- What Are 95% LTV Mortgages?

- How Do 95% LTV Mortgages Differ From Other Mortgage Products?

- How Much Can You Borrow with a 5% Deposit?

- Types of 95% LTV Mortgages

- Who Can Access 95% LTV Mortgages?

- What Are the Pros and Cons of 95% LTV Mortgages?

- How To Secure a 95% LTV Mortgage?

- How Does the Government’s 95% Mortgage Guarantee Scheme Work?

- Which Lenders Are Offering 95% LTV Mortgages?

- Things To Consider Before Getting a 95% Mortgage

- Key Takeaways

- The Bottom Line

Everything You Need To Know About 95% LTV Mortgages

Struggling to save up for a BIG deposit?

With SKY-HIGH rent, CRUSHING living costs, and your paycheck staying the SAME– saving money to buy your first home can be TOUGH. 😓

Despite this, you want to get onto the property ladder. 🏡

If so, a 95% LTV mortgage might be right for you. Learn how this mortgage can help fulfil your ULTIMATE dream of owning your first home in the UK.

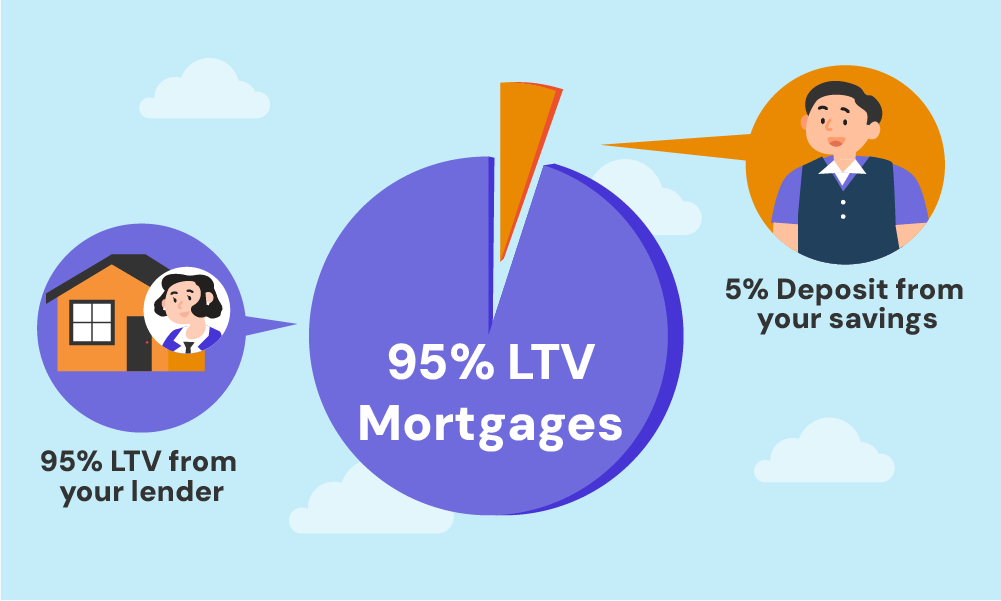

What Are 95% LTV Mortgages?

A 95% LTV mortgage is a type of loan that lets you borrow 95% of the property’s price from a lender, meaning you only need to come up with a 5% deposit from your pocket.

The term “LTV” stands for Loan-to-Value ratio, which is a way of expressing the size of your loan as a percentage of the home’s total value.

So, if you’re eyeing a house that’s priced at £200,000 and you go for a 95% LTV mortgage, you’ll need to have £10,000 saved up for the deposit.

The lender covers the remaining £190,000.

This setup is especially helpful if saving a BIG deposit is tough for you, making it simpler and quicker to GET onto the property ladder.

To know your mortgage options better, you can check your LTV ratio, using our calculator here.

How Do 95% LTV Mortgages Differ From Other Mortgage Products?

Compared to other mortgages with lower LTVs (like 75%), 95% LTV mortgages require a smaller deposit but usually come with higher interest rates.

This means your monthly payments might be HIGHER, and you might also need to pay for mortgage insurance or additional fees to cover the lender’s risk.

However, they make buying a home more accessible if saving for a big deposit is challenging.

How Much Can You Borrow with a 5% Deposit?

Lenders use a combination of factors to decide on the amount you’re eligible to borrow.

Let’s use the example we’ve set earlier.

Suppose you’ve set your sights on a home worth £200,000 and you have a 5% deposit, which amounts to £10,000.

With a 95% loan-to-value (LTV) ratio, you’re looking to borrow £190,000.

Lenders usually offer loans ranging from 4 to 4.5 times your annual income.

If you earn £50,000 a year, theoretically, you could borrow between £200,000 to £225,000.

But, the exact amount can still vary as lenders will also consider factors such as your outgoings, credit score, and the stability of your income.

Use our mortgage affordability calculator to know how much you can borrow based on your income.

