- What Is Debt Consolidation Exactly?

- Can I Get a Debt Consolidation Loan with Bad Credit?

- Where to Find Debt Consolidation Loans with Poor Credit in the UK?

- What Is the True Cost of Debt Consolidation Loans?

- Should You Get a Secured or Unsecured Consolidation Loan?

- What Debts Can Be Consolidated?

- Weigh Up the Pros and Cons Before Proceeding

- How Does Debt Consolidation Affect Your Credit Score?

- How to Choose the Best Debt Consolidation Loan for You

- Alternatives to Debt Consolidation Loans

- The Bottom Line: Take Control of Your Finances Today

Debt Consolidation Loans for Bad Credit: A Complete Guide

Debt can feel like a heavy burden, especially when you have poor credit. Multiple debts with high interest rates make monthly payments difficult.

Debt consolidation loans allow you to consolidate multiple debts into one manageable payment. But can you get a debt consolidation loan with bad credit in the UK?

This comprehensive guide explains everything about getting a bad credit debt consolidation loan in the UK.

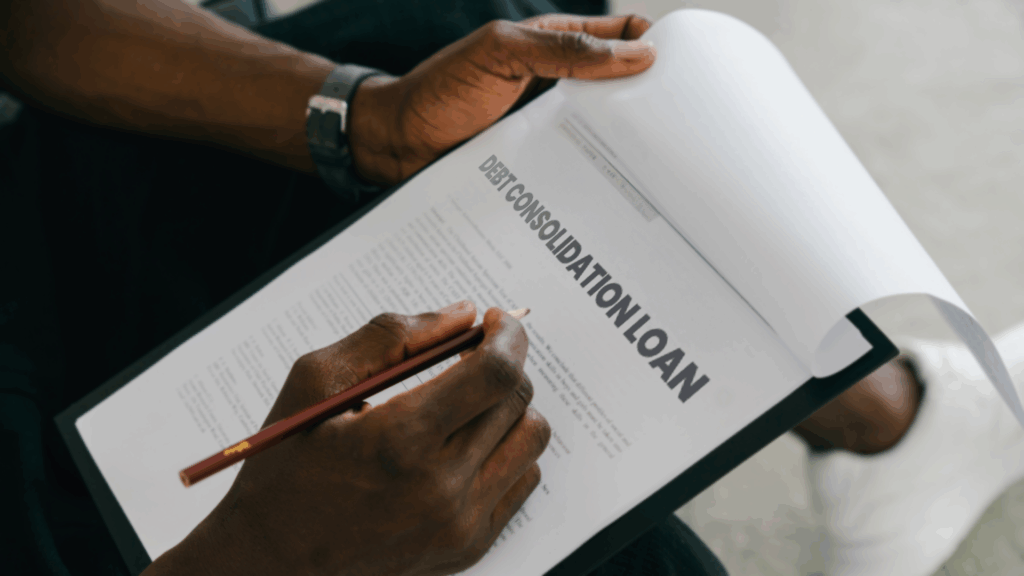

What Is Debt Consolidation Exactly?

Debt consolidation involves taking out a new loan that repays your existing debts entirely.

Rather than juggling multiple payments to different lenders each month, you get a lump sum that clears those accounts in one go.

Going forward, you make one monthly repayment to the debt consolidation lender. The loan amount covers your total debt balances, leaving only the single consolidation loan payment.

While unsecured personal loans are most common, you can take out a secured debt consolidation loan using your home as collateral through remortgaging. However, secured lending poses risks if you later struggle with repayments.

Consolidating your debts simplifies finances but doesn’t erase the need for responsible spending habits. Avoid accumulating new debt post-consolidation.

Can I Get a Debt Consolidation Loan with Bad Credit?

Yes, in the UK, it’s possible to secure a debt consolidation loan even if your credit isn’t top-notch.

However, the terms might differ from those with stronger credit histories.

Having a lower credit score can make lenders cautious, as they may view lending to you as a higher risk. As a result, they might offer loans with higher interest rates or shorter repayment periods.

But getting a loan isn’t out of the question.

Some lenders focus on assisting individuals with past credit issues. The key is to find a lender that suits your current financial situation.

Lenders evaluate your credit score when you apply for a loan. A score under 580 can present challenges.

