed to help you step onto the property ladder.

In this guide, we’ll explore the mortgages available to nurses, and provide you with valuable insights for a successful application in the UK.

Can Nurses Get Better Mortgage Deals?

Yes, you can. Nurses are essential professionals. So you’ll likely have the edge over other borrowers.

Lenders who favour healthcare professionals are more likely to approve your loan and offer lower interest rates. You’re also prioritised for government schemes, which we’ll talk about later.

While no mortgages are exclusively designed for nurses, you can access the same standard options as other borrowers. But, as a nurse, you may qualify for more favourable terms and flexible conditions.

Like anyone else, it’s important to present yourself well to lenders when applying for a mortgage.

The first step? Find out if you meet the eligibility criteria.

Eligibility and Criteria for Nurses

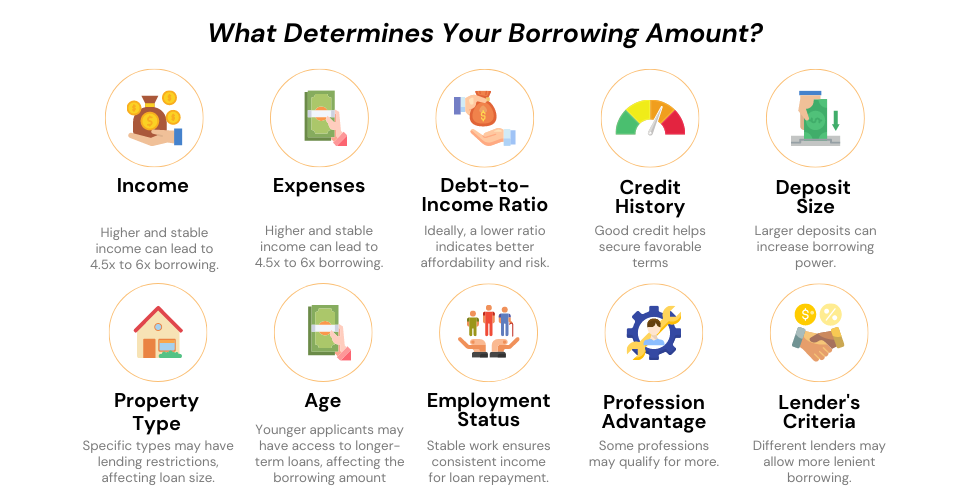

Every lender has their way of assessing your mortgage application, but there are six main factors they will consider:

- How much you earn and owe

- Your credit history

- The size of your deposit

- Your age

- Your job situation

- The type of property you’re eyeing

Earnings and Debts

When applying for a mortgage, lenders check your earnings and debts to ensure you can handle monthly payments.

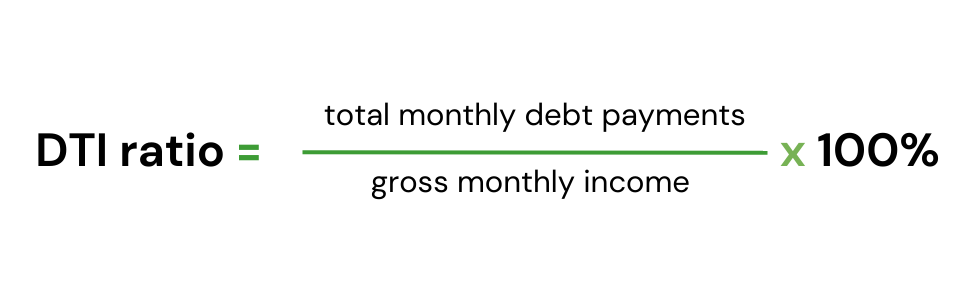

They’ll also calculate your debt-to-income (DTI) ratio. This tells lenders how much of your monthly income goes into your debts. Usually, lenders look for a DTI of 36% to 43%. The lower, the better.

To calculate your DTI, use this formula:

For instance, you have £900 in monthly debt payments (student loan, car loan, rent, credit card payment), and a gross monthly income of £2,250, your DTI ratio would be 40%.

If your DTI ratio is too high, you might need to pay off some debt or increase your income before you can get a mortgage.

You can check you debt-to-income ratio using our calculator here.

