- What Is a 95% LTV Mortgage?

- Why Is Bad Credit a Concern for Mortgage Lenders?

- Can I Get a 95% Mortgage with Bad Credit in the UK?

- How To Qualify for a 95% Mortgage with Bad Credit?

- How Likely Can You Get 95% Mortgages with Bad Credit?

- Tips to Boost Your Shot at a 95% Mortgage Despite Bad Credit

- Other Ways to Buy a Home if a 95% Mortgage Isn’t an Option

- Key Takeaways

- The Bottom Line

Can You Get Mortgages with a 5% Deposit and Bad Credit?

Getting a mortgage in the UK might seem tough, especially if you’ve had financial issues before. If you’re buying your first home and worried about your credit score, there’s good news.

You might be able to get a 95% mortgage, which means you only need a small deposit.

This article will show you that even with bad credit, getting a mortgage and owning a home is possible.

With some good advice and planning, you can achieve your dream of home ownership.

What Is a 95% LTV Mortgage?

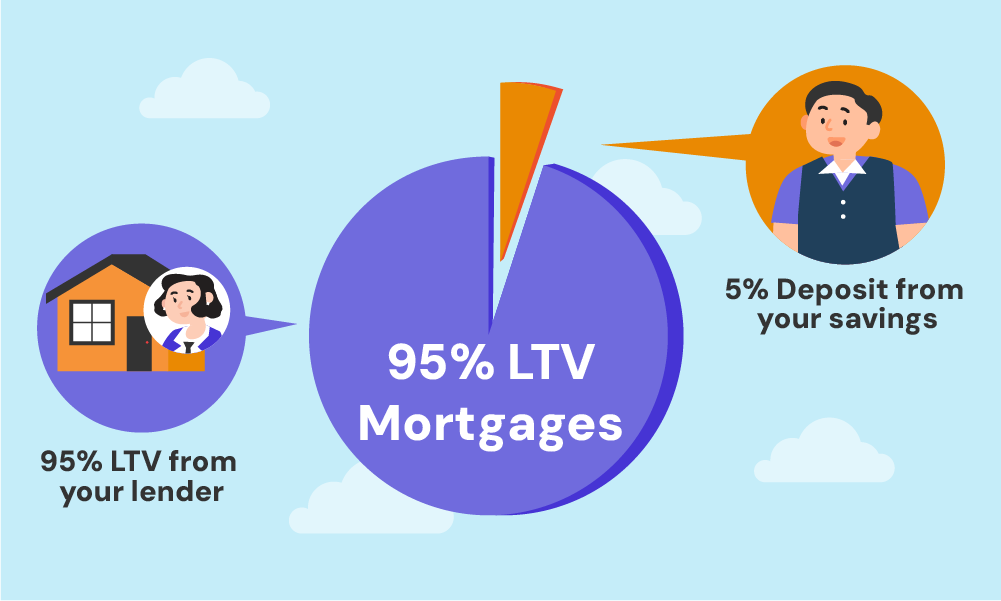

A 95% LTV (Loan to Value) mortgage is where the bank loans you 95% of the price of the house, and you only need to provide the remaining 5% as your deposit.

For example, if a house is priced at £100,000, a 95% LTV mortgage would mean the bank lends you £95,000, and you need to have £5,000 as your deposit.

The term “loan-to-value” (LTV) ratio is the percentage of the property’s value that the lender is willing to finance.

For a 95% mortgage, the LTV is high, meaning the loan amount covers almost the entire cost of the house.

This type of mortgage is great for first-time buyers who may not have saved a lot of money.

While it’s not impossible to get a 95% mortgage even with bad credit, securing approval can be tough.

Why Is Bad Credit a Concern for Mortgage Lenders?

Mortgage lenders look at your credit score to decide if they think you can pay back the loan.

Your credit score is like a report card for how you’ve handled money in the past. If your score is low, lenders might worry you won’t be able to keep up with mortgage payments.

This is why bad credit is a concern for them.

A low credit score can also mean you end up with a higher interest rate on your mortgage. Lenders do this to protect themselves, as lending money to someone with a history of financial troubles is riskier. They charge more interest to make up for this risk.

First-time buyers might have bad credit for many reasons. Sometimes it’s missed bill payments, using a lot of credit, or simply not having much of a credit history at all.

Can I Get a 95% Mortgage with Bad Credit in the UK?

Yes, it’s possible to get a 95% mortgage even if you have bad credit, but it can be a bit harder. The market for bad credit mortgages is smaller, but there are options out there. Your ability to get one of these mortgages depends on a few things:

- Type of your credit issue

- Severity and date of the issue

- Reason for poor credit

Many major banks have strict rules for lending to people with bad credit or small deposits. If they do offer you a mortgage, it might come with a higher interest rate to offset their risk.

But, you can improve your chances by looking into government-backed schemes or considering guarantor mortgages, which might offer more favourable rates.

Applying with specialist lenders could also be a smart move. These lenders cater specifically to those with bad credit, recognising that everyone’s financial journey is unique. They might be able to offer you a mortgage when traditional banks won’t.

Typically, these specialist lenders aren’t found through regular market searches or advertisements.

