Mortgage Approvals & Rejections: What You Need to Know

Getting a mortgage can feel like a rollercoaster ride. You’ve found your dream home, pictured yourself settled in, but then—bam!

The dreaded rejection email comes through, and suddenly it feels like everything’s on hold.

But don’t worry; you’re not alone in this experience.

Mortgage rejections happen more often than you think, and while it’s frustrating, understanding why it happens can make all the difference next time around.

In this article, we’ll explore what percentage of mortgage applications are approved, and why so many mortgage applications are declined.

We’ll also look at what you can do to boost your chances of success.

So, if you’ve ever been curious about why mortgage applications fall through or just want to be well-prepared for your next application—you’ve come to the right place.

What Percentage of Mortgage Applications Are Approved?

Let’s start with some good news: mortgage approvals in the UK are on the rise.

The Bank of England recently reported that net mortgage approvals for house purchases rose from 62,500 in July to 64,900 in August.

This rise suggests that lenders are still approving a significant number of mortgage applications despite the current economic challenges.

While this is encouraging for those looking to buy a home, not every application is successful.

So it’s helpful to understand why some might be declined. Let’s break down what’s behind these numbers and why some applications don’t get approved.

How Many Mortgage Applications Are Declined?

Unfortunately, mortgage rejections have been a common issue in the UK lately, particularly due to affordability concerns.

With living costs on the rise, many people find it harder to meet lender requirements.

While exact numbers can change with the market, non-traditional workers—like freelancers, gig economy workers, and those on zero-hours contracts—face particular challenges.

Research from The Mortgage Lender (TML) shows that nearly half (45%) of non-PAYE workers have had mortgage applications rejected.

Lenders often prefer predictable income, so if your earnings vary, you might find it harder to get approved.

This doesn’t mean you aren’t earning enough; it just means your income doesn’t fit into the usual model lenders expect.

Understanding these challenges can help you work out your next steps.

>> More about What To Do When Your Mortgage Application is Declined?

Why Are So Many Mortgage Applications Declined?

Getting a mortgage is really stressful, especially if you keep getting rejected. Let’s explore some of the common reasons.

Affordability Concerns

As we’ve discussed, this is the most common reason most people are declined for a mortgage.

Lenders are all about the numbers. If your income and outgoings don’t match up to their requirements, your application may be declined.

This is especially common today, especially when the cost of living is on the rise, making affordability checks stricter.

Lenders want to see that not only can you afford the monthly payments today, but you’ll be able to keep up even if your situation changes.

>> More about Mortgage Affordability

Non-Traditional Income Sources

For all the freelancers, gig economy workers, and those with zero-hours contracts—this one’s for you.

It’s frustrating, especially when you’re earning well but your income doesn’t fit the traditional model that lenders are used to seeing.

Lenders often find it hard to assess irregular income or fluctuating earnings, which is why self-employed people tend to face more obstacles.

Credit Score Issues

No surprises here—your credit score plays a massive role in whether your application gets approved.

If you’ve got a few late payments or a high amount of debt, your score might not look too hot.

The good news? There are specialist lenders who cater to applicants with poor credit, but you’ll likely face higher interest rates.

Asking to Borrow Too Much

One of the key reasons people get turned down is that they’re simply asking to borrow too much.

The bank will assess your income, expenses, and other commitments and will decide how much they are comfortable lending.

Sometimes, expectations and affordability just don’t align. It’s worth understanding your limits before applying, as this can save you time and stress.

High Loan-to-Value (LTV) Ratio

Lenders like to see that you’ve got a decent deposit to put down on the property. The higher your deposit, the lower the risk for the lender.

If you’re trying to borrow at a high LTV—let’s say 95% of the property value—you might find that lenders are more cautious. They prefer borrowers who have more skin in the game, as it reduces their risk.

How Can You Improve Your Chances of Approval?

If you’re facing mortgage rejections or simply want to put yourself in the best possible position, there are a few key things you can do:

1. Get Your Finances in Order

Before even starting the application, take some time to get your finances in tip-top shape.

This means paying down debts, reducing credit card balances, and saving up for a larger deposit if possible. It’s all about showing the lender that you’re a reliable borrower.

2. Speak to a Mortgage Broker

If you’re not sure where to start or want to make sure you’re applying to the right lender, a good broker can be a massive help. They know which lenders are likely to look at your application favourably and can save you a lot of time and stress.

Good brokers are also useful for non-traditional workers, as they often know which lenders have more flexible criteria.

