- Can You Secure a £3 Million Mortgage in the UK?

- How Much Will a £3 Million Mortgage Cost Each Month?

- What Do You Need to Get a £3 Million Mortgage?

- How Much Do You Need to Earn?

- What About the Deposit?

- Extra Costs to Think About

- What Kind of Houses Can You Buy?

- Should You Get an Interest-Only Mortgage?

- Getting Help from a Mortgage Broker

- The Bottom Line

How To Borrow a £3 million Mortgage?

A £3 million mortgage deal is a big commitment. Perhaps you’ve got your eye on a beautiful townhouse in Kensington, a historic country house in the Home Counties, or a newly built luxury home in Surrey.

Whatever property you’re dreaming of, a mortgage this size can help make it yours.

We know it might feel a bit overwhelming – after all, it’s a lot more than your average house price.

Not every bank offers mortgages this large, but don’t worry. With good planning and the right help, it’s perfectly achievable.

Let us guide you through everything you need to know – from getting your mortgage approved to working out your monthly payments and finding the perfect mortgage adviser who specialises in larger loans

Can You Secure a £3 Million Mortgage in the UK?

Yes, it is. However, not all lenders offer such large mortgages.

Mainstream lenders might extend to this amount under certain conditions, but often, there’s a cap on what they can lend.

For mortgages of this size, private lenders, who craft deals for those who meet their criteria, are a common route.

These lenders typically work through mortgage brokers, so finding a broker experienced in large mortgages is a smart move. They can connect you with the right lenders for your financial situation.

If you want a hassle-free way of finding the right mortgage advisor, send us an enquiry. We’ll set up a free, no-obligation consultation for you with a good advisor to help you get started with large mortgages.

How Much Will a £3 Million Mortgage Cost Each Month?

The amount you pay depends mainly on two things:

- The interest rate (think of it as the fee the bank charges for lending you the money)

- How long you want to take to pay back the loan (usually 25 or 30 years)

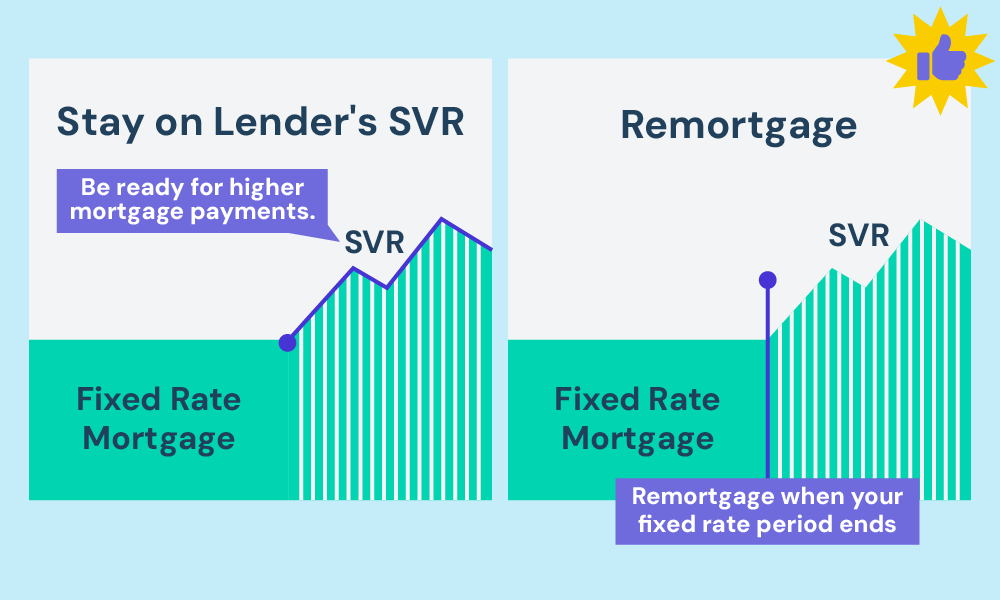

In the UK, most people choose a fixed interest rate, which means your monthly payments stay the same for a set time – usually 2, 3, or 5 years.

It’s like locking in a price, so you know exactly what to budget for.

After this time ends, the rate usually goes up, but don’t worry – you can usually shop around for a new deal (we call this remortgaging).

