Armed Forces Mortgages: A Guide to Homeownership in 2025

Military life is different from civilian life, and the same goes for mortgages.

While civilians usually have a single address, a predictable income structure, and a credit history, military personnel have unique financial circumstances.

Frequent deployments can make it challenging to prove your long-term stability to lenders.

Complex pay structures or low credit scores can make it difficult to find a lender who truly understands your needs.

On top of that, the demanding nature of your job leaves limited time to prepare for a mortgage application.

That’s why we’ve created an exclusive guide for you.

Here we’ll highlight the benefits of specialist lenders who understand your situation. We’ll explore schemes that support your homeownership, and discuss factors that affect your affordability.

We’ve also prepared a handy checklist to help you with your mortgage journey.

In short, by the end of this guide, you’ll have the answers you need about military mortgages.

Do Mortgage Lenders Offer Specific Products for Military Personnel?

Not exactly. Military or armed forces mortgages are not distinct products solely designed for military personnel. In general, you can also get the same standard mortgage like other borrowers.

But, certain lenders specialise in military mortgages. They have a more flexible approach to assessing your application.

These lenders understand the nature of your military service, including deployments and transfers. As a result, they offer mortgage options that accommodate these factors. You typically have access to two kinds of benefits or support:

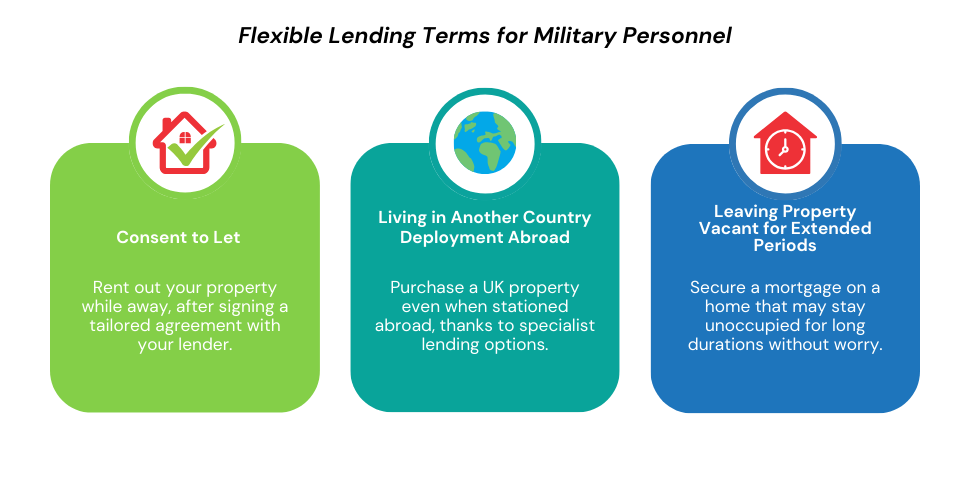

Flexible Lending Terms

Specialist lenders in the UK offer flexible lending terms for military personnel. This may include lower deposit requirements or less strict criteria for credit scores to make it easier for you to get a mortgage.

You also get additional support during deployments and relocations. Let’s take a look at some of these benefits in more detail.

Military personnel who needs to move away from their property temporarily, can rent it out instead of selling it. This is a good option as it lets you earn money from your property and retain ownership.

To do this, you’ll need to ask your lender and sign a new agreement with them. This sets out the terms of your let, such as the rental charges and the length of the tenancy.

Take note that some lenders impose higher rates or fees for these arrangements. It’s crucial to fully understand the terms and conditions, and your responsibilities as a landlord before entering into a consent-to-let agreement.

Living in Another Country – Deployment Abroad

Specialist military mortgage lenders also recognise that deployments and overseas assignments are part of your life.

That’s why they offer options that allow you to purchase a property in the UK even if you’re residing in another country.

Leaving Property Vacant for Extended Periods

Unoccupied properties can be a concern for lenders as they can be neglected and fall in disrepair that damages their value.

But, some specialist lenders are willing to consider mortgages on properties that will be left vacant for extended periods.

Forces Help to Buy Scheme (FHTB)

To help address the low rate of homeownership in the armed forces, the government has made this a permanent policy. This means you can apply for this scheme now and in the future.

The scheme allows you to borrow up to 50% of your salary, to a maximum of £25,000, completely interest-free. You can use this money for your deposit and other fees, such as for solicitors and estate agents.

Eligibility Criteria

To qualify, you must be a regular service personnel who:

- Has completed the minimum service requirement

- Is not a reservist or a member of the Military Provost Guard Service

- Have more than 6 months left to serve at the time of application

- Meets the right medical categories

For application

- You can use the self-service application on JPA.

- Or, if you don’t have access to JPA, you can submit JPA Form E035 to DBS Military Personnel FHTB Section. You must do this at least 6 weeks before the expected purchase completion date.

Can you combine this with another housing scheme?

