- What Exactly is a Pensioner Loan?

- Can You Secure a Loan While Retired?

- Is Age Just a Number? Age Restrictions on Loans

- What Factors Matter When You Apply for a Loan?

- What Loans Are Available for Retirees?

- How to Pick the Best Type of Loan for Your Needs

- How Much Can Pensioners Borrow?

- Is a Loan Right for Retirees?

- The Pros and Cons of Loans for Pensioners

- How Loan Repayments Work for Retirees

- Can You Take a Loan Against Your Pension?

- How Can You Get a Loan if Youâre Retired and Own a Home?

- Can Pensioners Get Loans with Bad Credit?

- What Are Some Alternatives to Pensioner Loans?

- What Should You Think About Before Getting a Pension Loan?

- Smart Moves and Mistakes to Avoid When Considering Pension Loans

- The Bottom Line

Loans for Pensioners: How to Get the Cash You Need?

Suppose you’ve reached retirement and find that, despite having assets in property or a robust pension plan, your daily cash flow isn’t quite as fluid.

In that case, you may contemplate taking out a loan for things like home renovations, a new car, or even a well-deserved holiday.

And why not? If you have a steady pension income and a strong credit score, borrowing could be a smart move for you.

So, before you make any decisions, it’s crucial to weigh the pros and cons of taking out a loan during this stage of your life.

This guide aims to arm you with all the information you need to make an educated choice.

What Exactly is a Pensioner Loan?

When we talk about pensioner loans, we mean any form of personal loan available to those who are retired or on a pension.

Specialised loans tailored for older homeowners, such as equity release schemes, also fall under this category.

Can You Secure a Loan While Retired?

Yes, securing a loan when you’re retired is possible.

Lenders assess multiple income streams you might have—from pensions (be it work, private, or state pensions) to income from part-time work or rental properties. Your credit score will also be scrutinised to determine the loan’s affordability.

It’s worth noting that while some lenders are more open to providing loans for pensioners, others may be more cautious, particularly for long-term loans.

This is usually due to the perceived higher risk of the borrower passing away before completing the repayments.

Is Age Just a Number? Age Restrictions on Loans

Most lenders will have an age ceiling for their loan products. Some lenders stipulate you must be below 70 by the time the loan concludes, while others are willing to stretch it up to 75.

Loans beyond that age bracket are sparse. Additionally, lenders often set a minimum pension income for loan eligibility.

So, although it’s not out of the question to secure a loan past the age of 70, your choices may be narrower, underlining the importance of shopping around for the best deals.

What Factors Matter When You Apply for a Loan?

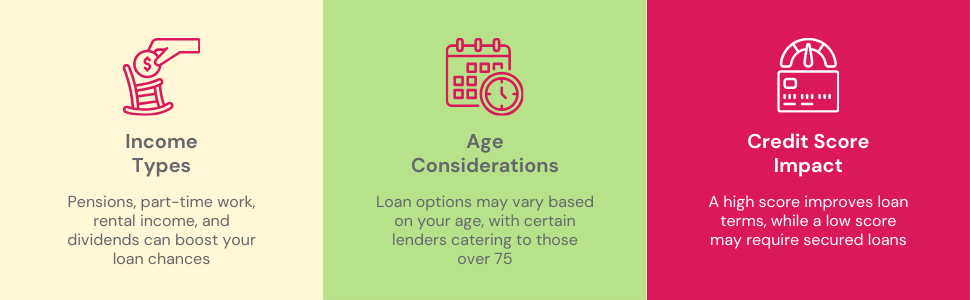

If you’re thinking about borrowing money, you need to know how lenders decide whether you’re a good risk. One of the main factors is your income.

Pensions are often accepted as income, whether it’s a state pension, a defined contribution pension you’ve put money into, or a defined benefit pension based on your work history.

Part-time work, rental income, and investment dividends can also count. The more income streams you have, the better your chances. Note that housing benefits aren’t usually counted as income.

Age is another factor. Lenders often set age limits for loan applications.

While many banks lend to individuals aged 70 and above, institutions like Sainsbury’s Bank and Nationwide Building Society go further, offering loans to those over 75.

If you’re over 80, you might find fewer options, so make sure to compare different lenders.

Your credit score can be a deal-maker or a deal-breaker. A high score improves your chances. A low score? You might still get a loan, but likely at a steeper interest rate.

