- Is Remortgaging with Bad Credit Possible?

- What is Considered a Bad Credit Score?

- Factors Mortgage Lenders Assess

- Why You Want To Remortgage Matters

- How To Remortgage with Bad Credit?

- How Does Bad Credit History Affect Remortgaging?

- Do the Timing of Credit Issues and Your Finances Matter?

- Can You Remortgage Without a Credit Check?

- How Different Credit Issues Affect Remortgaging

- The Pros and Cons of Remortgaging with Bad Credit

- Tips To Get the Best Remortgage Deal

- Key Takeaways

- The Bottom Line

How To Remortgage With a Bad Credit: A Complete Guide

Thinking of renovating the kitchen, building an extension, or finally booking that dream family holiday?

If bad credit’s been holding you back from remortgaging to free up cash, you’re not alone.

Many people worry that their past financial mistakes might prevent them from using their home’s value.

But good news: it’s possible to remortgage even with bad credit.

In this guide, we’ll show you how to remortgage despite a low credit score, what to expect, and how to boost your chances of success.

Whether it’s for home improvements, debt consolidation, or a fresh start, we’re here to help.

Is Remortgaging with Bad Credit Possible?

Having bad credit doesn’t mean remortgaging is off the table. It’s still possible to remortgage, even if your credit history isn’t perfect.

That said, it’s not always a smooth ride.

You might face tougher requirements from lenders and higher interest rates compared to standard deals. And there’s no guarantee of success, even with the help of a specialist broker.

Don’t lose hope though—there are still ways to remortgage, even with bad credit.

The reality is: lenders don’t just look at your credit score—they consider other factors too.

If you already own a property, you’ve got a bit of an advantage.

Having a property gives lenders some reassurance since your home acts as security for the loan. This could make it easier to get approved, even with a poor credit history.

Another important thing to look at is your home equity—that’s the part of your home you fully own.

The more equity you have, the better remortgage chances. This means you might be able to borrow more or even free up some money to pay off debts.

Paying off debts could help improve your credit score over time, which might make lenders more likely to approve your application.

What is Considered a Bad Credit Score?

Before jumping into remortgaging with bad credit, let’s talk about credit scores and what they mean.

A credit score is a number that shows how well you’ve managed money and debts in the past. It’s based on things like whether you’ve paid bills on time, how much of your credit you’re using, how long you’ve had credit accounts, and any recent applications for loans or credit cards.

In the UK, credit reference agencies like Experian, Equifax, and TransUnion each use their own scoring systems, so what counts as a “bad” score can vary.

Here’s a quick look at how their ranges compare for 2024:

| Credit Status | Experian | Equifax | TransUnion |

|---|---|---|---|

| Excellent | 961-999 | 811-1000 | 781 – 850 |

| Very Good | – | 671-810 | – |

| Good | 881-960 | 531-670 | 721 – 780 |

| Fair | 721-880 | 439-530 | 661 – 720 |

| Poor | 561-720 | 0-438 | 601 – 660 |

| Very Poor | 0-560 | – | 300-600 |

Knowing where your score sits can give you a better idea of how lenders might see you.

If your score is on the lower side, don’t panic—there are still ways to remortgage, and we’ll walk you through them.

Factors Mortgage Lenders Assess

After you’ve checked your credit score and fixed any errors, it’s time to think about what lenders will focus on.

Again, they don’t just look at your credit history—they dig deeper into your finances. Here’s a quick rundown of what they assess:

- Your Income. Lenders want to see a steady income that can cover your monthly payments. This includes your salary, bonuses, overtime, or even income from pensions or investments.

- Your Outgoings. It’s not just about what you earn—it’s about what you spend. Bills, loans, credit card payments, and general living costs all factor in. Lenders need to know you can afford the mortgage alongside your other expenses.

- Your Employment Status. Full-time, permanent roles tend to put lenders at ease. If you’re self-employed or on a temporary contract, they might ask for extra proof of income, like tax returns or business accounts, to make sure your finances are stable.

