- What is a Homeowner Loan?

- What’s a Secured Loan?

- Who Should Consider a Homeowner Loan?

- Are You Eligible for a Homeowner Loan?

- Different Kinds of Homeowner Loans

- What Should You Know Before Getting a Homeowner Loan?

- How Much Can You Borrow?

- How Much Will a Homeowner Loan Cost You?

- What Additional Fees Should You Expect?

- How Secured Loans Affect Your Credit Score

- Can You Qualify for a Homeowner Loan with Bad Credit?

- Is an Unsecured Homeowner Loan an Option?

- How To Manage Your Homeowner Loan Repayments

- The Bottom Line

How Do Homeowner Loans Work? A UK Guide in 2025

Using your home’s value could help you reach important goals in life.

Homeowner loans let you borrow money based on your home’s worth. You can use this to pay off debts, improve your house, or help your children buy their first home.

This guide explains what homeowner loans are, how they work, and why they might be a good choice in the UK.

What is a Homeowner Loan?

A homeowner loan lets you borrow money using your home as collateral. In simpler terms, you’re securing the loan against your property.

This makes it safer for the lender, but there’s a catch. If you can’t pay back the loan, the lender could take your home to recover the debt.

Homeowner loans go by various names like home equity loans, second-charge mortgages, or even second mortgages.

With these loans, you commit to regular monthly payments for a set period, ranging from 1 to 35 years.

Failing to meet these payments could put your home at risk. Additionally, some loans may have arrangement fees or other setup costs, so always read the fine print.

The Crucial Points:

- Borrowing Limit – You can borrow up to a certain percentage of your home’s value.

- Interest Payments – You’ll need to pay interest over the loan’s term.

- Approval Checks – Credit and affordability checks are typically required for approval.

What’s a Secured Loan?

Secured loans are backed by something valuable you own, known as “collateral.” This can be any asset, like a car, but most commonly, it’s your home.

The collateral reduces the lender’s risk, often resulting in a better deal for you.

While an unsecured loan doesn’t require collateral, secured loans usually offer more advantages:

- Borrow beyond the typical £10,000 limit associated with unsecured loans.

- Generally lower interest rates.

- More flexible loan terms.

The flip side? Fail to meet the repayments, and the lender can seize your collateral.

Who Should Consider a Homeowner Loan?

These loans are ideal for homeowners or mortgage holders looking to borrow larger sums of money. You may find a homeowner loan to be a good fit if you:

- Own your home partially or fully.

- Have difficulty qualifying for an unsecured loan due to poor credit.

- Need a large sum for significant expenses like home renovations or a wedding.

- Want to spread the repayment over a more extended period

- Wish to use the funds as a down payment on another property.

Lenders often prefer that you have some equity built up in your home. It assures them you have enough resources to cover the loan amount and any outstanding mortgage debt in case you default.

Are You Eligible for a Homeowner Loan?

Different lenders have different rules. Usually, they look at:

- Your credit score

- How much money do you make and spend

- How much value you have in your home

When you apply, the lender will check your credit, which shows up on your credit report. Moreover, you must be at least 18 and a UK resident to apply for a loan. Your eligibility also depends on your financial status.

Different Kinds of Homeowner Loans

When it comes to using your home as security, you’ve got several loan options to consider:

Mortgages

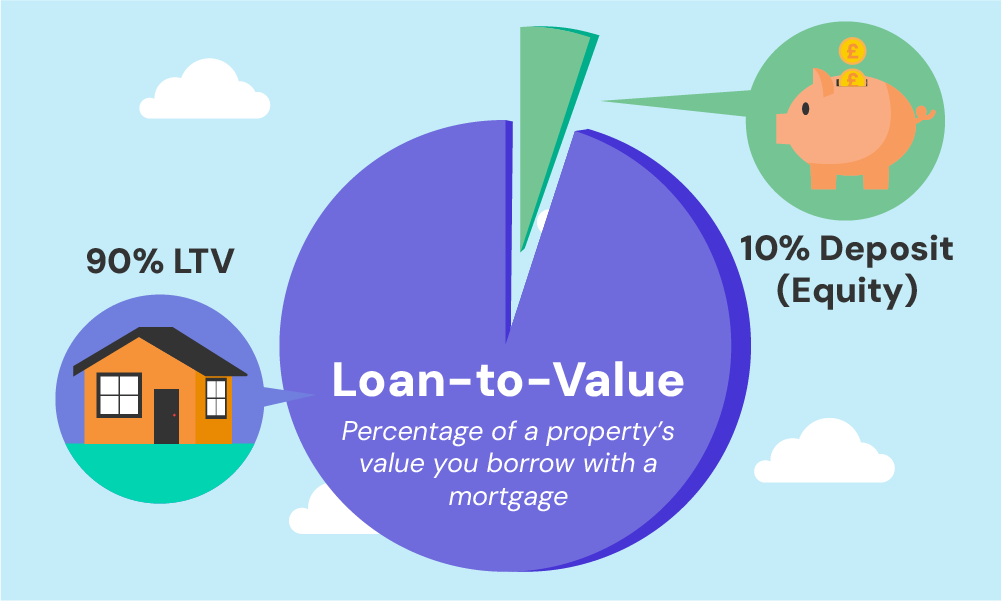

A conventional mortgage loan is usually secured against the value of your property, often covering up to 95% of your home’s worth. The loan-to-value (LTV) ratio can be quite high in these cases.