Credit History – Lenders will check this to see how you’ve handled your finances in the past. They want to see if you’ve made payments on time. Check your credit report for any errors before getting a mortgage.

Deposit Size – As a rule of thumb, the larger deposit, the better the perks. While a 5% deposit is acceptable, aim for at least 10% to unlock better deals. This lowers your LTV (that’s loan-to-value) and boosts your chances of scoring better rates.

Age – Some lenders have age limits for mortgages. If you’re approaching retirement or are already retired, there are specialist lenders who can help you.

Employment Type – Your job type affects your application. Lenders want to know if you can afford the repayments. If you’re self-employed or a bank nurse, you’ll need to find a lender who understands your income.

Type of Property – Lenders may be more cautious about unusual properties with a small market. They may be harder to sell if you default on your mortgage.

How much can you borrow?

In the UK, lenders use income multiples to assess how much you can borrow for a mortgage. This is usually 4 or 5 times your annual salary. But it can be up to 6 times in exceptional cases.

For example, if you have an annual salary of £37,000. You could borrow up to £148,000 with a multiple of 4, or £185,000 with a multiple of 5.

It’s important to note that this is just an example. The actual amount you can borrow will depend on many factors that we’ve mentioned above.

Mortgages Available to Nurses

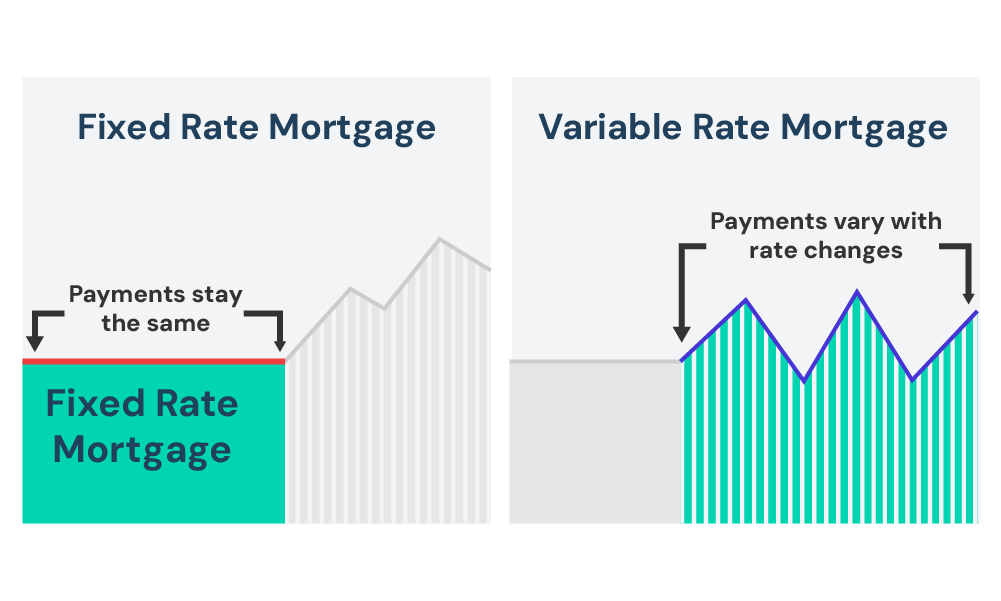

As a nurse, you can choose from the same mortgage products as anyone else. These include fixed-rate, variable-rate, and flexible mortgages.

- Fixed-Rate Mortgages: Your interest rate stays the same for 2 to 10 years.

- Pros: Predictable monthly payments for easier budgeting.

- Cons: No benefit if interest rates drop.

- Variable-Rate Mortgages: Your interest rate can change over time.

- Pros: Mortgage payment decreases if rates go down.

- Cons: Rates can rise, increasing your monthly payment.

- Flexible Mortgages: Repayments offer flexibility, allowing overpayments, underpayments, or payment holidays based on lender terms.

- Pros: More control and adaptability to your financial situation.

- Cons: Flexibility may come with higher interest rates or fees.

Do Nurses in the UK Get Help with Mortgages?

Yes. Some lenders are more understanding of medical professionals and offer better deals. There are also government schemes that can help you buy a home, such as:

In England, homes under the scheme can be bought at a 30-50% discount. The discount is permanent, so it will apply to future buyers too.