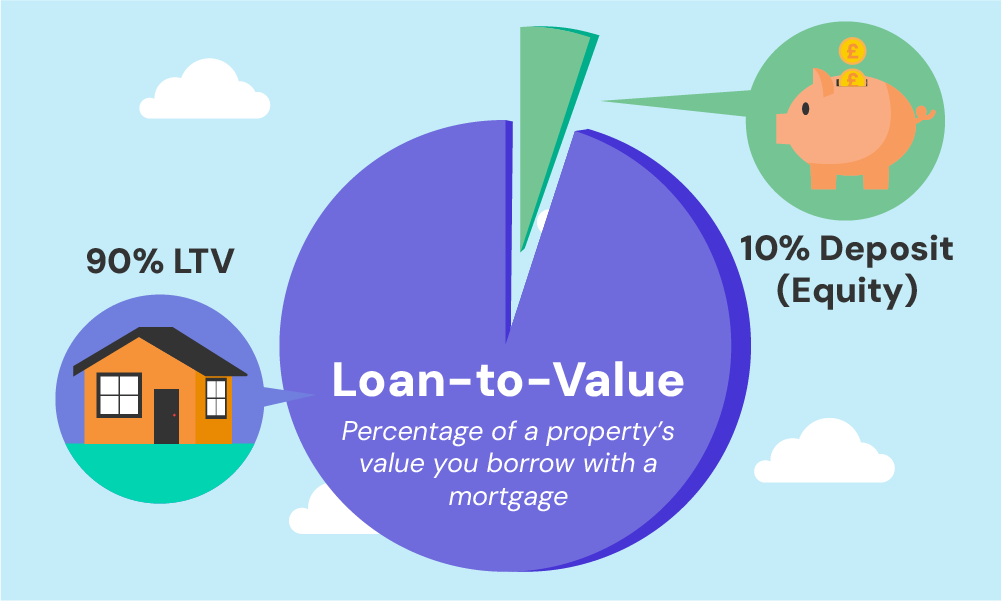

- Loan-to-Value Ratio (LTV). This is how much you want to borrow compared to your property’s value. A lower LTV (meaning you’ve got more equity in your home) usually works in your favour and makes approval more likely.

Why You Want To Remortgage Matters

Another important factor lenders consider when remortgaging is how you plan to use the funds.

Your reason helps them assess how risky the loan might be and whether they’re comfortable approving it.

Here are some common reasons people remortgage:

- To secure a better mortgage rate

- Consolidation of debts

- Funding for a major purchase or expense (for instance, purchasing a car or planning a holiday)

- Release equity from the property (for home improvements or investment)

- Buy out an ex-partner’s share

- Let to buy (Renting out your current home to purchase a new one)

Each of these reasons has its own risks and benefits.

For example, consolidating debts can simplify finances, but it also turns unsecured debt into secured debt tied to your home.

To improve your case, ensure you’re clear about why you’re remortgaging and make sure it fits with your financial plans.

This gives lenders more confidence in approving your remortgage.

How To Remortgage with Bad Credit?

If you’ve got your credit report and reason for remortgaging sorted, it’s time to tackle the next steps.

Let’s make one thing clear: getting a good remortgage deal with bad credit isn’t about luck. It’s about taking smart steps to show lenders you’re a safe bet.

Here’s how you can remortgage and secure better rates even with bad credit:

1. Work with a Specialist Broker

Bad credit mortgage brokers can simplify the process and connect you with lenders who understand your situation.

Your broker will also help you build a strong mortgage application. Here’s what they do:

- Offer personalised advice based on your finances and goals.

- Explain the process step-by-step, so it’s easy to follow.

- Suggest lenders likely to approve your application.

- Find deals you wouldn’t spot yourself, including exclusive offers.

- Negotiate better rates and terms for you.

- Take care of most of the paperwork and communication, saving you time and stress.

With a broker’s help, remortgaging feels less overwhelming, and you’re more likely to get a deal that works for you.

Disclaimer: Even with the help of a specialist broker, it’s possible there won’t be a remortgage option available to you.

2. Check Your Home Equity and LTV

As discussed, your home equity and loan-to-value ratio (LTV) can make a big difference when you’re remortgaging.