You might know this as a “homeowner loan.” The amount you can borrow is directly related to the equity you’ve built up in your home. The more equity you have, the more you can borrow.

For those with a spotty or limited credit history, a bad credit loan might be the way to go. These are often secured loans, leveraging your home to offset the risk to the lender.

These short-term loans can provide you with the capital you need to buy a new property while you’re in the process of selling your current one. Your current home serves as the collateral for this type of loan.

If you’re looking to merge various debts into a single, more manageable loan with a lower interest rate, a debt consolidation loan could be a smart choice.

In cases of poor credit history, these loans are often secured against your property.

What Should You Know Before Getting a Homeowner Loan?

If you’re thinking of getting a homeowner loan, here are a few things to ponder before you take the plunge:

- Understand Repayment Risks – If you don’t make repayments on time, you risk losing your home. Make sure you can afford the monthly payments for the entire duration of the loan.

- Consider the Long-Term Nature – Homeowner loans often require a long-term commitment. Evaluate your financial stability to ensure you can meet the repayments for the years ahead.

- Keep an Eye on Variable Rates – Watch out for variable interest rates, which can fluctuate with market conditions. Ensure you can handle possible rate hikes without compromising your financial stability.

- Compare Interest Rates Actively – Always shop around to compare both interest rates and APRs to land the best deal. This active comparison helps you grasp the true cost of the loan.

- Watch Out for Early Repayment Fees – Some loans come with penalties for early repayment. Read all the terms carefully to avoid unexpected fees.

- Factor in Additional Costs – Be mindful of extra charges like set-up and arrangement fees, as these can raise the total cost and APR of your loan.

- Check Your Credit Before Applying – An application rejection can harm your credit score. Verify your eligibility first to protect your credit history.

- Assess Your Home Equity – Your home equity limits the amount you can borrow. Make sure you have sufficient equity to secure the loan you need.

- Know the Repayment Holiday Rules – Not all lenders offer repayment holidays. Check if this feature is available before you agree to the loan terms.

- Assess Your Current Finances – Lenders apply the same financial checks for second mortgages as they do for first mortgages. Review your finances, eliminate unnecessary subscriptions, and ensure all your payments are up to date.

How Much Can You Borrow?

Homeowner loans are generally for larger sums, often between £10,000 and £500,000, repayable over 5 to 25 years. The borrowing limit depends on:

- Home equity

- Income

- Credit history

- Age

- Loan term duration

If you’re considering a secured homeowners loan, try the secured loan calculator to get an idea of what your monthly repayments might be.

Keep in mind, that these numbers are just a starting point.

For a complete financial picture, including any hidden fees or costs, chat with a mortgage advisor. They can help you make a savvy choice that fits neatly with your financial plans and situation.

How Much Will a Homeowner Loan Cost You?

Interest rates for homeowner loans change based on the loan size, how long you’ll be paying it back, and your property’s value.

Remember, a longer loan term might give you lower interest rates. But don’t forget, you’ll be paying it back for a longer time, which can add up.

What Additional Fees Should You Expect?

When budgeting for a homeowner loan, be aware that lenders might charge extra fees. These could include:

- An arrangement fee for initiating the second mortgage

- A valuation fee, since your property secures the loan

- A broker fee, which can be up to 10% of the loan’s total value

- Early repayment charges if you settle the loan before the agreed-upon term ends, as the lender will lose out on expected interest.

How Secured Loans Affect Your Credit Score

Your credit score is a key factor in determining what type of homeowner loan you can get. If you have a low credit score, you may be able to borrow less money and will likely be charged higher interest rates.

However, homeowner loans are secured by your property, which often makes them easier to qualify for. But remember, a higher credit score will still give you access to better loan terms.

Your credit score does not just affect the loan; the loan also affects your credit score. If you fail to make your monthly payments, your credit score will be damaged.

Conversely, making early repayments could improve your credit score. Therefore, it is crucial to manage your monthly payments effectively.

Can You Qualify for a Homeowner Loan with Bad Credit?

Getting a loan with bad credit can be challenging, and taking on more debt may not be advisable if you’ve had financial struggles.

However, bad credit doesn’t automatically disqualify you from getting a homeowner loan. Some lenders specialise in serving applicants with poor credit histories.

Still, you should proceed with caution. All loans, no matter how attractive the rates, come with both cost and risk—particularly when your home is the collateral.

If possible, consider saving up instead of taking on more debt. And if you’re already dealing with debt, consult free debt advice services before applying for a homeowner loan.

Is an Unsecured Homeowner Loan an Option?