Let’s look at a simple example to help you understand.

Imagine you get a mortgage with a 3.5% interest rate fixed for 5 years. You’d have two main choices for how to pay it back:

Option 1: Repayment Mortgage

- You pay about £54,575 each month

- This pays off both the loan itself and the interest

- After 5 years, you’ll have paid back some of the £3 million you borrowed

Option 2: Interest-Only Mortgage

- You pay about £8,750 each month

- This only pays the interest charges

- After 5 years, you’ll still need to pay back the full £3 million

Think of it like this: a repayment mortgage is like buying a house outright bit by bit, while an interest-only mortgage is more like renting the money from the bank while saving up separately to pay back the loan later.

Remember, these numbers are just examples – the actual amount you’d pay depends on:

- What interest rate you can get

- How long you want to take to pay back the loan

- What type of mortgage you choose

The longer you take to pay back the mortgage, the lower your monthly payments will be, but you’ll end up paying more in total because you’re borrowing the money for longer.

It’s always a good idea to talk to a mortgage adviser who can explain your options and help you find the best deal for your situation.

They’re experts at this and can give you exact figures based on today’s mortgage rates.

Example Monthly Payments for a £3 Million Mortgage (3.5% Fixed for 5 Years)

| Mortgage Type | Monthly Payment (£) | Total Paid Over 5 Years (£) |

|---|---|---|

| Repayment Mortgage | £54,575 | £3,274,514 |

| Interest-Only Mortgage | £8,750 | £525,000 |

To see how much your mortgage payments will look like, use our mortgage calculator.

What Do You Need to Get a £3 Million Mortgage?

Getting a mortgage this big is a bit like applying for a really important job – the bank needs to make sure you’re the right fit.

Here’s what they’ll look at:

- Your Income. You’ll need to earn quite a lot – typically around £500,000 a year or more. Think of it like making sure you can afford the monthly payments without struggling.

- Your Track Record with Money. The bank will check if you’re good at managing money by looking at your credit score. It’s like a report card for how well you handle your finances.

- Your Job. Banks love to see that you’ve had a steady job for a while. It shows them you’ll keep earning enough to pay back the loan.

- Your Savings. Having some money saved up is brilliant – it shows you’re good at managing money and have a safety net if needed.

- Your debt-to-income ratio. This is the measure of how much your income is going toward your debts each month. Lenders use it to see if you can take on a mortgage of this size. A lower rate means you can handle additional debt. You can use our debt-to-income ratio calculator to see where you stand.

- Property type and its value. Lenders prefer well-built, good-condition properties, and the value should match the mortgage amount you’re requesting.

How Much Do You Need to Earn?

Most banks use something called ‘income multiples‘ to work out how much they’ll lend you – it’s really just a simple way of checking if you can afford the monthly payments.

Typically, banks will multiply your yearly income by 4.5. This means you’d need to earn at least £670,000 per year to qualify for a £3 million mortgage.

That sounds like a very specific number, doesn’t it? But don’t worry if your income isn’t exactly that much.

Some banks might be more flexible and offer up to 5 or even 6 times your income, especially if:

- You have an excellent credit history

- You work in a profession that typically sees income grow over time (like doctors or lawyers)

- You have other sources of income (like investments or bonuses)

- You have lots of savings

So if a bank offered 5 times your income, you’d need to earn about £500,000 per year.

Remember, this could be a combined income if you’re applying with someone else, like your partner.

What About the Deposit?

The deposit is the money you put towards the house yourself, and it’s a really important part of getting a mortgage.

For a £3 million property, you’ll need quite a substantial amount saved up.

Most lenders will ask for at least 20% of the property’s value as a deposit. Let’s break this down:

- For a £3 million house, a 20% deposit would be £600,000

- Some lenders might ask for 25%, which would be £750,000

- If you’re really lucky, you might find a lender who accepts 15% (£450,000)

- In rare cases, some specialist lenders might accept 10% (£300,000)

Here’s the clever bit: the bigger your deposit, the better deal you’re likely to get on your mortgage.