Why? Because lenders love low-risk borrowers, and having more equity—or a lower LTV—makes you a safer option.

So it makes sense to check your home equity. Here’s how you can do it:

- Check your current property value. If you’re not sure, an estate agent can give you a good estimate. You can also look at recent sales of similar homes in your area

- Use this formula to calculate your equity: Home Equity = Current Property Value – Remaining Mortgage Balance. For example, if your home is worth £300,000 and you still owe £180,000, your equity would be: £300,000 – £180,000 = £120,000

- Work out your LTV. This shows what percentage of your home’s value you’re borrowing. The formula is: LTV = (Remaining Mortgage Balance ÷ Current Property Value) × 100

Using the same example:

LTV = (£180,000 ÷ £300,000) × 100 = 60%

In this case, you’re borrowing 60% of your home’s value, and the other 40% is your equity.

Generally, a lower LTV (usually under 80%) means you’re more likely to get better deals from lenders.

If your LTV is 60% or lower, even better—you might qualify for some of the best rates. On the other hand, a higher LTV (closer to 90% or more) could mean fewer options or higher rates, but it’s not a dealbreaker.

Here’s how it might look in a table:

| Description | Amount |

|---|---|

| Property Value | £300,000 |

| Remaining Mortgage | £180,000 |

| Home Equity [Property value – Remaining mortgage] | £120,000 |

| Loan-to-Value (LTV) [Remaining mortgage / Property value] x 100 | 60% |

For more personalised results, use our LTV calculator to see how your equity and borrowing amount stack up.

3. Provide Proof of Stable Income

Lenders like to see that you’ve got a reliable income to cover your mortgage payments without any hiccups.

It’s your chance to show them you’ve got things under control.

Here’s what to do:

- Gather up documents like payslips, bank statements, or tax returns (if you’re self-employed).

- Include other sources of income too, like rental income, pensions, or any government benefits you receive.

Every lender has their own way of looking at income, but having these documents ready makes things much easier—and shows you’re serious about getting approved.

How Does Bad Credit History Affect Remortgaging?

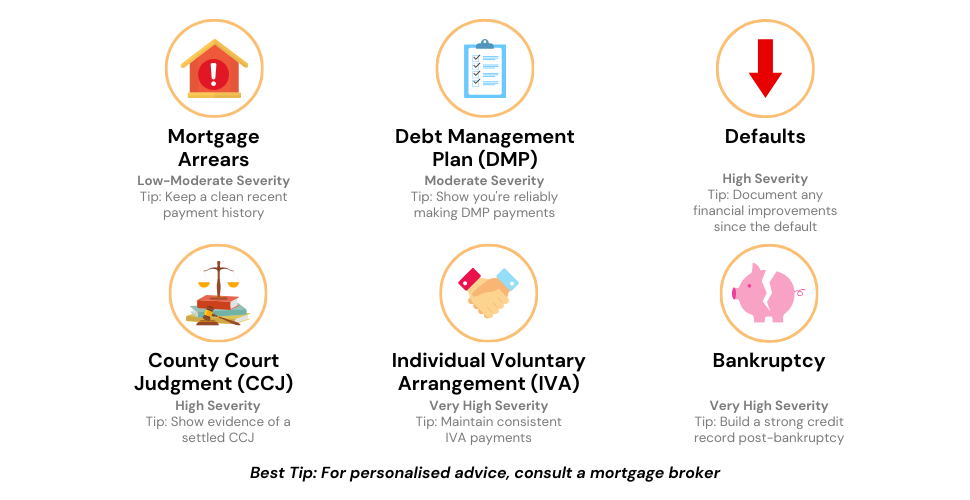

Different credit issues have different levels of impact, and the more serious the issue, the harder it might be to secure a deal.

