- What is an Interest-Only Secured Loan?

- Why Might You Need an Interest-Only Secured Loan?

- How Much Can You Possibly Borrow?

- What Makes You Eligible?

- What Types of Interest-Only Secured Loans Are Available?

- Should You Get Interest-Only Secured Loans?

- Which Lenders Provide These Loans?

- Are There Any Alternatives?

- Getting Interest-Only Secured Loans with Bad Credit

- The Bottom Line

Interest-Only Secured Loans: A Comprehensive Overview

Need extra cash for a home makeover or a dream holiday?

An interest-only secured loan could be the financial tool you’ve been searching for. It’s not just for big spending; it’s also a savvy move if you’re looking to lump your debts together into one manageable payment.

But make no mistake—this isn’t a decision to take lightly. That’s why we’re here to break it down for you.

In this guide, you’ll get the inside scoop on how interest-only secured loans work, what you can realistically borrow, and why talking to a broker might just be your ticket to a better deal.

What is an Interest-Only Secured Loan?

An interest-only secured loan, often called an interest-only second-charge mortgage, offers a practical way for existing homeowners to unlock additional funds by freeing up home equity.

This type of loan uses your home as security, so failing to make payments could result in the lender seizing and selling your property.

Unlike traditional loans where you pay off both the principal and the interest, here you only pay the interest each month. You’ll need to repay the full loan amount when the mortgage term ends.

To get this type of loan, you must show your lender a solid repayment plan. You could plan to sell another property, use inheritance money, or rely on cash savings, among other strategies.

Keep in mind that taking out this loan adds another mortgage to your financial responsibilities. It’s wise to consult a broker to figure out if this loan suits your financial landscape.

Why Might You Need an Interest-Only Secured Loan?

People take out interest-only secured loans for a variety of reasons, including:

- To finance home improvements, such as loft conversions, extensions, or new kitchens and bathrooms.

- To consolidate debt, such as credit card debt or other loans, into a single monthly payment with a potentially lower interest rate.

- To fund major life events, such as weddings, holidays, or the purchase of a new car.

- To invest in a property or business.

- To cover unexpected expenses, such as medical bills or job loss.

Interest-only secured loans can be a useful financial tool, but it is important to understand the risks involved.

For example, if you do not have a plan for repaying the loan at the end of the term, you may be forced to sell your home or take out another loan with higher interest rates.

It’s also important to note that interest-only secured loans are not available to everyone. Lenders will usually require you to have a good credit score and a high equity stake in your home. We’ll discuss this in detail later on.

If you’re considering taking out an interest-only secured loan, speak to a financial advisor to get advice on the best option for your circumstances.

How Much Can You Possibly Borrow?

When you’re considering taking out a loan, the foremost question that comes to mind is about the amount you can borrow.

It varies greatly with different lenders, but generally, the minimum amount starts from £10,000 and it can go up to a whopping £1 million.

But, this is determined by numerous factors including your ability to meet the eligibility criteria and a solid repayment strategy you have in place.

What Makes You Eligible?

To qualify for such loans, there’s a stringent set of criteria that you should be prepared to meet.

While each lender might have unique requirements, here are some common rules that you would generally need to fulfil:

