Police Mortgages: A Definitive Guide in 2025

Police officers are never off duty. You put your lives on the line every day to keep us safe. But amidst your noble service, you face a unique challenge: securing a mortgage.

As a police officer, time can be your enemy. The demands of your profession, the irregular shift patterns, and the sacrifices you make often create hurdles when it comes to finding the right mortgage solution.

You’re probably worried about how you’ll get onto the property ladder in the UK.

But there’s good news.

Being a police officer has an advantage when it comes to getting a mortgage. You’re more likely to get a mortgage than other borrowers.

We know that you’ve got a lot on your plate, so we’ve made this guide as clear and concise as possible. Here we’ll equip you with the knowledge on how to get police mortgages in the UK and invaluable insights to help you make wise decisions for your mortgage application.

If you’re a first-time buyer or a seasoned homeowner, this guide helps you find the perfect mortgage for your needs.

What is a Police Mortgage?

There are no specific mortgages exclusively for the police force. But, being a police officer increases your chances of getting a mortgage.

Lenders often sees your job to carry less risk and are more likely to make timely mortgage repayments. As a result, you can get mortgages with more flexible underwriting, lower rates, or higher loan-to-value.

The best part is that you don’t have to be actively serving on the front line. Even if you work in other areas of the emergency services, you’ll find it easier to secure a mortgage compared to other professions. As long as you’re employed by the police force, lenders consider you as a reliable candidate.

Moreover, the structure of police employment makes it easy for lenders to assess your financial situation. This gives you an advantage over applicants with variable income or those who are self-employed.

How Much Can Police Officers Borrow?

Lenders in the UK use income multiples to work out how much you can borrow for a mortgage. They multiply your annual income by a set number, which is usually between four and five times your salary.

To illustrate, let’s take a police officer in England with a starting salary of £21,402 per year.

- With an income multiple of 4, you can borrow £ 85,608 (£21,402 x 4).

- With an income multiple of 5, you can borrow £ 107,010 (£21,402 x 5).

Keep in mind that income multiples are not set in stone. Lenders may increase or decrease your borrowing amount based on your circumstances.

For example, if you’re a police officer with a good credit history or bigger deposit, you’re likely to get a higher income multiple than someone who has a poor credit history or a smaller deposit.

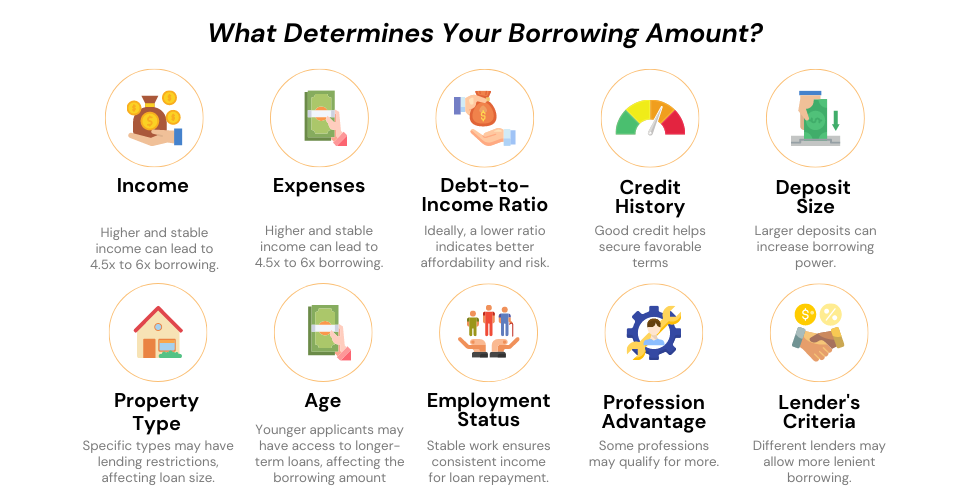

In addition, lenders will consider factors such as your income, outgoings, deposit, and type of mortgage you’re applying for. So it’s best to be ready before applying for a mortgage.