Here’s a quick look at how common credit problems can affect your remortgaging options:

| Type of Credit Issue | Severity | Impact on Remortgaging |

|---|---|---|

| Late Payments | Low to moderate | This might cause lenders to question your ability to make timely payments, making remortgaging a bit challenging. |

| Debt Management Plans | Moderate | Shows that you’ve had trouble with debts, but also that you’re actively trying to manage them, with mixed impact on remortgaging. |

| Defaults | High | These can significantly impact your ability to remortgage as they indicate a failure to meet previous credit agreements. |

| County Court Judgements (CCJs) | High | This indicates serious issues with managing credit and may make many lenders hesitant to offer a remortgage deal. |

| Individual Voluntary Arrangements (IVA) | Very High | This signals severe debt problems and can limit your remortgaging options significantly. |

| Bankruptcy | Very High | Severely impacts creditworthiness, often leading to outright rejection by many lenders. |

| Repossession | Very High | Suggests a major failure in managing a previous mortgage, making remortgaging very difficult. |

Do the Timing of Credit Issues and Your Finances Matter?

Yes, they do! If your credit problems are recent, lenders might see you as a bigger risk.

But if they happened over 6 years ago and you’ve been handling your money well since, you’ll look much better to them.

Lenders also look at your overall financial situation—your savings, debts, income, and how you manage your money day-to-day.

They want to see that you’re financially stable and responsible.

Even if your credit history isn’t perfect, showing that your finances are in good shape now can really improve your chances of getting approved. It’s all about proving you’ve turned things around.

Can You Remortgage Without a Credit Check?

It’s rare, but sometimes you can remortgage without a credit check. This usually happens if you stick with your current lender and have a good payment history.

If you’re switching lenders, expect a credit check. It all comes down to the lender’s rules and your financial situation.

How Different Credit Issues Affect Remortgaging

As we’ve mentioned, the outcome of your remortgage depends on the type and severity of the issue, how much equity you have in your home, and the lender’s rules.

Here’s a closer look at how specific credit issues might influence your remortgaging options:

Remortgaging with Mortgage Arrears

The Severity of Credit Issue: Low to moderate

Missed payments suggest financial instability, which makes lenders cautious. They may worry about whether you’ll manage future repayments.

What you can do:

- Show that you’re now back on track with payments.

- Explain why the arrears happened, especially if it was due to a one-off issue like illness or redundancy.

- Provide recent bank statements and proof of consistent payments to rebuild confidence.

Remortgaging with a Debt Management Plan (DMP)

The Severity of Credit Issue: Moderate

A DMP shows you’ve struggled with debts but are taking responsibility. Some lenders may still hesitate, seeing it as a sign of risk.

What you can do:

- Stick to your payment plan and avoid missing DMP payments.

- If possible, finish your DMP before applying.

- Use a broker to find lenders who specialise in working with borrowers on DMPs.

Remortgaging with Defaults

The Severity of Credit Issue: High

Defaults are serious and suggest you’ve had difficulty keeping up with payments.

But, lenders may be more lenient if the defaults were a long time ago (usually over 6 years) or have been settled.

What you can do:

- Pay off the default if you can—it looks better to lenders.

- Be upfront about why it happened and show evidence of financial improvement since.

- Strengthen your application: Increase your deposit, lower your loan-to-value (LTV), or work with a broker to find lenders who accept applicants with past defaults.

Remortgaging with a CCJ

The Severity of Credit Issue: High

A CCJ is a major red flag, as it shows unresolved financial disputes. Settled CCJs are viewed more favourably, but they still lower your appeal to some lenders.

What you can do:

- Settle the CCJ as soon as possible to improve your chances.

- Provide evidence of better financial management since the CCJ.

- Work with a broker to find lenders who are willing to consider your application.

Remortgaging with an Individual Voluntary Arrangement (IVA)

The Severity of Credit Issue: Very High

An IVA shows significant past financial difficulties, which makes many lenders cautious. Some may still consider you if you’re close to completing the arrangement or have already finished it.

What you can do:

- Complete your IVA if you can before applying—it opens up more options.

- Show consistent payments during your IVA to prove responsibility.

- Focus on demonstrating current financial stability with payslips, bank statements, and savings.

Remortgaging after Bankruptcy

The Severity of Credit Issue: Very High

Bankruptcy is one of the most severe credit issues and signals high risk to lenders.

Many lenders won’t consider you until at least six years have passed.

What you can do:

- Focus on rebuilding your credit with small, manageable steps like paying bills on time and using a credit-builder card.