This scheme replaces the old key worker mortgage scheme that ended in 2019. It aims to help key workers and first-time buyers get on the property ladder.

To qualify, you need to be 18 or older, a first-time buyer with a household income of less than £80,000 (£90,000 in London), and able to secure a mortgage for at least half of the property’s value.

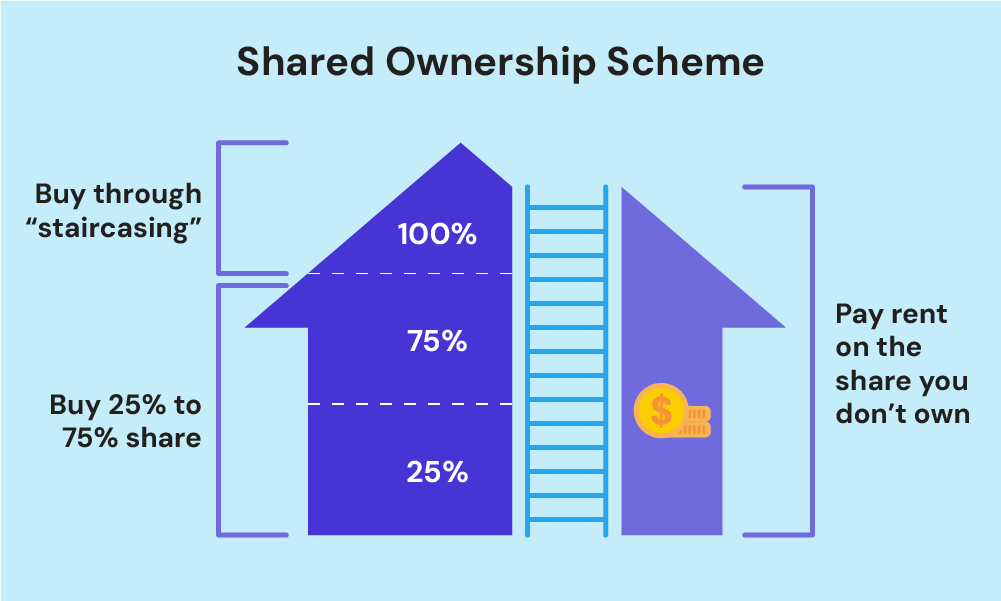

This scheme is perfect if you want to own property while managing costs. You can buy a share of a property, anywhere from 10% to 75%, and pay rent on the rest.

You’ll also need to pay a deposit. Usually 5% to 10% of the share you’re buying.

Each month, you’ll make payments for a mortgage on the portion of the property you bought, the rent for the portion you don’t own, and a service charge.

As you save up more money, you can buy more shares in your home, eventually owning it outright. This is called “staircasing.“

Sadly, this scheme is no longer open to new applicants. But if you’ve registered, here’s how it works:

You can buy a new-build home from a registered homebuilder with a 5% deposit. The government can lend you up to 20% (40% in London) of a property’s price. So you can get a 75% mortgage with a 5% deposit.

There’s no interest on your equity loan for the first five years. After that, it will be 1.75% or more depending on Consumer Price Index (CPI) plus 2%.

Nurses who rent from the council can buy their homes at a discount through Right to Buy. The discount depends on where you live, how long you’ve been a tenant, the type of property and its value.

The maximum discount is £127,900 in London and £96,000 in the rest of England. It goes up every April with the Consumer Price Index (CPI). You have to repay the discount if you sell your home within 5 years.

To be eligible, you must be the main tenant, have rented for at least 3 years, plan to live in the property as your main home, and have had a public sector landlord.

You can’t join if you’re at risk of eviction, bankruptcy, or have a lot of debt. You also can’t join if your home is for the elderly or disabled, or if there’s a housing shortage.