How to Qualify for a Police Mortgage?

To qualify for a police mortgage, you need to meet certain factors that your lender has set. These factors and specific requirements may vary between lenders.

But to give you an idea, we’ve outlined the common factors lenders will assess in your mortgage application:

- Your income and outgoings

- Overtime and bonus payments (if applicable, depending on the lender)

- Your employment contract

- Your age

- Your credit score

- The deposit you’ll provide

- The type of property you’re interested in

The importance given to each factor also differs depending on the lender and the type of mortgage you’re applying for.

Some lenders might focus on your credit score, while others might pay more attention to your employment history.

Income and Outgoings

Lenders assess your income and outgoings to determine if you can get a mortgage and manage the repayments.

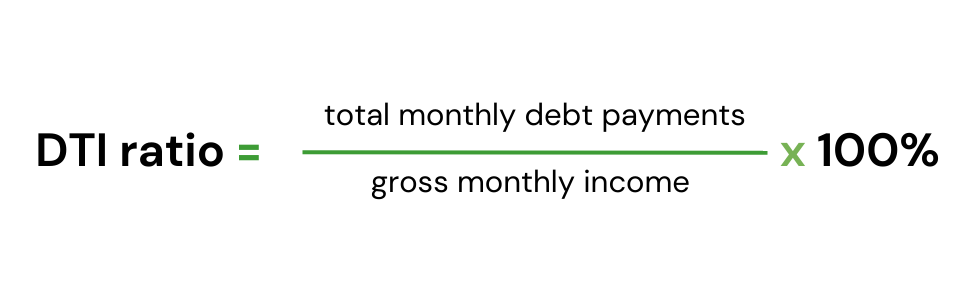

As part of this, lenders calculate your debt-to-income ratio (DTI) to see how much of your monthly income is used to pay debts.

A high DTI ratio means you’re spending a lot of your income on debt, which can impact your mortgage affordability. To check your DTI ratio, consider this illustration: With £2,000 in monthly debt obligations and a gross monthly income of £5,000, your DTI ratio amounts to 40%.

This is considered as good risk for lenders as it’s advisable to have at least 43% DTI ratio.

Use the debt-to-income calculator to see where you stand as a borrower.

Overtime or bonus payments

Your lender will decide whether to include overtime and bonus payments in your mortgage amount. Some lenders may consider these payments as part of your income, while others may not.

Typically, they may add these payments if they are consistent and likely to continue.

Employment contract

Generally, lenders see full-time employees as being more stable and less likely to face a job loss. This means you’re more likely to get approval for a mortgage.

If you have a part-time contract, you may still be able to get a mortgage. But you may need to give more proof of your financial stability.

Your Age

While you need to be at least 18 years old to qualify, the maximum age limit varies based on the lender’s terms. Most lenders prefer to approve mortgages for individuals who are still in their working years.

Credit score

Your credit score is another factor for lenders. A good score shows you’re a reliable borrower who has a history of making payments on time. This could get you a better mortgage deal and rates.

Some lenders accept a 5% deposit. But it’s advisable to have at least a 10% deposit to get better rates. A larger deposit attracts lenders; it shows you give more financial commitment to the property.

This also lowers your loan-to-value (LTV) ratio – the percentage of your mortgage to your home value. It’s calculated by dividing the mortgage amount by the property’s value.

A lower LTV ratio indicates a lower risk of default. This means you may get a mortgage with lower rates or good terms.

Type of Property

Property types matter to lenders. They care about the property’s value, marketability, condition, and location before approving a mortgage.

They usually prefer properties that are standard and have broad market appeal. So, it’s important to check if the property you’re interested in meets their criteria

Mortgages for New Police Officers

Lenders are more cautious about lending to new police officers, but it’s still possible to get a mortgage. They will want to see that you have a stable job and steady income.