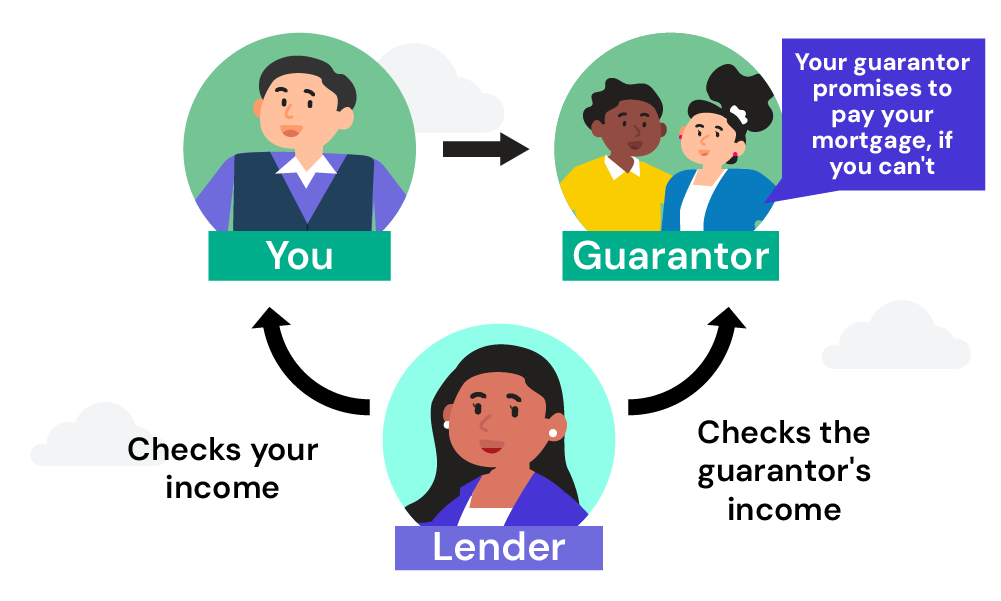

Typically, homeowner loans are secured loans, meaning your property serves as collateral. This is why these loans can offer larger borrowing amounts.

However, some lenders provide unsecured homeowner loans in the form of guarantor loans. In these cases, someone else “guarantees” your loan, taking on the responsibility of repayment if you fail to meet your obligations.

How To Manage Your Homeowner Loan Repayments

When you secure a homeowner loan, it’s crucial to handle your repayments effectively. Failing to do so can have dire consequences. Here’s what you need to know.

Don’t Skip Repayments

- Missed payments will not only damage your credit score but could also lead to the repossession of your home.

- If you fear missing a payment, contact your loan provider immediately. They might be able to arrange a solution.

Budget Wisely

- Having a new monthly expense requires careful budgeting. Whether it’s skipping a holiday or dining out less often, make loan repayments a priority.

Pay Off Early, If Possible

- If you come into extra money, consider settling your loan ahead of time.

- Watch out for early repayment fees. However, you could save significantly over the long term by paying off your loan early.

The Bottom Line

Unlocking the value of your home with a homeowner loan can be a game-changer for you.

To make sure you’re getting the best deal, it’s wise to consult with a seasoned mortgage broker. They can tailor options specifically for your needs and financial situation.

Ready to get started? Fill out our quick form, and we’ll match you with a top mortgage broker who can guide you through the process.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What is Home Equity?

Home equity is the difference between your property’s current market value and the remaining balance on your mortgage. Essentially, it’s the portion of your home that you own free and clear.

For example, if you bought a house for £300,000 and you still owe £180,000 on your mortgage, your home equity would be £120,000.

Lenders assess your home equity when you apply for a homeowner loan, as it helps them determine how much you can borrow and at what interest rate.

What's the loan-to-value ratio?

The loan-to-value (LTV) ratio shows how much you can borrow with the value of your property, expressed as a percentage. Lenders set a maximum LTV when offering homeowner loans. Generally, the more equity you have in your home, the more you can borrow. If you have low home equity, your borrowing limit will be restricted.

What is the typical variable rate for a homeowner loan?

There is no real “typical” variable rate for homeowner loans. Variable rates can change over the loan term based on factors like the Bank of England’s base rate and overall economic conditions.

While it’s unlikely to change every month, you should check your rate regularly. Changes in the rate will directly affect your monthly repayments, either positively or negatively.

Does a broker fee affect my homeowner loan cost?

Yes. If you use a broker to find a homeowner loan, remember to factor in their fee when calculating the total cost of your loan. This fee varies depending on the broker, but it’s a separate expense and is not added to your loan amount.

Brokers are third-party agents who help you find better loan deals, and they earn a commission or fee for their services.

What are some alternatives to a homeowner loan?

If you’re exploring ways to secure extra funds, you have various alternatives besides a homeowner loan. For instance:

- Remortgaging – If your current mortgage term is wrapping up, this might be an economical way to access the additional money you need.

- Opt for an Unsecured Loan or 0% Credit Card – If you have strong credit, you could consider a personal loan or a 0% interest credit card, which can be particularly useful for borrowing smaller amounts over shorter periods.