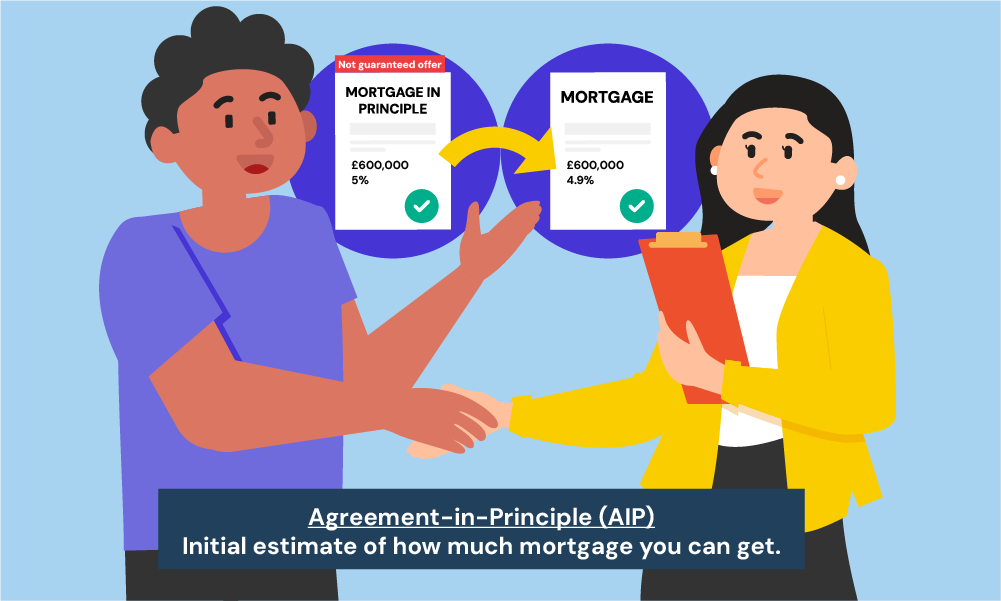

3. Apply for a Mortgage in Principle

Getting a mortgage in principle is a smart move. It’s essentially a pre-approval that gives you an idea of how much you can borrow.

This way, you can house-hunt within your budget, avoiding the heartbreak of falling for a property that’s out of reach—no one wants that.

Plus, it shows sellers you’re serious, which can give you an edge if there are multiple offers.

However, it’s important to remember that a mortgage in principle is not a guarantee. It’s based on the information you provide at the time, and the lender will still need to do a full assessment before officially approving your mortgage.

So, while it’s a great starting point, it’s not the final say.

4. Improve Your Credit Score

Your credit score is one of the biggest factors in your application. Simple steps like setting up direct debits for bills, paying off outstanding debts, and not applying for any new credit before your mortgage application can all help boost your score.

Downloading your credit files to check and correct/update any errors can also make a big difference. It’s worth taking these steps well in advance of applying.

5. Show Proof of Savings and Stability

The more you can show that you’ve got your financial life together, the better. Lenders love stability—whether it’s a regular savings habit, staying in the same job for a while, or reducing unnecessary spending.

These little things can make a big difference when the lender assesses your risk.

Are Young People More Likely to Be Rejected?

In short: yes, unfortunately. Younger applicants, particularly those aged 18-24, are more likely to face rejections.

Why? It often comes down to having a shorter credit history and less time to build up a strong credit profile.

In fact, four in ten young homeowners have faced mortgage rejections before buying their current home.

This also applies regionally—Londoners, for example, are more likely to be turned down than those in other areas.

With high property prices, lenders are often more stringent when it comes to affordability checks for London-based applicants.

Key Takeaways

- Mortgage approvals in the UK are increasing, but high living costs and strict affordability checks make it tougher for many applicants.

- Non-traditional incomes, such as freelancing and gig work, often lead to rejections due to unpredictable earnings.

- Low credit scores, high borrowing requests, and small deposits (high LTV) may all lead to declined applications.

- To boost your chances, get your finances in order, save for a larger deposit, consider working with a broker, and consider a mortgage in principle to set realistic expectations.

The Bottom Line

Getting a mortgage can feel like running a marathon with lots of hurdles. But don’t worry—you can cross the finish line.

Many people get rejected, but with some planning and effort, you can make yourself look good to lenders.

It’s like tidying up your room: sort out your finances, know your limits, and don’t hesitate to ask for help—especially from a qualified mortgage broker.

Mortgage brokers can make things easier by finding the best deals for you. They know which lenders are more likely to approve you, saving you time and reducing the chance of rejection.

They can also handle the paperwork and have access to exclusive deals you might not find on your own.

If you get turned down, it’s not the end of the world. Many people need a few tries before they succeed.

Ready to take that next step? Get in touch with us—we’ll connect you with a trusted mortgage broker to guide you every step of the way.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can I reapply if my mortgage application is declined?

Yes, but it’s wise to wait and address any issues first. Consult with a mortgage broker to find lenders who may be more open to your circumstances.

Is it more difficult to get a mortgage now in the UK?

Yes, getting a mortgage in the UK has become more challenging. Lenders now have stricter affordability checks, and with the rising cost of living, they’re being more cautious.

If you have a non-traditional income, like freelancing, you might face extra hurdles. That’s why it’s important to present a strong financial profile.

Working with a mortgage broker can also help, as they can connect you with lenders who may be more flexible with their criteria.

Why is my mortgage application taking so long in the UK?

Mortgage applications can take time due to thorough affordability assessments, document reviews, and property valuations.

Lenders often require additional information, especially if your financial situation is complex. Delays can also result from high demand, so having all required documents ready can help speed things up.

How many times can you miss a mortgage payment?

Missing one mortgage payment is serious, but multiple missed payments can lead to default and even repossession.

Most lenders will work with you if you communicate early and seek a solution. But falling behind consistently can damage your credit score and reduce future borrowing options.

How long does it take for a mortgage to be approved?

On average, a mortgage can take between 2 to 8+ weeks to be approved, depending on the lender’s processes and your financial situation.

To help speed things up, make sure you have all your documents ready and sort out any potential issues in advance.

>> More about Mortgage Application Approval

Can anything go wrong after a mortgage offer?

Yes, a mortgage offer can be withdrawn if your finances change, if there are issues with the property’s valuation, or if the lender finds concerns during final checks.

It’s best to keep your finances steady and avoid big changes, like taking on new debt, until the sale is final.