Generally, you’ll need to provide proof of income, such as:

- 3 months or more of payslips

- Your employment contract

Government Schemes to Help You

Although no government schemes are specifically aimed at police officers, here are some standard schemes that can help you get onto the property ladder:

This scheme offers discounts of 30% to 50% on new-build homes in England for first-time buyers and key workers. If you sell the property, the same discount applies.

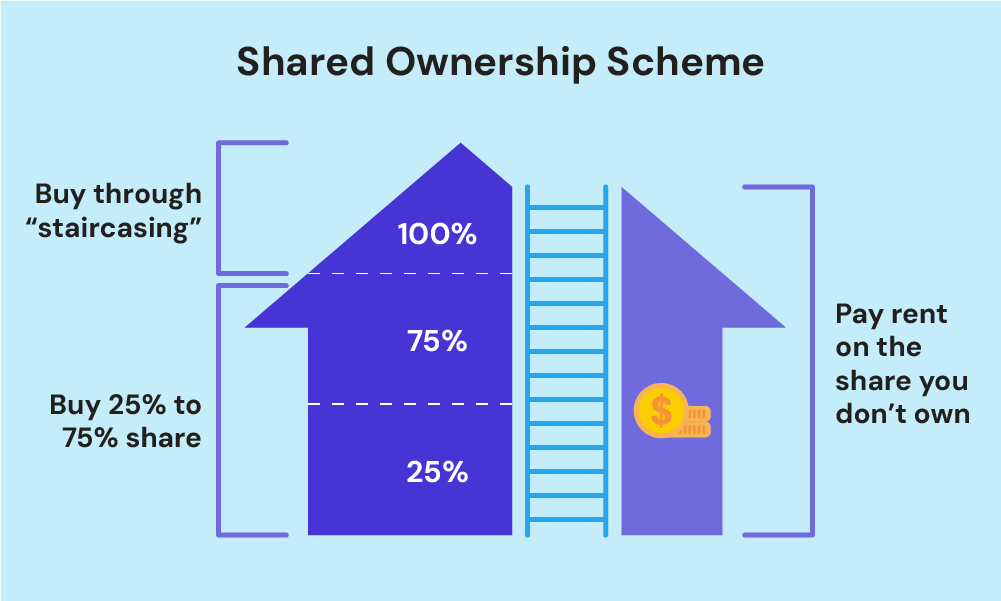

If you can’t buy a property outright, this scheme lets you buy a share of the property, usually between 25% and 75%. Then, pay rent and service charges on the rest to your landlord.

To finance your share, you must get a mortgage loan and pay a 5% or 10% deposit. You can then increase your share over time until you own 100% of the property. This process is known as “staircasing.”

This scheme is available to any home buyers until the June 30, 2025.