This is because:

- You’ll be borrowing less money overall

- Banks see you as less risky if you have a bigger deposit

- You’ll usually get lower interest rates

- Your monthly payments will be smaller

Extra Costs to Think About

When you’re planning for a £3 million mortgage, there are quite a few extra costs to budget for. Let’s go through them all:

- Arrangement Fee. This is charged by the lender for setting up the mortgage. It can vary, but for large mortgages, it could be around 1% of the loan amount, which would be about £30,000 for a £3 million mortgage.

- Valuation Fee. This fee is for the lender to assess the property’s value. It can range from £500 to £1,500, depending on the property size and value.

- Solicitors’ Fees. These cover the legal work involved in the mortgage. Expect to pay between £1,500 and £3,000.

- Survey Costs. A detailed survey of the property can cost anywhere from £600 to over £1,500.

- Stamp Duty. This is a tax on property purchases. For a property worth £3 million, the stamp duty can be quite significant, often exceeding £100,000.

- Insurance. Building insurance is essential, and the cost depends on the property and coverage level. You might also consider life insurance linked to the mortgage.

- Broker Fees. If you use a mortgage broker, they may charge a fee for their services, which can be a fixed fee or a percentage of the loan amount.

Remember, these costs can vary based on your circumstances and the specifics of the property and mortgage deal.

It’s important to budget for these additional expenses to ensure a smooth mortgage process.

What Kind of Houses Can You Buy?

When you’re looking at properties in the £3 million range, you’ve got lots of exciting options, but some properties are easier to get a mortgage for than others.

As mentioned earlier, lenders prefer properties that are easy to sell if needed. This means they often favour standard construction types and properties in good condition.

Here are the properties banks love:

- Traditional houses in good condition

- Properties in desirable locations

- Houses made with standard building materials

- Properties that would be easy to sell if needed

- Modern houses with all the proper certificates

- Period properties that have been well maintained

Properties That Might Be Trickier

- Listed buildings (especially Grade I or II*)

- Houses with unusual construction methods

- Properties with special planning restrictions

- Very remote properties

- Houses with structural issues

- Properties with commercial elements

Keep in mind that this doesn’t mean you can’t get a mortgage for the trickier properties – you might just need a specialist lender or a bigger deposit.

Should You Get an Interest-Only Mortgage?

Interest-only mortgages can be an option for a £3 million loan, but they’re not suitable for everyone. With this type of mortgage, you only pay the interest each month.

The principal – the actual amount borrowed – isn’t reduced over time. At the end of the mortgage term, you still owe the full £3 million.

These mortgages often require a solid plan for repaying the principal at the end of the term, like selling the property or using other investments.

Interest-only mortgages can have lower monthly payments, but they require careful financial planning.

If you’re considering this option, make sure you have a robust repayment strategy in place.

Getting Help from a Mortgage Broker

Using a specialised mortgage broker is a smart move when you’re looking for a large mortgage like one for £3 million.

These brokers have the expertise and connections you might not find on your own. They understand the complexities of large loans and can guide you through the process.

A broker can also help you find lenders who offer competitive rates for large mortgages and negotiate terms on your behalf.

They know the ins and outs of the mortgage market and can access deals that aren’t always available directly to the public.

In short, a good broker can save you time, money, and a lot of stress.

The Bottom Line

House prices are going up, especially in popular areas. That’s why a £3 million mortgage is becoming more common for people who want a high-quality home.

If you’re thinking about this, the first step is to work out how much you can afford.

For a mortgage this size, you’ll usually need a deposit of £300,000 to £750,000. The bigger the deposit, the better the deal you can get on your mortgage.

Lenders will also look at your income and credit history to check if you can handle the monthly payments.

And don’t forget about other costs, like stamp duty and legal fees—they can add up quickly.

It might all feel a bit much to figure out on your own. That’s where a mortgage advisor can help. They’ll explain your options in simple terms, help you pick the right mortgage, and guide you through the process.

If you’re ready to take the next step, get in touch with us. We can connect you with a specialist advisor who can help you get started and make things as easy as possible.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can I get 3 million for a commercial mortgage?

Yes, you can get a £3 million commercial mortgage, but it depends on several factors like your business’s financial health, credit history, and the value of the commercial property. Lenders will also look at your business plan and revenue forecasts. It’s important to have a strong case to show that your business can afford the repayments.