But, don’t give up yet. Some lenders still provide loans to those with lower credit scores, albeit at higher interest rates to mitigate their risk.

To be eligible for these loans, you’ll need to demonstrate stable employment and the ability to repay the loan. Here are some suggestions to increase your chances:

- Ensure your credit report is accurate and error-free.

- Register on the electoral roll to demonstrate stability.

- Use pre-approval tools to assess your loan eligibility before applying.

- Consider having a guarantor – someone who agrees to repay the loan if you’re unable to.

- Borrow only the amount you need.

Where to Find Debt Consolidation Loans with Poor Credit in the UK?

If you’re in the UK and your credit isn’t great, there are several options for securing a debt consolidation loan. Let’s explore a few:

Online Lenders. These firms are quite adaptable. They cater to a variety of financial situations, understanding that perfect credit isn’t common. Some notable online lenders include:

- Finio Loans – Offers loans from £500 to £5,000 with a 39.9% APR, repayable over 1 to 3 years.

- Shawbrook Bank – Provides loans with a repayment period of up to seven years at a 16.6% APR.

- Everyday Loans – Accessible for those with bad credit, albeit with a high 99.9% APR.

- Solution Loans – Suitable for those with poor credit scores, offering loans up to £25,000 at a 14.3% variable APR.

- Pegasus – Caters to individuals with poor credit, offering loans ranging from £2,000 to £15,000 at a 14.9% APR.

Credit Unions. These are more personalised and may assist even with poor credit. For example, the London Mutual Credit Union provides loans up to £15,000 at 16.5% APR, for individuals aged 18-74 with a regular income.

Traditional Banks. They may have stricter criteria for credit scores, but some still offer consolidation loans.

Peer-to-Peer Lenders. These platforms facilitate loans directly between individuals and may be more lenient regarding credit scores.

When considering a loan, it’s crucial to compare interest rates, fees, and terms from various sources to find the best fit for your needs.

What Is the True Cost of Debt Consolidation Loans?

The true cost of a debt consolidation loan encompasses several factors:

- Interest Rate. This is a critical factor in determining the overall cost. A higher interest rate can significantly increase the total amount repayable.

- Loan Term. Longer loan terms can lower monthly payments but increase the total interest paid over the life of the loan.

- Fees. Some lenders charge origination fees, late payment fees, or penalties for early repayment.

- Impact on Credit Score. Applying for a new loan might affect your credit score initially, but consistent on-time payments can improve it over time.

To illustrate, here’s a simple comparison table showing how different interest rates affect the cost of a £10,000 loan over a 5-year term:

| Loan Amount | Interest Rate | Loan Term | Monthly Repayment | Total Repayable |

|---|---|---|---|---|

| £10,000 | 6% | 5 years | £193 | £11,580 |

| £10,000 | 8% | 5 years | £202 | £12,120 |

Altering the interest rate or term length can significantly change these figures. It’s crucial to calculate not just the monthly repayment but the total amount payable, including interest, over the loan’s lifetime.

Always weigh the immediate benefits of lower monthly payments against the long-term cost of additional interest.

Know the True Cost – Check the Small Print

The APR (Annual Percentage Rate) shows the total yearly cost of a loan including all interest and fees. Always compare APRs from multiple lenders to find the best deal.

Watch for:

- Representative APR based on typical successful applicants – your actual rate may differ

- Maximum APR you could be charged based on your credit history

- Any arrangement, early repayment or missed payment fees

- Longer terms mean more interest paid over the lifetime of the loan

Should You Get a Secured or Unsecured Consolidation Loan?

Unsecured loans don’t require an asset as collateral. However, lenders may charge higher interest rates to offset the increased risk, especially for borrowers with bad credit.

Secured debt consolidation loans use your home as security through remortgaging. This provides access to cheaper interest rates but means your home could be repossessed if you default on repayments.

Consider your situation and existing debts to decide if an unsecured or secured consolidation loan makes more sense. Secured lending poses greater risks if you already have credit problems.

What Debts Can Be Consolidated?

Common debts suitable for consolidation include:

- Credit cards – Combine multiple cards into one monthly payment

- Store cards – Most major retailers offer branded credit cards

- Overdrafts – Reduce expensive overdraft fees and interest

- Payday loans – Avoid rollover costs by repaying in full

- Personal loans – Combine multiple short-term loans into a longer-term loan

It may also be possible to include logbook loans, hire purchases and guarantor loan balances in the amount borrowed.