- Save as much equity as possible in your home—it helps balance out your history.

- Use a specialist broker to find lenders who accept post-bankruptcy applicants.

The Pros and Cons of Remortgaging with Bad Credit

Here’s a quick look of the pros and cons to help you decide:

Pros:

- Get lower or better interest rates if your credit score has improved.

- Consolidate debts into one manageable payment.

- Access your home equity home for big purchases or paying off debts.

- Free up cash by lowering monthly payments, even if it means extending your term.

- Lock in a fixed interest rate to avoid future rate hikes.

- Improve your credit score by successfully managing a new mortgage.

- Move away from your current lender’s standard variable rate (SVR), which could save you money.

Cons:

- Face higher interest rates if your credit hasn’t improved.

- Pay extra costs like valuation and legal fees.

- Risk turning unsecured debts into secured ones tied to your home.

- Have fewer lender options, as not all lenders will work with bad credit borrowers.

- Be offered lower borrowing limits based on your credit history.

- Experience a longer approval process due to closer scrutiny of your finances.

- Pay early repayment charges (ERCs) if you’re leaving your current mortgage deal early.

- Reduce your equity, which could leave you with less financial security if property values drop.

Tips To Get the Best Remortgage Deal

Here’s how you can get the best remortgage deal even with bad credit:

- Get Professional Advice. A broker who specialises in bad credit mortgages can save you time and help you find deals that suit your situation. It’s worth having an expert on your side.

- Improve Your Credit Where You Can. Small, consistent changes to your credit score can make a big difference. Pay bills on time, reduce your debts, and fix any errors on your credit report. Even a slight improvement can open up better options.

- Shop Around for Offers. Don’t settle for the first deal you find. Lenders have different criteria, so one might offer better terms than another. Compare deals or use a broker who knows which lenders are flexible with bad credit.

- Limit Credit Applications. Avoid multiple credit applications before remortgaging—they can lower your score and make you look riskier to lenders. Be strategic and only apply when you’re confident.

Key Takeaways

- Remortgaging with bad credit is possible, but it’s not always easy. You might face stricter rules and higher interest rates, and while a specialist broker can improve your chances, success isn’t guaranteed for everyone.

- Lenders look at more than just your credit score—they also consider your income, spending, home equity and LTV. That’s why improving these factors can help open doors to better rates and deals.

- How much your credit problems affect remortgaging depends on how bad they are and how long ago they happened. Serious or recent issues make it harder, while older or resolved ones might not be a big deal.

The Bottom Line

If you’ve made it this far, you’re probably wondering if remortgaging with bad credit is worth the effort.

Maybe you’ve got questions like “Will anyone actually approve of me?” or “Am I just wasting my time?”

The truth is, it’s not easy, but it’s not impossible either.

While the process could get intimidating, overwhelming, and full of jargon, it doesn’t have to be.

A good mortgage broker can cut through the confusion, match you with lenders who get it, and help you see what’s actually possible.

No fluff, no false promises—just solid advice and options that suit your situation.

So, what’s next? If you’re serious about exploring your remortgage options, now’s the time to act.

Get in touch with us and let’s connect you with someone who can make this process easier (and maybe even a little less stressful).

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What happens if I can't remortgage?

If you can’t remortgage, you will automatically be transferred to your lender’s standard variable rate (SVR), which might be higher than your current mortgage rate. This could potentially increase your monthly repayments.

I have equity but bad credit in the UK, is it possible to remortgage?

Yes, it is possible to remortgage with bad credit in the UK, especially if you have a significant amount of equity in your home. But, the rates might be higher and the choices may be limited compared to someone with good credit.

Does remortgaging affect credit score?

Yes, remortgaging can affect your credit score. When you apply for a remortgage, the lender will perform a hard credit check, which will leave a mark on your credit report and may lower your score temporarily.

Is it easier to remortgage than to get a mortgage?

Generally, it’s often easier to remortgage than to get an initial mortgage, especially if you have equity in your home and a history of timely payments. However, your credit rating, current income, and market conditions can affect the ease of remortgaging.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.