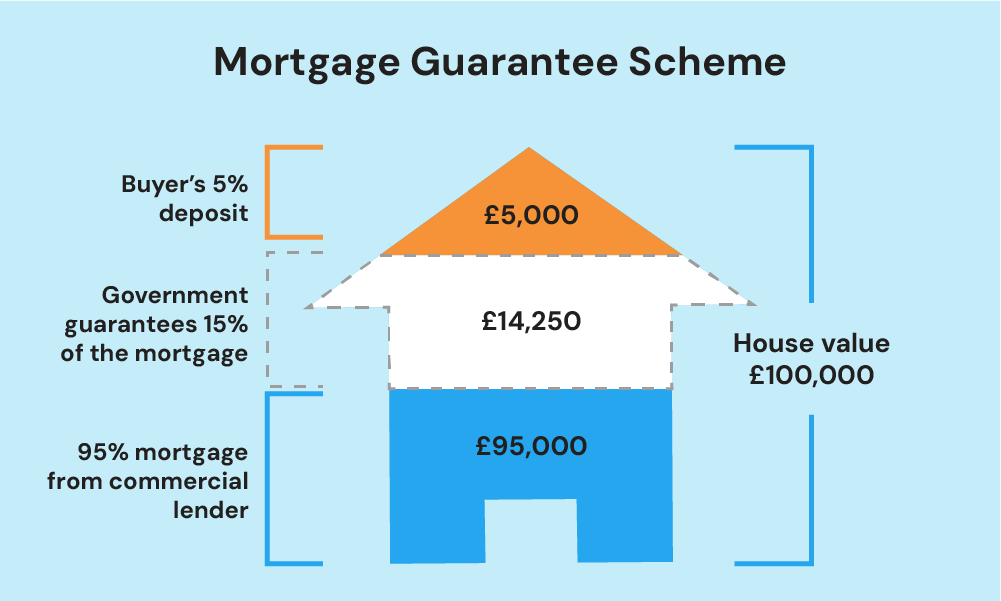

Here’s how it works: You can get a mortgage with a deposit of 5% to 9% for properties valued up to £600,000.

Then, your lender gives you a 95% mortgage. If you default, the government covers your lender’s losses for 15% of mortgage amount.

If you have been a council tenant for at least 3 years, you can buy your own home at a discounted price. The largest discount available is £96,000 in England and £127,900 in London.

The discount amount varies depending on location, length of tenancy, property type, and home value. The discount is also adjusted annually in line with the consumer price index (CPI).

Mortgage Payment Protection Insurance (MPPI)

Being a police officer can be physically and mentally demanding. Your job puts you at a higher risk of injury or illness. That’s why adding an MPPI can be a valuable financial safety net.

MPPI is an insurance that can help you pay your mortgage if you lose your job or you’re unable to work due to illness or injury.

Deciding if you need MPPI depends on your circumstances. If you work in a high-risk role, like on the front lines, you are more likely to need MPPI than if you work in a low-risk role, such as in the admin department.

There are also various MPPI policies available, so it’s crucial to compare them carefully before making a decision.

Some policies will cover your mortgage payments if you are unable to work due to a temporary illness or injury, while others will only cover you if you are unable to work due to a permanent disability.

The cost will also differ based on the policy type and your circumstances.

To get one, it’s best to ask your mortgage lender or a financial advisor. They can help you to understand your options and choose the right policy.

Mortgages for Police Officers with Bad Credit

You can still get mortgages even with bad credit. While this can impact your borrowing options and lead to higher interest rates or more stringent criteria.

There are still solutions to explore.

Lenders focus on the severity and recency of your credit issue. Some will consider beyond credit scores, such as your employment stability and income.

They usually cater to bad credit borrowers and have more flexibility in their lending criteria.

It is important to be proactive and improve your credit score before applying for a mortgage. This can include paying off outstanding debts, making timely payments, and keeping credit utilization low.

Additionally, providing a larger deposit can help decrease the lender’s risk and increase the chances of getting a mortgage.

The Bottom Line

Finding a mortgage can be stressful for anyone, especially for police officers. Between the endless paperwork and the demands of your job, you don’t have much time to spare when it comes to applying for a mortgage.

So here’s a game-changing solution: get help from qualified mortgage brokers.

Imagine no more drowning in paperwork and no more scratching your head over complex jargon. These professionals can do the legwork for you, introduce you to specialist lenders for police mortgages, and simplify the whole process.

With their expertise and knowledge about the mortgage market, you can easily get the best deals without stress.

To find a good mortgage broker: Get in touch with us today. We’ll match you with a the right broker who specialises in mortgages for police officers.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What types of mortgages are available for police officers?

As a police officer, you can access any type of mortgage as long as you meet the lender’s criteria and pass the affordability assessment.

This includes residential mortgages, such as fixed-rate mortgages, variable-rate mortgages, or flexible mortgages. You can also opt for Buy-to-Let mortgages if you’re looking to diversify your income with rental properties.

The type of mortgage you choose will depend on your circumstances and goals. You should also make sure that you understand the risks involved before you commit to a mortgage.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.