The key is consolidating existing debts, not freeing up space for new spending.

Weigh Up the Pros and Cons Before Proceeding

Benefits of debt consolidation loans:

- Simpler money management with one monthly payment

- Reduce interest paid by securing a cheaper rate

- Quickly get funds to settle multiple debts

- Chance to improve credit rating through diligent repayments

Potential risks:

- Loan rejection and credit check footprint after applying

- Higher interest rates compared to borrowing with excellent credit

- Long repayment terms mean more interest paid over time

- Missed repayments severely damage credit records

Assess your circumstances to determine if consolidation is optimal, as alternatives may suit your situation better.

How Does Debt Consolidation Affect Your Credit Score?

When you apply for a debt consolidation loan, the lender will do a credit check.

This check gets noted on your credit file, but don’t worry – it’s unlikely to make a big dent in your score by itself.

However, multiple applications in a short time can add up, so it’s wise to choose your applications carefully.

Now, if you get the loan and manage it well, it can help your credit score in the long run. Here’s how:

- Consistent Payments. Making your repayments on time and in full shows you’re reliable. Over time, this positive behaviour can boost your credit rating. It’s like showing that you can handle borrowed money responsibly.

- Lower Credit Utilisation. By consolidating, you’re essentially combining multiple debts into one. This could lower your overall credit utilisation ratio – a key factor in your credit score. Lower utilisation rates are viewed favourably by credit bureaus.

- Closing Old Accounts. Once you’ve paid off your debts through consolidation, it’s a good idea to close these accounts. Why? Having fewer open lines of credit can simplify your financial profile and reduce the temptation to rack up more debt.

But, there’s a cautionary note: missing payments on your consolidation loan can hurt your credit score quite a bit.

Late or missed payments are big red flags for credit bureaus. So, only go for debt consolidation if you’re confident you can afford the new monthly payments.

Also, keep in mind that debt consolidation isn’t a one-size-fits-all solution. It can be a smart move if it simplifies your payments and reduces the interest rate. But it’s important to consider the length of the new loan too.

Sometimes, a longer repayment period can mean paying more in interest over time, even if the monthly payments are lower.

In summary, debt consolidation has the potential to positively impact your credit score, provided you manage the loan responsibly.

It’s all about making timely payments and using the opportunity to streamline your finances. Always consider your overall financial situation and long-term goals before making a decision.

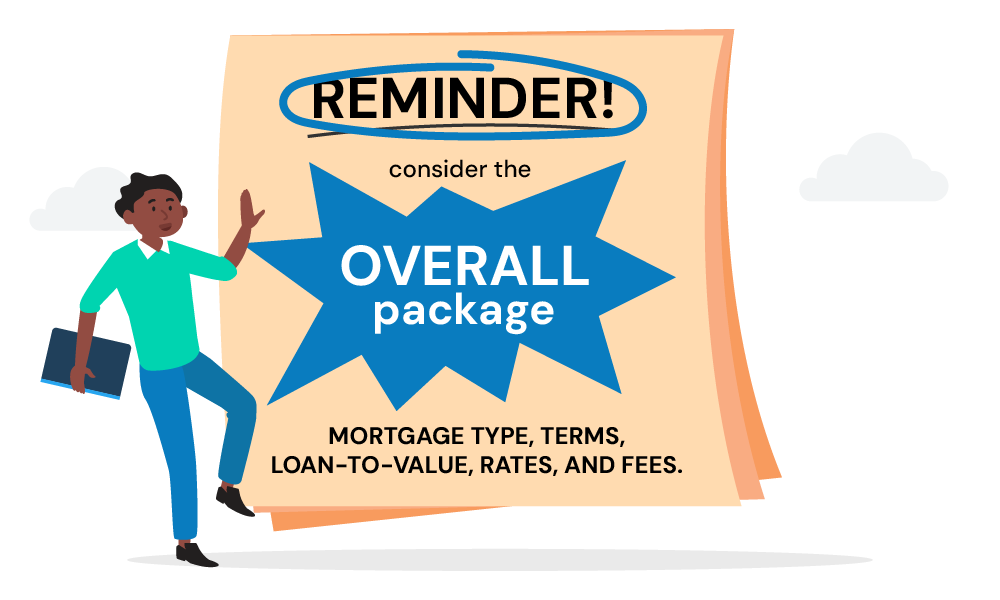

How to Choose the Best Debt Consolidation Loan for You

When it’s time to pick a debt consolidation loan, there’s a bit more to think about than just grabbing the first offer you see. Here’s how to make a smart choice:

- Compare Interest Rates and Fees. Look around and compare the interest rates different lenders offer. But don’t stop there – check out the fees too. Some loans might seem cheap at first but come with high fees.