The best way to discover them is by working with a mortgage broker. A good broker can provide you with more choices and help you find a lender suited to your situation.

How To Qualify for a 95% Mortgage with Bad Credit?

If you’re keen to get onto the property ladder with a small deposit, then a 95% mortgage can be perfect for you.

Here’s how you must prepare:

Gather Your Documents

To guide you, here’s the list of the documents required you must collect before application:

- Proof of ID – A passport or driving licence to show who you are.

- Proof of Address – Recent utility bills or bank statements (usually within the last 3 months) to prove where you live.

- Proof of Income – 3-6 months of your payslips or P60s if you’re employed, or 2-3 years of SA302 or tax returns and business accounts if you’re self-employed, to show how much you earn.

- Bank Statements – To give the lender an idea of your spending habits and how you manage your money.

- Credit Report – Some lenders might ask for this, or you might want to show it to them to discuss any issues.

- Deposit Proof – Evidence of your savings for the deposit.

- Debt Information – Details of any other loans or credit cards you have.

While this list gives you all the usual documentation needed for a mortgage, it’s important to know that each lender is different.

The rules and requirements can differ, and the best way to know this is to ask directly your chosen lender or use a mortgage broker’s help with your paperwork.

Don’t Forget the Fees

It’s important to account for additional expenses that accompany buying a home. This includes:

- Arrangement Fee. This is a fee charged by lenders for setting up the mortgage. Amounts can range from £0 to over £2,000. Some lenders allow you to add this fee to your mortgage, but this means you’ll pay interest on it over the life of the mortgage.

- Valuation Fee. The fee for the lender’s survey of the property to ensure it’s worth the money you’re borrowing. Typically ranges from £150 to £1,500, depending on the property’s value.

- Solicitor’s Fees. You’ll need a solicitor or conveyancer to handle the legal aspects of buying a home. Generally between £850 and £1,500 plus VAT, depending on the complexity of the transaction.

- Stamp Duty. This is a tax paid on homes costing more than a certain amount. The rate varies depending on the property price, location, and if you’re a first-time buyer. Properties below £425,000 are exempt.

- Survey Costs. Besides the lender’s valuation, you might want a more detailed survey to check for structural problems. A homebuyer report can cost between £400 and £1,000, while a full structural survey may cost £500 to £1,500 or more, depending on the property size and type.

- Mortgage Broker Fees. If you use a broker to find a mortgage, they may charge a fee. Some charge a flat fee, around £500, while others might take a percentage of the loan amount (typically 0.3% to 1%).

- Insurance. Lenders often require you to have building insurance at the least, and you might also consider life insurance. Costs vary widely based on the property type, location, and amount of coverage. Buildings insurance might start around £100 per year, but it’s highly variable.

- Removal Costs. This covers the cost of moving your belongings from your old home to your new one. The amount can vary greatly depending on how much stuff you have, how far you’re moving, and whether you opt for a full-service removal company that packs for you or just a van hire.

Consult a Trustworthy Mortgage Broker

Find a broker who has experience with bad credit mortgages. They can guide you to lenders more likely to accept your application.

Furthermore, prepare to discuss your credit issues openly. A good broker will need to understand your situation to give the best advice.

To speak with the right broker, get in touch with us. We’ll set up a free, no-obligation call with a good mortgage broker to help you get a bad credit 95% mortgage.

How Likely Can You Get 95% Mortgages with Bad Credit?

The table below provides a general overview of how different bad credit factors might affect your chances when applying with a 5% deposit.

Keep in mind, these are estimates and the actual chances can improve with a larger deposit.

| Type of Credit Issue | Severity | Impact on Securing 95% Mortgages |

|---|---|---|

| No Credit History | Minor | Possible, with a potential need for additional evidence of financial responsibility |

| Low Credit Score | Minor | Generally possible, may require a higher interest rate |

| Missed Payments | Minor to Moderate | Possible, especially if isolated incidents |

| Overdraft Fees | Minor | Possible, considered less severe |

| Mortgage Late Payments | Major | Less likely, seen as a higher risk |

| Account Defaults | Major | Less likely, impacts perceived creditworthiness |

| County Court Judgments (CCJs) | Major | Less likely, significantly affects lender confidence |

| Debt Management Plans (DMPs) | Critical | Unlikely, suggests financial difficulties |

| Individual Voluntary Arrangements (IVAs) | Critical | Very unlikely, indicates serious credit issues |

| Bankruptcy | Extreme | Not likely without a substantial period of financial recovery |

| Multiple Credit Problems | Extreme | Not likely, reflects the high risk to lenders |

| Property Repossession | Extreme | Not likely, considered one of the most severe credit issues |

Tips to Boost Your Shot at a 95% Mortgage Despite Bad Credit

Here’s how you make yourself look attractive to lenders:

- Check Your Credit File. Start by getting your free credit report from Equifax, Experian, and TransUnion. Look for any mistakes or outdated information and report them. Wrong information can lower your score. A mortgage advisor can also help make sure your credit report looks its best for a mortgage application.

- Build Your Credit History. Use credit wisely to show you can manage it well. If you don’t have much credit history, start building it by using a credit card for small purchases and paying it off each month.