With a poor credit history, consider a secured loan. But remember, if you can’t pay it back, you could lose whatever you’ve used as collateral, such as your home or car.

To be eligible for a loan, you must:

- Have a strong credit score.

- Meet the income requirements.

- Be within the lender’s maximum age limit.

- Provide an asset for collateral if you choose a secured loan.

What Loans Are Available for Retirees?

Loans for retirees come in a variety of forms, each with its own set of eligibility criteria, such as age restrictions and income minimums. Below, you’ll find several borrowing options worth considering:

1. Mortgages

If you’re looking to borrow a large amount, extending your existing mortgage often offers lower interest rates than personal loans.

However, this choice will likely increase your monthly repayments. Consider a fixed-rate mortgage to ease budgeting, especially as interest rates are rising.

2. Unsecured Loans

Unsecured loans let you borrow a predetermined amount, which you repay in fixed monthly instalments. These loans usually carry higher interest rates compared to secured loans. No asset is needed as security.

3. Secured Loans

If you own a home or other substantial assets, a secured loan allows you to borrow more money at a competitive interest rate.

But be cautious: failing to meet repayments puts your assets at risk of repossession by the lender.

4. Equity Release/ Lifetime Mortgages

Equity release schemes give you the option to access your home’s value without worrying about monthly payments.

You have the choice to either roll up the interest and pay it when you pass away or opt to make monthly interest payments. This option can affect what you leave behind for your family.

5. Debt Consolidation

A debt consolidation loan combines multiple debts into one, simplifying your repayments. This can also potentially lower your monthly costs.

You can choose between secured and unsecured consolidation loans based on your needs.

6. Car Finance

If you’re in the market for a new car, various finance options exist. Personal contract plans or hire purchase contracts are options worth considering.

Your credit score and income levels will determine your loan amount and interest rates.

How to Pick the Best Type of Loan for Your Needs

To find the right loan, you’ll need to know two things: how much you want to borrow and what you can afford to pay back each month.

Then you can figure out which loan fits both your financial and personal needs.

However, wading through the multitude of options can be overwhelming. A loan broker can provide invaluable insights into which loan best suits your situation.

If you’re in search of tailored advice, simply reach out to us. We’ll set up a no-obligation, free consultation with the right loan broker for you today.

How Much Can Pensioners Borrow?

Your borrowing limit largely depends on your income. If you’re on a tight budget, lenders may offer you a smaller loan amount.

For unsecured loans, you can generally borrow between £25,000 and £30,000, though some lenders may let you borrow up to £50,000.

When it comes to secured loans, also known as homeowner loans, you might be able to borrow up to a whopping £500,000.

However, the actual amount you can borrow will depend on your home’s value. Let’s say your lender sets a maximum loan-to-value (LTV) ratio of 70%.

This means you can only borrow up to 70% of the total equity you own in your home. So, if your house is worth £200,000, don’t expect to secure a loan for £500,000.

Remember, only borrow what you can manage to repay. Don’t put yourself in a financial bind.

If you’re eyeing a secured loan, consider using a secured loan calculator to estimate your monthly repayments. This will give you a basic understanding of what you can afford.

Lastly, these numbers are just a starting point.

To get a more detailed financial picture, consider chatting with a mortgage advisor. They can guide you through hidden fees, and costs, and make a recommendation that aligns with your financial situation.

Is a Loan Right for Retirees?

Deciding to take out a loan during retirement is a personal choice that depends on several factors. You should think about why you need the loan and explore cheaper alternatives, like saving or help from family.

Lenders will assess your financial situation and credit score. Before applying, get a free credit report and see if there’s anything you can do to improve it.

Also, examine how easily you can manage the monthly repayments by looking at your budget.

The Pros and Cons of Loans for Pensioners

Getting a loan can offer several benefits:

- You can cover significant expenses such as holidays or home improvements quickly, rather than saving for them.

- Depending on your credit score and income, you may qualify for a large loan at a competitive interest rate.

- Fixed monthly repayments can help you budget your finances effectively.

- You can choose the loan’s repayment term, giving you control over your financial commitment.

- Loans offer a way to get cash without selling your valuable assets.

But loans also have downsides:

- Over time, the added interest means you will pay more for a loan than if you used savings or cash.

- A limited income and poor credit score may restrict the loan amount lenders offer you, and you may be charged a high interest rate.

- Using an asset as collateral for secured loans puts you at risk of losing that asset.