Types of 95% LTV Mortgages

There are two primary types of mortgages: Fixed-Rate Mortgages and Variable-Rate Mortgages.

Fixed-Rate Mortgage – This type locks in your interest rate for a set period, usually between 2 to 5 years.

The main advantage is the certainty it provides. Also, your monthly payments remain the same, making budgeting easier.

However, the downside is that if the Bank of England base rate falls, you’ll miss out on potential savings.

Variable-Rate Mortgage – Unlike fixed-rate, the interest rate on a variable-rate mortgage can change, usually in line with the Bank of England base rate.

This means your monthly payments could go up or down.

The benefit here is the potential to save money if rates fall, but the risk is higher monthly payments if rates rise.

Pro Tip: Choose the type that aligns with your financial situation and risk appetite. A fixed-rate mortgage for stable payments, or a variable-rate if you’re comfortable with interest rate changes, and potential savings

Who Can Access 95% LTV Mortgages?

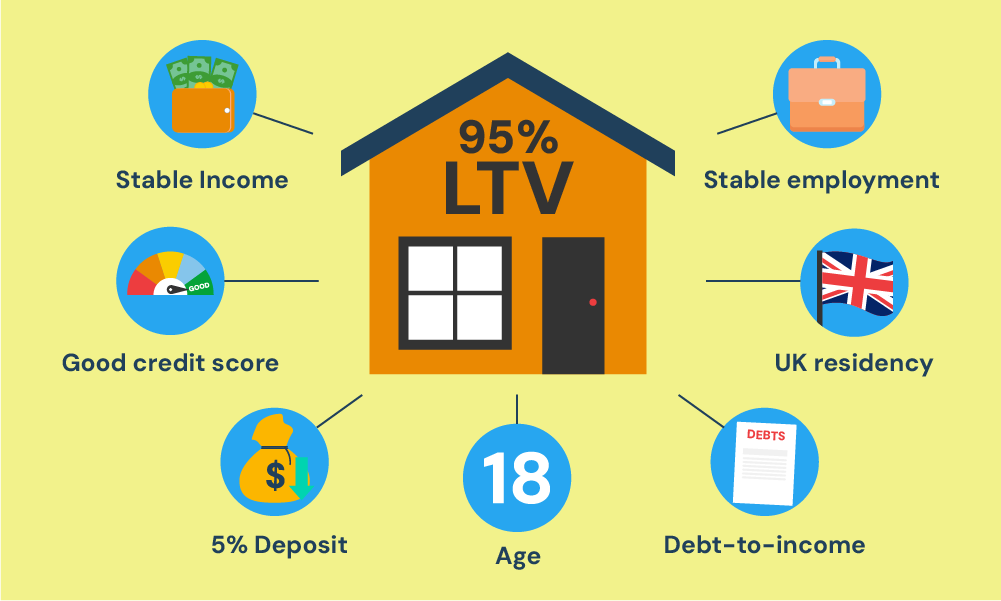

To qualify for a 95% LTV mortgage, you’ll need to tick off a few key boxes. Here’s what you generally need:

- A Stable Income – It’s important to show that you’ve got a regular flow of money coming in. This tells lenders you can keep up with monthly payments.

- Good Credit Score – Your credit score is like a financial report card. The higher it is, the more trustworthy you appear to lenders.

- 5% Deposit – You need at least 5% of the property’s value saved up as a deposit. This is your part of the bargain in buying a home.

- Stable Employment – Lenders love consistency. A steady job indicates that you’re less of a risk and can manage long-term commitments.

- UK Residency – Living in the UK usually is a must.

- Age – There’s often a minimum age, usually 21 or above, but don’t forget the upper age limit. Some lenders have rules on how old you can be when the mortgage ends.

- Debt-to-Income Ratio (DTI) – This helps lenders see if you have enough income left over each month after paying your debts. A lower DTI means you’re not stretched too thin financially. It suggests that you can comfortably take on a mortgage payment. You can use our DTI calculator to check yours.

Different lenders have their own set of rules, and they might focus on different parts of your financial life.

Some might be happy to accept a lower credit score if you have a larger deposit. Others could be strict about your income source.

What Are the Pros and Cons of 95% LTV Mortgages?

To help you make a smart decision on your way to the property ladder, you must know the pros and cons of a 95% mortgage. Let’s break it down.

Pros

- Get on the Property Ladder Sooner. You don’t need to save a huge deposit to buy a home. With just 5% down, you can start owning rather than renting.

- Accessibility to Homeownership. These mortgages open the door to buying a home for those who might otherwise struggle to save a 10-20% deposit.

- Benefit from Property Value Increase. If your home’s value goes up, your equity (the part of your home you outright own) increases too, which is great for your financial health.

Cons

- Higher Interest Rates. Because you’re borrowing more, lenders often charge higher interest rates on these mortgages, leading to higher monthly payments.