- Make Regular Payments On Time. Pay all your bills and debts on time every month. This shows lenders you’re reliable and can manage your money.

- Keep Credit Utilisation Low. Try to use less than 30% of your available credit. This means if you have a credit card limit of £1,000, try not to use more than £300 of it.

- Register to Vote – Being on the electoral roll at your current address helps prove who you are and where you live, making you look more stable to lenders.

- Limit Credit Applications. Only apply for credit when you need it. Applying for lots of credit in a short time can make you look desperate for money.

- Use an Eligibility Checker. Before you apply for new credit, use online tools to see if you’re likely to be approved. This helps avoid unnecessary hard checks on your credit file.

- Put Utility Bills in Your Name – Paying for things like your phone or electricity on time can improve your credit score because it shows you’re good at paying bills.

- Avoid Payday Loans. These can make lenders think you’re struggling with money. Instead, look into options like credit-builder loans or cards that help improve your score.

- Cut Old Financial Ties. If you have old joint accounts with someone who has bad credit, this can affect your score. Make sure you remove these ties from your credit report.

- Save for a Bigger Deposit. The more money you can put down as a deposit, the less risky you are to lenders. Even though 95% of mortgages are for small deposits, saving a bit more can make a big difference.

- Get a Mortgage in Principle. This is a lender saying they might lend to you, based on some quick checks. It’s not a guarantee, but it shows sellers you’re serious and can move quickly when you find the right home.

Other Ways to Buy a Home if a 95% Mortgage Isn’t an Option

If getting a 95% mortgage feels out of reach due to your credit history, there are several other routes to home ownership worth considering:

A family member or friend promises to cover your mortgage payments if you’re unable to.

- Pros: Increases your chances of mortgage approval.

- Cons: Puts financial pressure on the guarantor, risking their finances.

This scheme allows you to buy a portion of your home, and pay rent on the remainder, with the option to buy more over time.

- Pros: Smaller deposits and mortgages are needed for the share you buy.

- Cons: You don’t own the entire property initially, and there are selling limits.

Programs like the Mortgage Guarantee Scheme offer support for those with small deposits, making 95% of mortgages more accessible by guaranteeing a part of the loan.

- Pros: Helps first-time buyers enter the market with a small deposit.

- Cons: You must meet certain criteria to qualify.

Joint Buyer Sole Proprietor (JBSP) Mortgages

This lets you buy a home together with someone else, like a parent, who helps with the deposit but doesn’t live in the property.

- Pros: Leverage their credit and equity to secure a mortgage.

- Cons: The responsibility of the mortgage falls solely on you, which can be a significant financial commitment.

This is a cash gift given by family members or close friends to help you buy a property. These contributions are meant to be gifts, not loans, and cannot be expected to be repaid.

- Pros: Increases your deposit size, potentially improving loan terms.

- Cons: The donor must confirm the gift is non-repayable, ensuring lenders accept it as part of your deposit.

Key Takeaways

- 95% LTV mortgages allow you to buy a home with just a 5% deposit, but they can be harder to get if you have bad credit.

- Lenders check your credit score to assess risk. Bad credit might mean higher interest rates or difficulty getting approved.

- To qualify, you’ll need documents like ID, proof of income, bank statements, and deposit evidence, as well as funds for extra fees like stamp duty and surveys.

- Improving your credit score by paying bills on time, using less credit, and avoiding payday loans can boost your chances.

- If a 95% mortgage isn’t an option, consider alternatives like guarantor mortgages, shared ownership, or government schemes.

The Bottom Line

95% LTV mortgages are designed to help people with smaller deposits. However, having bad credit can make securing one more challenging, but not impossible.

The key is to get the right advice.

Reaching out to a reliable mortgage broker could be a game-changer. A good broker will guide you through your options, boost your approval odds, and make sense of complicated mortgage terms for you.

Their expertise ensures you get the best possible deal. As they take care of the nitty-gritty, you’re FREE to focus on your priorities.

If you’re looking to save stress and time to find the right broker, reach out to us. We’ll connect you with a specialist bad credit mortgage broker who can help you get the best deal.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What can I do if I have no deposit?

If you’re unable to put down a deposit and have a history of bad credit, your options might seem slim. But, if your family can support you by ‘gifting’ a deposit, this can significantly help your situation, almost as if you had saved a 5% deposit yourself.

Without any deposit, it’s wise to focus on saving money and improving your credit score. This approach will gradually open up more mortgage options for you.

Can I secure a mortgage with a 5% deposit after bankruptcy?

Yes, but there’s a catch: your bankruptcy needs to have been discharged for at least three years. Only then will you start to find lenders who might consider your mortgage application.

Is it better to save for a bigger deposit or pay off my debts?

Both paying off debts and saving for a larger deposit can be beneficial when looking to get a mortgage. Clearing debts can improve your debt-to-income ratio, potentially allowing you to borrow more.

Meanwhile, a larger deposit could make you eligible for better mortgage deals by improving your loan-to-value ratio.

A mortgage broker can give you tailored advice on which route could open up more lender options and better rates for you.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.