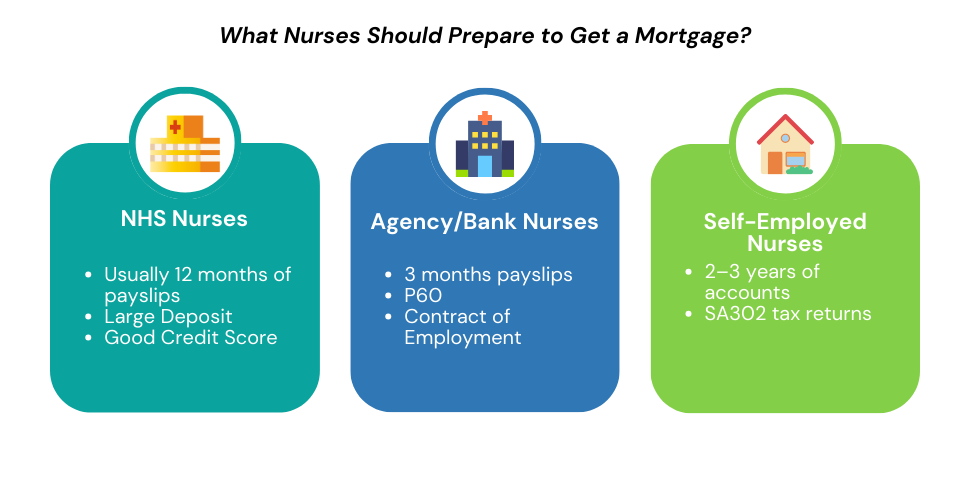

What Nurses Should Prepare to Get a Mortgage?

Providing proof of income is the most important part of your mortgage application. You’ll also need to provide evidence of your qualification, UK residency, and a deposit.

Here is what you need to prepare to prove your income, no matter your role as a nurse:

NHS Nurses and Employed in the Private Sector

If you’re an NHS nurse or employed in the private sector, you’ll get paid through PAYE. To apply for a mortgage, you’ll need:

- 3 months’ worth of payslips to show your monthly income

- Your P60 to show your annual income and any overtime or shift bonuses

- Your contract of employment to show you’re employed and in a permanent position.

Make sure your payslips are up to date and match your current address, pay scale, and bands. Lenders might ask for more payslips if your income fluctuates or you’re newly qualified.

Agency and Bank Nurses

Finding a lender as an agency or bank nurse can be tough. As your income varies and you’re often on short-term contracts.

Traditional lenders see bank nurse work as similar to zero-hours contracts, which means it’s not guaranteed. But that doesn’t mean you can’t get a loan.

To show consistent work within your current role, lenders typically require at least 12 months of payslips. A large deposit and a good credit score will also help you get approved.

Self-Employed Nurses

Lenders can be cautious when lending to self-employed nurses. They may find it difficult to decide how much to lend to you. This is because your income is unpredictable.

To counter this, you need to provide more proof of income. This includes

- 2-3 years of accounts approved by a qualified accountant

- SA302 tax returns, , which are official summaries of your annual income reported to the UK’s HM Revenue & Customs (HMRC).

New self-employed nurses can still get a mortgage from specialist lenders if they have 1 year’s worth of accounts.

Nurses with Poor Credit History

If you have bad credit, you might have fewer mortgage options. The severity and length of your bad credit will affect your options.

The older your poor credit, the better your chances of getting a mortgage. It could be best to wait to improve your credit before applying. A big deposit and sufficient proof of income could also help.

The Bottom Line

Nurses like you play a vital role in our healthcare system. So, it’s right that you have access to mortgages that fit your needs.

Building financial security takes time, but it’s worth it. Keep saving, improve your credit score, and get proof of all your income. Once you’ve done these things, you’ll be in a much better position to apply for a mortgage.

Along with your mortgage search, seek good advisors to help you. They can take care of your application and find the right lender for you.

To get started, reach out to us today. We’ll match you with a good mortgage advisor who specialises in mortgages for nurses.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can Nurses working with the NHS get a discount on Mortgages?

Nurses don’t get NHS discounts on mortgages. But there are lenders who offer good rates or fees to nurses. These are rare, and you might struggle to find one on your own. It’s best to speak to a mortgage advisor to find the right lender for you.

Can student nurses get mortgages?

Yes, student nurses can get mortgages. Bursaries can be counted as income, alongside any other earnings.

Will my student loan affect my mortgage application?

Yes, it might. Lenders will look at your monthly student loan repayments and your income to see if you can afford a mortgage. Student loans are seen as low-risk debt, so they won’t automatically rule you out of getting a mortgage.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.