- What is a Net Profit Mortgage?

- Will Your Net Profits Get You that Mortgage?

- What Are the Eligibility Requirements for Net Profit Mortgages?

- What is the Minimum Deposit Required for a Net Profit Mortgage?

- How Much Can I Borrow?

- Using Net Profit as a Sole Trader for a Mortgage

- Mortgages for Company Directors: The Net Profit Angle

- Which Lenders Are Open to Net Profit Mortgages?

- Key Takeaways

- The Bottom Line: For Your Next Stepsâ¦

Self-Employed Mortgages Based on Net Profit: A Full Guide

Getting a mortgage isn’t always easy, and it can be even trickier if you work for yourself.

Most lenders like to see payslips and proof of a steady income—things you might not have if you’re self-employed.

That puts you in a bit of a tough spot. While people with regular jobs usually have it easier, you might face a few extra hurdles.

But here’s the good news: your net profits can help prove you earn enough to get a mortgage.

A net profit mortgage could be just what you need to finally own your own home. What once seemed impossible might actually be closer than you think.

This guide will break it all down for you. We’ll explain how the process works and share some simple tips to make getting a mortgage feel a lot less stressful.

What is a Net Profit Mortgage?

As a self-employed individual, your net profit is a major factor in your mortgage application process.

Essentially, a net profit mortgage is determined by the after-expense income your business pulls in each year.

Different lenders have their ways of calculating mortgages. Some may even consider retained profits within your business, while others do not.

Therefore, most mortgage assessments primarily consider your net profits rather than your gross income.

It’s important to choose a lender whose assessment criteria are aligned with your financial profile. This will optimise your chances of not only getting approved but also maximising the amount you can borrow.

The challenge here is that your declared net profits may NOT always reflect your full financial capacity.

Investments in business growth or other deductibles can reduce your net income, making your mortgage application less attractive.

In essence, getting a mortgage as a self-employed individual is not as straightforward as it is for salaried individuals.

Will Your Net Profits Get You that Mortgage?

When you’re self-employed, which includes roles like company directors, sole traders, freelancers, and even landlords, your mortgage eligibility isn’t just about showing a net profit.

It’s a multi-faceted application, which involves a thorough evaluation of your credit score, other financial particulars, and even the length of time your business has been operational.

Also, the BIGGER your upfront deposit, the BETTER your odds are in securing a mortgage.

If you’re a salaried individual with payslips, you’re in a different boat altogether. You won’t be eligible for a net profit mortgage.

The focus here is on self-employed income that is, at its core, comprised of net profits.

What Are the Eligibility Requirements for Net Profit Mortgages?

Lenders often have specific eligibility criteria beyond the typical income calculations.

Here’s what you might come across:

- Maximum Loan Amount – Lenders often have a ceiling on the amount they’re willing to loan, which can differ between institutions.

- Assets vs. Liabilities – You’ll likely need to show that your assets have outweighed your liabilities for at least the past two years.

- Proof of Future Work – Especially if you’re applying for a substantial loan, some lenders may request evidence of upcoming contracts or gigs.

Of course, there are also standard eligibility criteria that lenders apply across the board. These include:

- Loan to Value (LTV) – This is the ratio of your loan to the property’s value.

- Credit History – A strong credit score can make all the difference in your mortgage application.

- Age – Lenders often have age restrictions for mortgage applications.

- Profession – Your line of work can also play a role in the mortgage you’re eligible for.

- Property Type – Some lenders restrict the types of property they’re willing to mortgage.

For an in-depth look at the entire eligibility checklist, check out our comprehensive guide to self-employed mortgages. This will provide you with the insights you need to move forward confidently in your mortgage journey.

What is the Minimum Deposit Required for a Net Profit Mortgage?

Different lenders have different rules, with some demanding at least a 10% deposit while others might go as low as 5%.

Generally, if you’ve been in business for a while and have a good credit score, you may find more lenient deposit requirements.

On the flip side, if your business is relatively new or you’ve had recent credit issues, be prepared to set aside a larger deposit.

Setting a higher deposit not only increases your chance of approval but also unlocks more favourable mortgage rates.

While a 15% deposit can land you some competitive deals, anything higher could put you in the territory of headline rates that save you money in the long term.

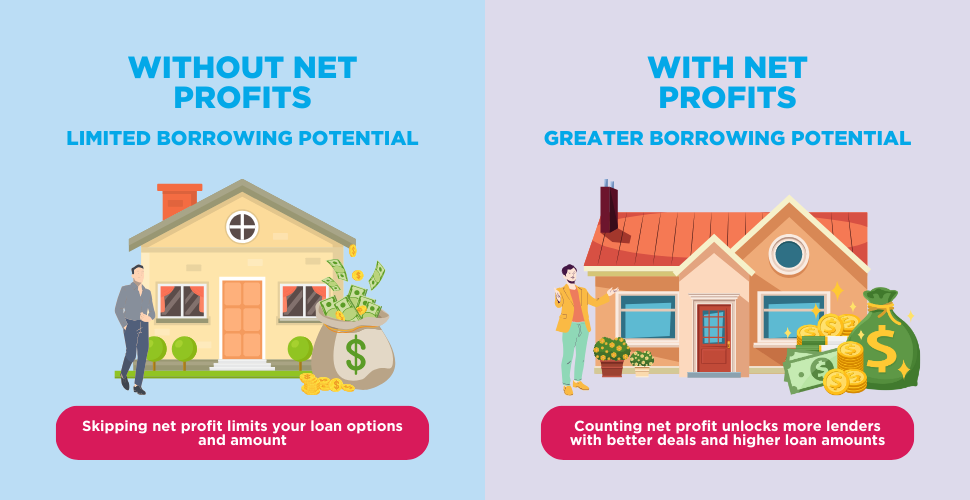

How Much Can I Borrow?