- Missing a payment can harm your credit score and result in additional charges and accumulated debt.

- If you die before repaying the loan, the balance will reduce the value of your estate, affecting your legacy.

How Loan Repayments Work for Retirees

Choosing a personal loan means committing to fixed monthly repayments. The “term” or the length of the loan affects both your monthly payment and the total amount you’ll pay in interest.

Shorter loan terms cost less in interest but have higher monthly payments. Longer terms have smaller monthly payments but cost more overall due to higher interest.

For example, Jane and John are retired and want to take a loan of £7,000 for a world cruise. Their monthly pension income after taxes is £2,000.

They have two options: a secured loan with a 3-year term at a 7% APR or a 5-year term at the same 7% APR.

Here’s how the costs stack up:

| Loan Term | Interest Rate | Monthly Payment | Total Interest Paid |

|---|---|---|---|

| 3 years | 7% | £217 | £782 |

| 5 years | 7% | £139 | £1,317 |

What Does This Mean?

If Jane and John go with the 3-year term, they’ll pay £78 more per month but save £535 in interest compared to the 5-year option. It’s a trade-off between higher monthly payments and lower overall cost.

Can You Take a Loan Against Your Pension?

Yes, you can. But know that it’s often a pricier option. These kinds of loans go by names like pension advances, pension loans, or pension buyouts.

What usually happens is you agree to give up some of your monthly pension payments for a loan that lasts 5 to 10 years.

Think of this loan as similar to a payday loan—it can get super expensive.

We’re talking about Annual Percentage Rates (APRs) that can shoot past 100%. And sometimes, you might even have to get life insurance, making it costlier still.

How Can You Get a Loan if You’re Retired and Own a Home?

If you own your house, that’s something you can use to get a loan, sort of like a mortgage. Usually, you could be between 70 and 85 years old by the time you finish paying off this kind of loan.

If you’re still paying off your first mortgage, a second one could be an option. Just make sure you have enough money for everyday stuff and the loan payments.

Can Pensioners Get Loans with Bad Credit?

If you’re retired and have a poor credit history, getting a loan can be more challenging but not impossible.

Some lenders specialise in working with people who have low credit scores.

When you look for loans with us, we’ll only do a ‘soft’ credit check, so it won’t affect your credit score. It’s also a good idea to double-check your credit report for any mistakes that might be bringing down your score.

What Are Some Alternatives to Pensioner Loans?

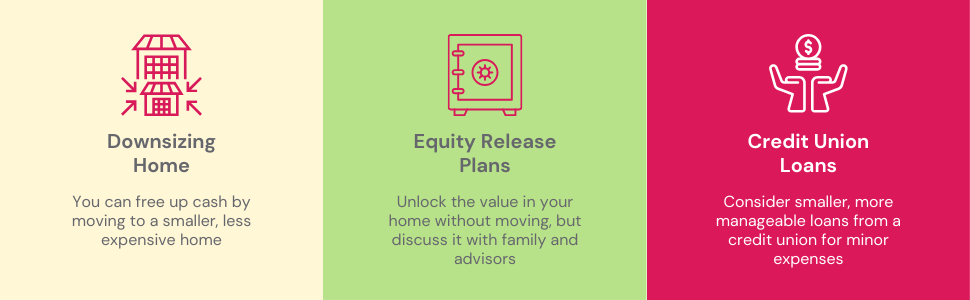

There are other ways to get the money you need instead of taking out a loan.

For instance, if your home has some value and you’re finding it hard to cover day-to-day expenses, you might think about downsizing to free up some cash.

You can also talk to your family to see if they can help with specific costs.

If you’d rather stay in your home, look into equity release plans. Just be sure to discuss it with your family and seek professional financial advice first.

For smaller financial needs, an approved overdraft, a credit card, or a loan from a credit union might be a better fit.

Always compare the benefits and drawbacks, as well as the costs, before making a decision.