Home Equity

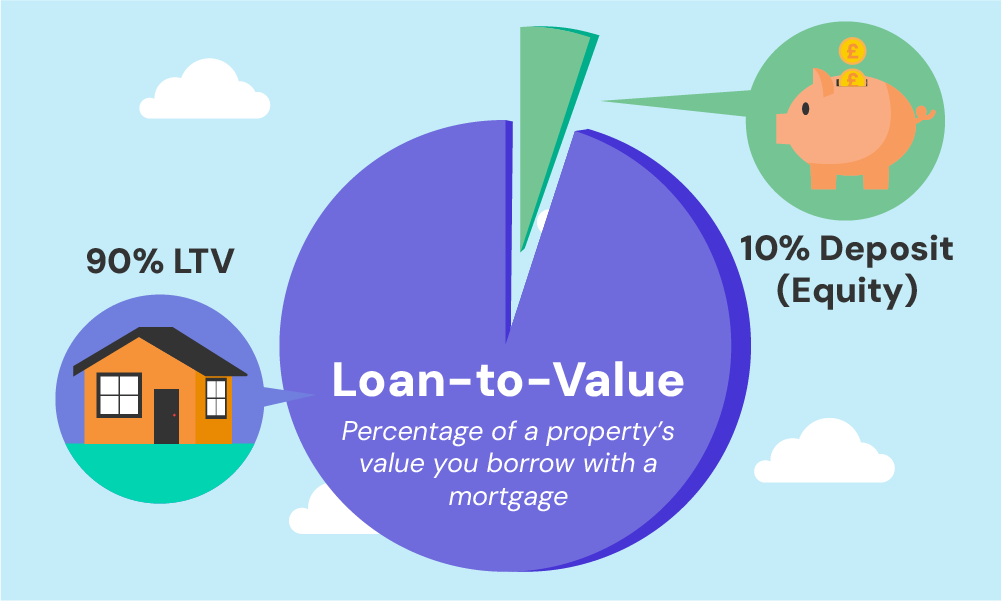

Having a considerable amount of equity in your property is often a fundamental requirement.

Usually, this needs to be at least £100,000, but it can sometimes be more. You can find out your equity by subtracting any remaining mortgage from your property’s value.

The loan-to-value (LTV) percentage, which is influenced by the amount of equity you have, often ranges between 50% and 80%.

Concrete Repayment Strategy

You must have a robust repayment plan in place, as you are required to repay the entire loan amount at the end of the term.

This could involve a variety of strategies, such as using an inheritance, a portion of your pension, proceeds from the sale of a property, or income from investments.

If you have a shortfall, you may need to remortgage or sell your property, especially if you are over 55.

Decent Credit Score

While a few negative marks on your credit history may not have a big impact on your approval chances, having a clean credit report and a history of responsible repayment can lead to more favourable deals.

Financial Stability

Even though the monthly repayments are usually lower compared to capital repayment loans, lenders want to ensure that you are capable of managing the repayments of two loans simultaneously. This is determined by evaluating your income against your monthly expenditures.

In addition to the above criteria, lenders may also consider other factors, such as your age, employment status, and purpose for the loan.

If you are considering taking out an interest-only secured loan, it”s important to speak to a financial advisor to get advice on the best option for your circumstances.

What Types of Interest-Only Secured Loans Are Available?

You’ll find three main types available:

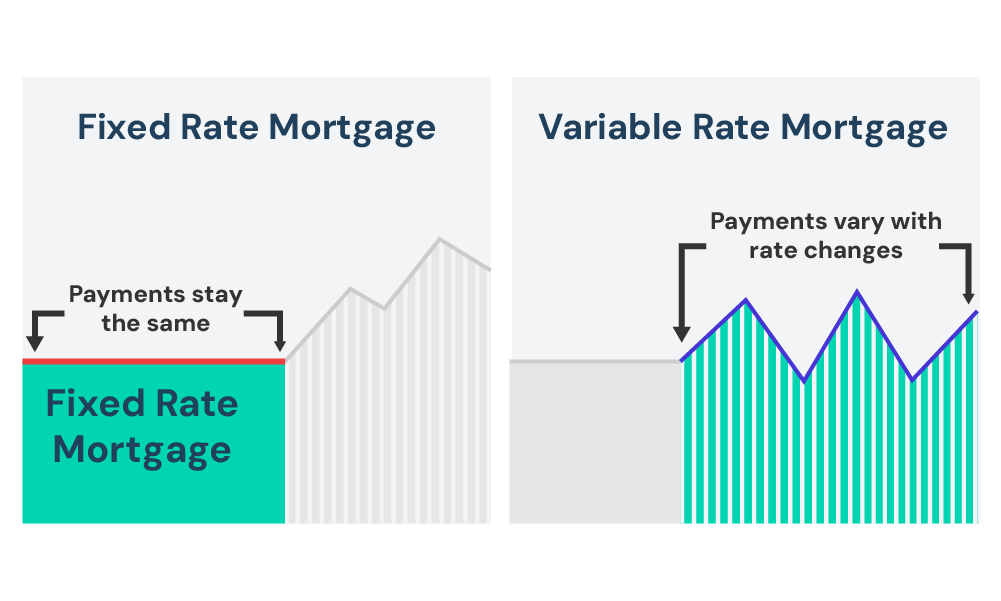

Suitable if you prefer having consistent monthly payments throughout the loan period. This might be your choice if you fancy sticking to a set budget.

Short-Term Fixed

With this option, your payments remain unchanged for a specified duration, say 2 or 5 years, before transitioning to your lender’s standard variable rate which may fluctuate based on market trends.

Variable Rate

Here, the interest rate you shell out is in line with the Bank of England base rate. This means your monthly payments might either increase or decrease over time, reflecting the movements in the base rate.

Should You Get Interest-Only Secured Loans?