The amount you can borrow for a mortgage depends on several factors, but your net profits are often the deciding factor.

Lenders use income multipliers based on your net profits to estimate how much they are willing to lend you.

Different lenders have different multipliers – some may use a 3x multiplier, while others may go up to 5x your annual net profit.

This difference between lenders can have a significant impact on your borrowing power, so it is important to choose the right lender for your circumstances.

In addition, some lenders will assess your latest annual net profit, while others may average out your net profits over the past three years.

If you are looking to borrow a larger amount, be prepared to provide more documentation. Such as future work contracts, to reassure lenders about the stability of your business.

Before you apply for a mortgage, it is always a good idea to run the numbers through a self-employed mortgage calculator. This will give you a clearer picture of your borrowing potential.

Using Net Profit as a Sole Trader for a Mortgage

If you’re a sole trader, using your net profit for a mortgage comes with its own set of rules.

Generally, lenders will scrutinise your financial history for the past three years, which can be substantiated either through certified accounts or your SA302 forms from self-assessment.

If your net profits have been volatile, lenders will likely average your income over these three years.

A recent downturn in profits, especially due to a loss or heavy investment in the business, can jeopardise your mortgage application.

But, if your business is showing growth. that’s a BIG plus.

While each lender has their approach, many will focus on your most recent net profits, especially if they’ve been on the rise.

Even if you’ve seen a recent dip due to business investment, some lenders might be understanding. You may even find those who are willing to proceed based on just one year’s accounts.

Mortgages for Company Directors: The Net Profit Angle

If you’re a company director, the rules for getting a mortgage change.

Your income is usually drawn from a combination of dividends and a fixed annual salary. And not all lenders will consider the company’s net profit when assessing your eligibility.

This is why it’s important to choose the right lender. Some lenders will outright reject applications that seek to include retained or net profits from a limited company.

Others are more flexible and may consider not just the income you’ve personally drawn but also the net profits that remain within the business.

This can be a considerable advantage, significantly increasing the amount you’re eligible to borrow.

Whether you’re a sole trader or a company director, there are challenges and opportunities associated with each route.

However, knowing how net profits play into each scenario will give you a leg up in securing a mortgage that suits your self-employed income.

Which Lenders Are Open to Net Profit Mortgages?

Great news for the self-employed folks out there—many UK lenders are more than willing to consider your net profits when you apply for a mortgage.

This option is available at established high-street banks like Natwest, Santander, and Halifax.

However, specialist lenders, who focus solely on this type of lending, can often offer you a more tailored and advantageous deal.

The real task is identifying the lender that perfectly matches your specific financial profile. Lenders assess risk differently. So the closer your situation aligns with a lender’s risk profile, the better the chances of getting approved and receiving a favourable rate.

Key Takeaways

- Focus on your net profits, as they are a key factor in qualifying for a net profit mortgage if you’re self-employed.

- Choose a lender whose evaluation process aligns with your net profits to improve approval chances and maximise borrowing potential.

- Check eligibility criteria like loan limits and proof of future work, as these can significantly affect your mortgage application.

- A larger deposit can lead to better mortgage rates and increase your likelihood of approval.

- Understanding how net profits influence your mortgage options helps you find the best deal, whether you’re a sole trader or a company director.

The Bottom Line: For Your Next Steps…

Getting through mortgages can be tricky for self-employed individuals. But most lenders will look at your net profits to decide how much you can borrow.

Choosing the wrong lender can be more than just a minor hiccup. It could result in an outright decline or an offer for a far smaller mortgage amount than you had in mind.

That’s why it is so important to consult an advisor who can steer you towards lenders that are MORE likely to APPROVE you for the maximum amount you are eligible for.

The advisor will do more than just match you with lenders. They’ll assess your entire financial portfolio, including your business performance, years in operation, and credit history.

They’ll also take into account the specifics of the property you’re aiming to purchase.

This comprehensive assessment ensures you’re paired with the most suitable lenders, optimising your chances for approval and potentially saving you a considerable sum over the lifetime of your mortgage.

Keen to start the process? Simply, fill out this quick form. We will link you with a self-employed mortgage advisor who can guide you on the mortgage types you’re eligible for based on your net profits.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can I qualify for a mortgage if I had a SEISS grant?

Yes, but it depends on the lender. Some lenders will consider your application even if you received a SEISS grant during the pandemic. For detailed guidance, consult our guide on obtaining a mortgage after receiving a SEISS grant.

Can I use net profits for a buy-to-let mortgage?

Yes, you can. If you meet the lender’s criteria, getting a net profit mortgage for a buy-to-let property is doable. Many landlords opt for this type of mortgage. For more specifics, see our guide on buy-to-let mortgages for self-employed individuals.

Are self-certified mortgages still an option?

No, they’re not. Self-certified mortgages were discontinued in 2009.

Are dividends taken into account for mortgages?

Yes, dividends are often considered part of your income when applying for a mortgage. Especially if you’re a company director or shareholder. Different lenders have their policies on how they treat dividends.

So it’s essential to check with each lender for their specific criteria.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.