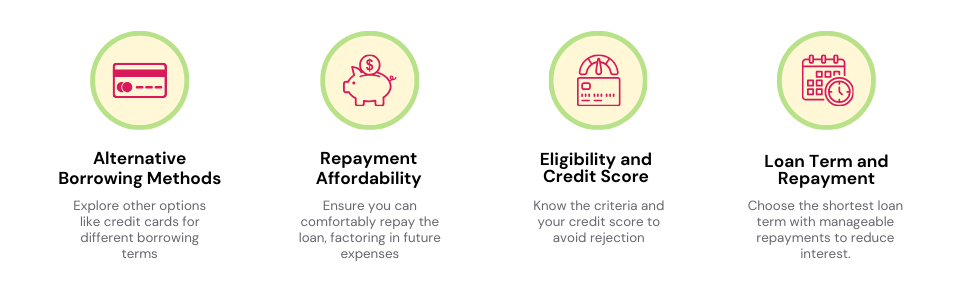

What Should You Think About Before Getting a Pension Loan?

Before diving in, take a step back. Could another borrowing method, such as a credit card, be better for you?

After all, there are different types of borrowing available and each comes with its own set of terms.

And really think about whether you need to borrow at all.

Can you afford to pay it back? It’s important to consider your financial stability, as well as your ability to repay the loan amount you’re considering.

Don’t just look at your current expenses; anticipate future costs as well. You might face other large outgoings in the near future, affecting your ability to repay or even causing you to borrow more.

If you decide that a pension loan is indeed your best course of action, then make sure you fit the criteria.

Many people overlook this step, but knowing the eligibility criteria inside out ensures that you’re not setting yourself up for a rejection.

It’s good to know your credit score too. A strong credit score generally improves your chances of loan approval.

One piece of advice often neglected is the term length and repayment amounts. Opt for the shortest loan term and highest repayments that you can comfortably manage.

This strategy will help you minimise your interest payments and clear your debt more quickly.

So, before you take out that pension loan, consider all these factors carefully.

Each decision point could significantly impact your financial well-being in your retirement years. Make each choice count.

Smart Moves and Mistakes to Avoid When Considering Pension Loans

Do:

- Stay on top of your bills, including your phone and store card payments, to maintain a strong credit score.

- Choose the shortest loan term and highest monthly payments that you can realistically manage to reduce the total cost of the loan.

- Verify your eligibility for the loan beforehand to avoid a declined application, which could negatively impact your credit history.

- Explore alternative borrowing options, such as credit cards, which might better suit your financial needs.

- Prepare for unexpected expenses that could disrupt your loan repayment plans.

Don’t:

- Take out a larger loan than what’s absolutely necessary.

- Overlook your day-to-day living costs when calculating how much you can afford in repayments.

- Simultaneously apply for multiple loans, as it could lead to financial strain and damage your credit rating.

- Provide false information, such as your age, as this can result in complications later on.

Remember, securing a loan against your pension is a significant decision that should not be taken lightly. Make sure to weigh all your options and fully understand the terms before proceeding.

The Bottom Line

If you’re retired and in need of additional funds, a loan could be a smart choice, especially with a solid credit history and favourable interest rates.

Always explore your options, verify you meet the eligibility criteria, and only borrow what you can comfortably repay.

To save you stress, time, and money, why not consult a loan broker? They can introduce you to the right lenders suited for pensioners.

If you’re aiming for a hassle-free loan experience, just reach out to us. We’ll pair you with a suitable broker for a no-cost, no-commitment conversation to guide you through the process.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

How quick is the loan process for retirees?

Filling out a loan application usually takes about 15 minutes or so, but the actual time can differ depending on the lender you choose.

After that, you could get the loan money in just a few hours or it might take up to 2 to 5 business days. It depends on the loan you’re getting.

What happens to my loan if I pass away?

If you die before your loan is paid off, the remaining balance needs to be settled. This money usually comes out of your estate, which includes any cash and assets you have.

If the loan is joint, the other person will still need to make payments and is responsible for the debt.

Is getting a loan risky when you're older?

Taking out a loan always comes with some risks, whether it’s secured or unsecured. If you miss payments, you’ll end up paying more because of added interest and penalties. This can also hurt your credit score, making it tougher to borrow money later on.

If you’ve put up your house as collateral for a secured loan, you could even lose it if you can’t make the payments. So, make sure you’re comfortable with what you’ll need to pay back before taking out a loan.

Is there a no-credit-check loan option for pensioners?

No, lenders will always check your credit history, but some may approve loans even for those with poor credit scores.

What can I do if my pension income doesn't meet the lender's minimum?

If your pension income falls short of a lender’s minimum requirement, you’ll need to look for other loan options that match your income level.

Are secured loans for retirees taxable?

No, secured loans are not considered taxable income. You’ll receive the full amount approved by the lender, and it won’t affect your tax return.