If you’re contemplating an interest-only secured loan, weighing the pros and cons is crucial. Here’s a quick rundown to help you make an informed decision.

Pros:

- Lower Monthly Payments. You pay less each month compared to traditional mortgages but remember, you’ll need a plan to cover the loan amount when the term ends.

- Better Interest Rates. Asset-backed loans usually come with more favourable rates.

- Longer Repayment Terms. You often get more time to pay back the loan than with the 7-year limit on most unsecured loans.

Cons:

- Remaining Loan Balance. The main downside is you must settle the initial loan amount at the end of the term, making a solid repayment plan essential.

- More Interest Over Time. Because the loan amount stays the same, you’ll pay more in interest over the term.

- Added Risk. If your repayment plan—be it investments or pensions—doesn’t go as planned, you could face difficulties in settling the loan.

Which Lenders Provide These Loans?

Getting your hands on these loans might be a bit challenging as they are primarily offered by specialist lenders like United Trust Bank, Shawbrook Bank, and Masthaven.

The rates can fluctuate depending on various factors including your financial assessment and the loan term.

Generally, the interest rates are slightly higher, ranging from 4% to 9%, since the primary lender gets priority in case of repayment defaults.

Consulting a specialist broker can guide you to the best lender suited for your situation.

Are There Any Alternatives?

If you find that an interest-only secured loan doesn’t align with your needs, fear not, as there are several other avenues to acquire cash.

Here are some alternatives:

- Unsecured personal loan. If you qualify, you may be able to get an unsecured personal loan. These loans are not secured against any assets, so they can be easier to get, but the interest rates are usually higher.

- Credit card debt. If you have a good credit score, you may be able to increase your credit card limit. This can be a quick and easy way to get money, but it is important to be careful not to overspend.

- Equity release. If you are over 55, you may be eligible for equity release. This is a way to borrow money against the value of your home without having to sell it.

- Remortgaging. Remortgaging involves switching to a new mortgage deal with your existing lender or a new lender. You can borrow more money as part of the remortgage process. This option can be especially attractive if you are approaching the end of your current mortgage term, although there may be exit fees if you remortgage early.

Getting Interest-Only Secured Loans with Bad Credit

Poor credit doesn’t automatically rule you out when you’re seeking an interest-only secured loan. It comes down to the nature and timing of your credit issues.

Specialist lenders exist who may consider lending to you if you’ve experienced:

- Late payments on bills

- Defaulted on previous loans

- Court judgements for debt (CCJs)

- Fallen behind on mortgage payments

- Entered into debt management schemes

- Been part of an Individual Voluntary Arrangement (IVA)

- Filed for bankruptcy in the past

- Had a property repossessed

If you have credit issues, check your current credit report. It can help you decide if you should apply now or wait to improve your credit for better loan terms.

The Bottom Line

Taking out an interest-only secured loan is a significant financial decision, so it is important to plan carefully and research your options thoroughly.

You need to weigh the pros, such as lower monthly payments and competitive interest rates, against the cons, such as higher long-term costs and the need for a robust exit strategy.

Always compare the costs of different loan options to make an informed decision.

A loan broker can streamline this process for you. They can present a range of suitable options tailored to your circumstances and can often negotiate better terms on your behalf.

Their expertise can make the complex process of securing a loan more manageable and potentially more cost-effective.

To get started, get in touch with us. We will pair you with an expert loan broker who can guide you through the application process and help you make the best decisions for your financial future.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What's the typical term for an interest-only secured loan?

The loan term usually ranges between 15 and 25 years, in contrast to the standard 7-year term of an unsecured loan.

What happens if I fail to repay my interest-only secured loan?

Failing to repay the loan could lead to the lender repossessing your property to recover the debt. However, this is generally a last resort, as lenders prefer alternative solutions.

What's expected after my interest-only secured loan?

You’ll need to repay the initial amount borrowed using the repayment strategy you initially outlined to your lender. Options include utilising savings, selling property, or using investment instruments among others.

What alternatives do I have if my repayment plan falls through?

Options for salvaging the situation include raising cash, switching to a repayment mortgage, or selling the property. Equity release products are also available for those nearing or past retirement age.

What if I hit retirement age before the loan term ends?

Some lenders don’t have age restrictions and offer equity release products tailored for applicants over 55. Consulting mortgage brokers can help clarify your options in this scenario.

Is taking out a second-charge mortgage better than remortgaging?

The choice between the two depends on your needs and financial situation. Reasons for avoiding a remortgage might include a favourable existing mortgage rate, early repayment fees, or changes in your financial circumstances that affect your eligibility.