- Read Customer Reviews. What are other people saying? Customer reviews can give you the real scoop on what it’s like to borrow from a lender. They can flag up any issues with customer service or hidden costs.

- Consider All Your Options. Don’t overlook alternatives like transferring your debt to a 0% interest credit card, which can be advantageous if you’re able to pay off the debt within the interest-free period.

- Get Free Advice. There are brokers in the UK who provide free and personalised advice. To take advantage of this, send us an enquiry. We’ll set up a free, quick, and no-obligation consultation with an expert.

- Borrow Only What You Need. It might be tempting to borrow a bit extra, but remember, this is about consolidating what you already owe. Borrowing more means more to pay back later.

- Choose the Right Loan Term. A longer loan term might mean lower monthly payments, but you’ll pay more in interest over time. A shorter term means higher payments, but less interest overall. Think about what works for your budget.

- Check Lender Reputation and Customer Service. Ensure the lender is reputable and provides good customer service. Verify that they are authorised and regulated by the Financial Conduct Authority (FCA) for added peace of mind and security.

- Look at the Bigger Financial Picture. Consider how the loan fits into your overall financial plan. Will it help you get out of debt faster? Will it make your monthly budget easier to manage?

- Be Aware of Your Credit Score Impact. Remember, applying for multiple loans in a short period can affect your credit score. So, do your homework before applying.

Alternatives to Debt Consolidation Loans

Other potential debt solutions:

- 0% balance transfer credit cards – Shift credit card balances to a 0% interest deal.

- Debt management plans – Agree on reduced interest rates on debts with creditors. Can be arranged through charities.

- Debt charities like StepChange – Provide free advice on the best options for your circumstances.

- Debt relief orders – For those with minimal disposable income.

- Bankruptcy – Emotional and financial impact make this a last resort.

The Bottom Line: Take Control of Your Finances Today

Hopefully, this guide has explained debt consolidation loans and empowered you to take positive action.

Juggling problem debts alongside poor credit can feel discouraging. But support is available.

Some independent brokers can help you decide if this is the right financial strategy for you. They can also help you understand other options, give smart advice and get the admin work done for you.

To get started, simply reach out to us. We’ll connect you with your ideal debt consolidation loan broker who can help you secure the best deals in the market.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Does the length of my debt consolidation mortgage change how much I pay in total?

Yes, the length of your mortgage changes how much you pay back. If your mortgage lasts for a long time, your monthly payments will be lower, but you’ll pay more interest over the years.

If it’s shorter, you’ll pay more each month, but less interest in total. It’s important to find a balance that works for your budget.

Will consolidating my debt into a mortgage affect my taxes?

In most cases in the UK, putting your debt into a mortgage doesn’t change your taxes. Remember, the interest you pay on your mortgage isn’t tax-deductible. It’s a good idea to talk to a tax expert for advice specific to your situation.

Can I include debts from loans I've co-signed on in my debt consolidation mortgage?

Yes, you can usually include co-signed or guarantor loans in your debt consolidation mortgage. This depends on what your lender says is okay. Remember to consider how this might affect you and the person who co-signed the loan.

How does using a mortgage to pay off my debts impact my chances of getting a refinancing deal later?

Using your mortgage to pay off debts can affect future refinancing. Lenders look at how much of your home you own outright and your total debt when you want to refinance.

If you don’t have much equity in your home after consolidating your debts, it might be harder to get a good refinancing deal.

What should I do with my money after I consolidate my debts into a mortgage?

After you put your debts into your mortgage, it’s smart to be careful with your money.

Make a budget to control your spending, try not to get into more debt, and always pay your mortgage on time.

It’s also a good idea to save some money for emergencies and keep checking your finances regularly. This helps you stay on track and avoid new debt problems.