Yes, you can combine the Forces Help to Buy Scheme (FHTB) with other housing schemes. But, you’ll need to check with your lender first to make sure they’re happy to do so.

Here are some other housing schemes that you could combine with FHTB:

First Homes Scheme

This scheme offers a discount of 30% to 50% on newly built properties. It is available to military personnel, first-time buyers, and other key workers.

To qualify, your annual income should be below £80,000 (or £90,000 in London). If/when you are sell the property, the same discount shall apply.

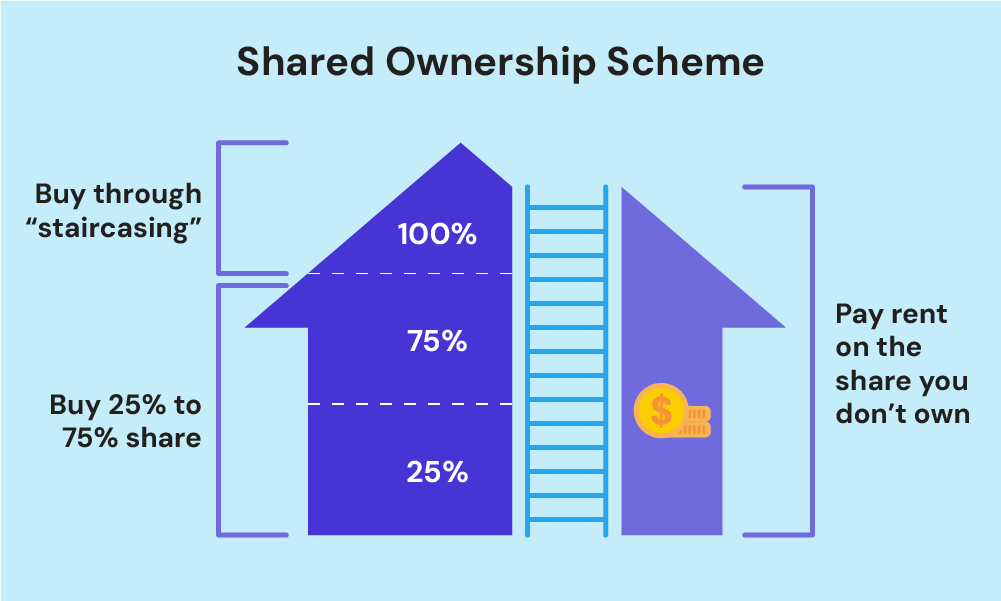

Shared Ownership Scheme

This is a way to buy a home by buying a share of it, usually between 25% and 75%. You then pay rent on the remaining share to your landlord. In the future, you can buy more shares up to 100% ownership.

What happens if you leave the military after applying for FHTB?

- Even if you leave the armed forces, the loan will remain in effect. But, if you receive a resettlement grant, it’s possible that the loan repayment will be deducted from your grant or final month’s salary.

Can former military personnel buy a home with Forces Help to Buy?

- Unfortunately, the FHTB scheme is only for service personnel who have at least 6 months left to serve. But, there are specialist lenders who offer support to former military personnel.

Learn more about Forces Help to Buy.

How Much Can You Borrow?

Lenders use income multiples to decide how much they’re willing to lend. They usually multiply your annual income by 4 or 4.5.

For example, an officer after training can earn an annual pay rate of £34,690. This will be multiplied by either 4 or 4.5. You can then borrow between £138,760 (£34,690 x 4) and £156,105 (£34,690 x 4.5).

Moreover, lenders may adjust your income multiple based on your circumstances. They will consider your ability to afford the monthly repayments.

The factors we’ve set below can impact your borrowing amount too. So if your monthly expenses are high, you may not be able to borrow the full four times of your salary.

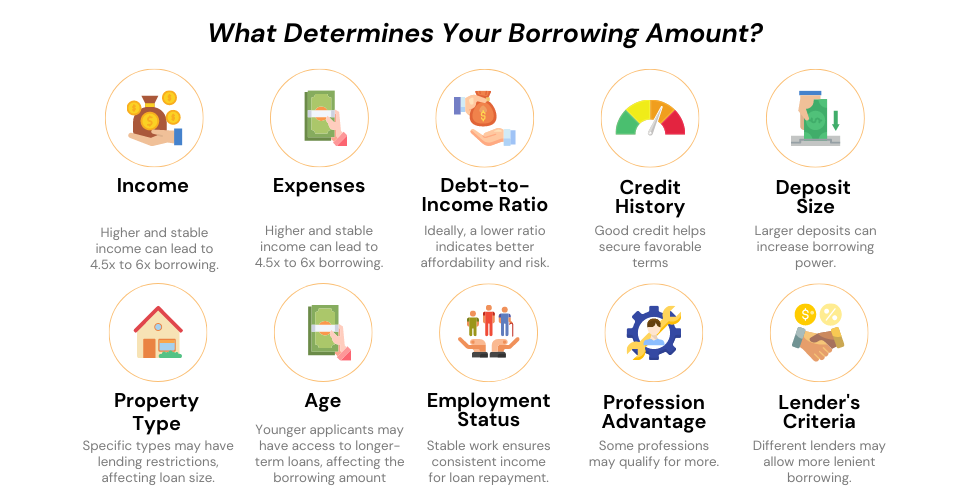

Influencing Factors on Your Mortgage Application

Here are some things that lenders consider when deciding on your mortgage application:

Your income and outgoings

Lenders assess your income and debts to see if you can afford a mortgage. They take into account your monthly earnings, including bonuses and overtime, along with your regular expenses like loans, credit card payments, and utility bills.

This assessment also involves calculating your debt-to-income (DTI) ratio, which shows the proportion of your monthly income that goes towards debts.

A DTI ratio of 43% or below is considered favourable. The lower your DTI ratio, the more appealing you are to lenders.

To calculate your DTI ratio, click here.

Your credit score

Lenders look closely at your credit history to decide if you’re a good risk. A good score shows that you’re a responsible borrower. This can boost your mortgage approval and get you a good interest rate.

But if you’re in the military, your credit score might have taken a hit because of frequent moves. Luckily, some lenders are aware of this and may make exceptions.

Deposit Size

The deposit you put down can affect your mortgage application. Lenders may accept a 5% deposit, but some may ask for at least 10%.

A larger deposit will improve your loan-to-value (LTV) ratio. This is the percentage of the property’s value that you borrow from your lender.

For instance, with a £200,000 property and a £10,000 (5%) deposit, your LTV is 95%. This means that you’re borrowing 95% of the property’s value, which could result in higher interest rates because lenders see this as a higher risk.

But, if you have saved at least £40,000 (20%) deposit, your LTV decreases to 80%, which may lead to more favourable interest rates.

A lower LTV means less risk for the lender, so they’ll usually offer you a competitive rate. That’s why it’s important to strike a balance between affordability and securing the best mortgage deal when considering your deposit size and LTV.

Saving a bigger deposit will increase your chances of getting a mortgage and reduce your interest payments in the long run.

Your Age

Age can be a factor considered by lenders. This is to ensure that the mortgage can be repaid within the borrower’s working years.

The youngest is between 18 and 21, but some lenders may have a higher maximum age limit. If you’re an older applicant, lenders might still offer you a mortgage with a shorter term.

The Property Type

The type of property you’re buying can also have an impact on your mortgage application. Lenders will look at the property’s value, marketability, condition, and location.

In general, the more unusual or risky a property is, the more difficult it will be to get a mortgage on it. Here are some properties that could be difficult to get a mortgage on:

- High-rise flats

- Properties with short leases

- Homes of unusual construction

- Ex-local authority housing

- Properties in poor condition

Armed Forces and Military Mortgages Checklist

- Consider Specialised Lenders. Look for lenders who specialise in military mortgages, as they may have tailored products and better understand the unique circumstances of service members.

- Plan for Deployment. If you anticipate deployments or frequent relocations, discuss flexible mortgage options with lenders that accommodate your unique circumstances.

- Explore Government Schemes. Familiarize yourself with government-backed schemes, such as the Forces Help to Buy scheme, which provides interest-free loans to military personnel, to determine if you qualify for additional support.

- Calculate Affordability. Assess your income, expenses, and financial obligations to determine how much you can comfortably afford to borrow. You may use online mortgage affordability calculators to get an estimate.

- Save for a Deposit. Aim to save for a deposit that aligns with your desired loan-to-value (LTV) ratio. A larger deposit can improve your chances of approval and secure more favourable interest rates.

- Review Your Credit Report. Obtain a copy of your credit report and ensure it is accurate and up-to-date. Address any errors or discrepancies before applying for a mortgage.

- Maintain Good Credit. Pay your bills on time, minimize outstanding debts, and avoid new credit applications before and during the mortgage application process to maintain a healthy credit score.

- Gather Documentation. Prepare necessary documents, such as proof of income (payslips, tax returns), bank statements, proof of address, and identification, to streamline the application process.

- Seek Professional Advice. Consult with good mortgage advisors who specialise in assisting military personnel. They can provide expert guidance, assess your eligibility, and help you navigate the mortgage market.

The Bottom Line

Getting a mortgage while serving in the army can be tough. Most mortgage lenders may not understand your unique needs.

That’s where a good mortgage broker comes in handy. With their expertise, they can help you find the best deal to move forward with your home-buying journey.

Reach out to us today, and we’ll hook you up with a good mortgage broker who specialises in serving military personnel.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can military and armed forces get insurance for mortgages?

Yes, but it can be tricky. Military service involves inherent risks and potential exposure to hazardous situations. But, there are specialist insurers and brokers who understand your needs. They may offer tailored insurance products for the specific risks and circumstances associated with military service.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.