- Risk of Negative Equity. If house prices fall, you could owe more on your mortgage than your home is worth. This makes it tricky if you need to sell or remortgage.

- Impact of Market Fluctuations. Your home’s value can go up or down. If the market dips, you’re more exposed with a smaller deposit, potentially affecting your financial stability.

How To Secure a 95% LTV Mortgage?

Should you decide a 95% mortgage is right for you, here are the next steps you must take to apply:

1. Organise Your Finances

First up, getting your financial ducks in a row is crucial. To find out where your current finances stand, get a FREE financial health check here.

Additionally, when sorting out your finances, you need to:

- Check your credit score. Download your credit reports for FREE from these credit agencies – Experian, Equifax, and TransUnion. A solid credit score boosts your appeal to lenders.

- Save for a deposit. You should have at least 5% of your future home’s purchase price to avail of a 95% mortgage.

- Budget for extra costs. Set aside funds for additional expenses like survey fees, conveyancing, and stamp duty.

- Gather important documents. Lenders will need to see:

- Proof of ID such as a valid passport or driving licence.

- Proof of address such as utility bills or credit card bills from the last three months for address proof.

- Last three months’ savings account statements to show your deposit.

- Three months’ payslips for income proof if employed.

- Three months’ current account bank statements to show income and spending.

- Evidence of bonuses or commission, if part of your income (lender policies may vary).

- For self-employed, two to three years’ accounts or tax returns.

- Statements for any other loans or credit card debts to show existing financial commitments.

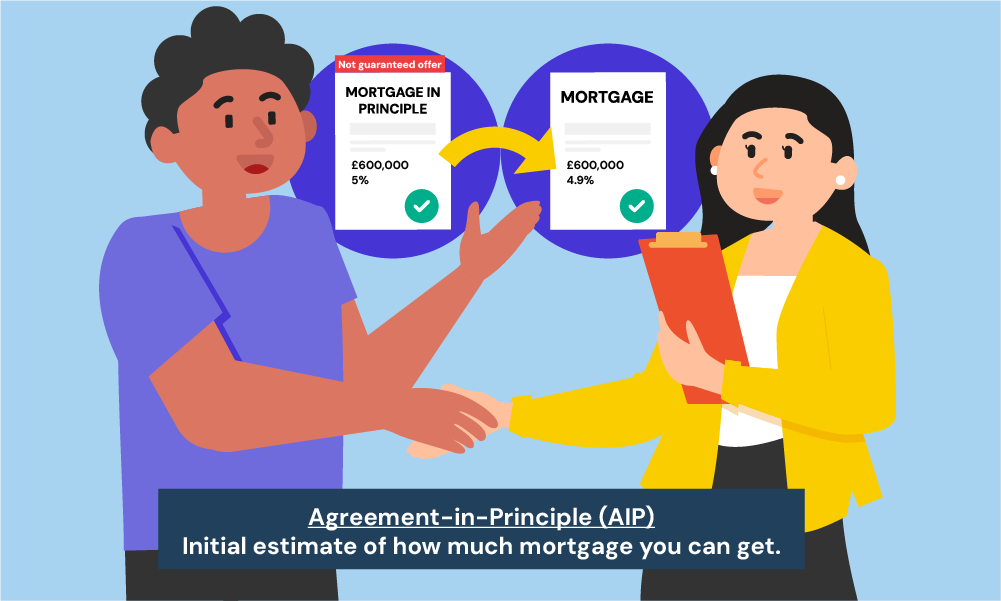

2. Get an Agreement in Principle

Before you start house hunting, it’s a good idea to get an agreement in principle (AIP) from a lender.

While it’s NOT mandatory, getting an AIP is a smart move.

An agreement in principle (AIP) from a lender can give you a ballpark figure of how much you might be able to borrow. This document also shows to sellers you’re a serious buyer.

Be cautious, as some lenders do a hard credit check for an AIP, which could impact your credit score.

3. Find Your Home

Now, the exciting part – looking for your new home. Take your time to find a place that ticks all your boxes and fits within your budget.

Once you’ve found your ideal home, make your offer through the estate agent. Your AIP can help make your offer more appealing to the seller.

4. Apply for a Mortgage

Once your offer is accepted, go back to your lender to formally apply for a 95% LTV mortgage. You’ll need to provide detailed information about your income, outgoings, and the property.

Your lender will require a survey to assess the property’s value and condition, ensuring it’s a safe bet for them to lend against.

5. Finalise the Offer

If your application is successful, you’ll receive a formal mortgage offer. This is the time to double-check all the details and make sure you’re happy to proceed.

6. Complete the Process with a Solicitor

You’ll need a solicitor or conveyancer to handle the legal side of buying a home. They’ll take care of things like transferring the property into your name and paying any stamp duty.

7. Move In

Once the legalities are sorted and the funds have been transferred, you’ll get the keys to YOUR new place.

Congratulations, you’re now a homeowner!

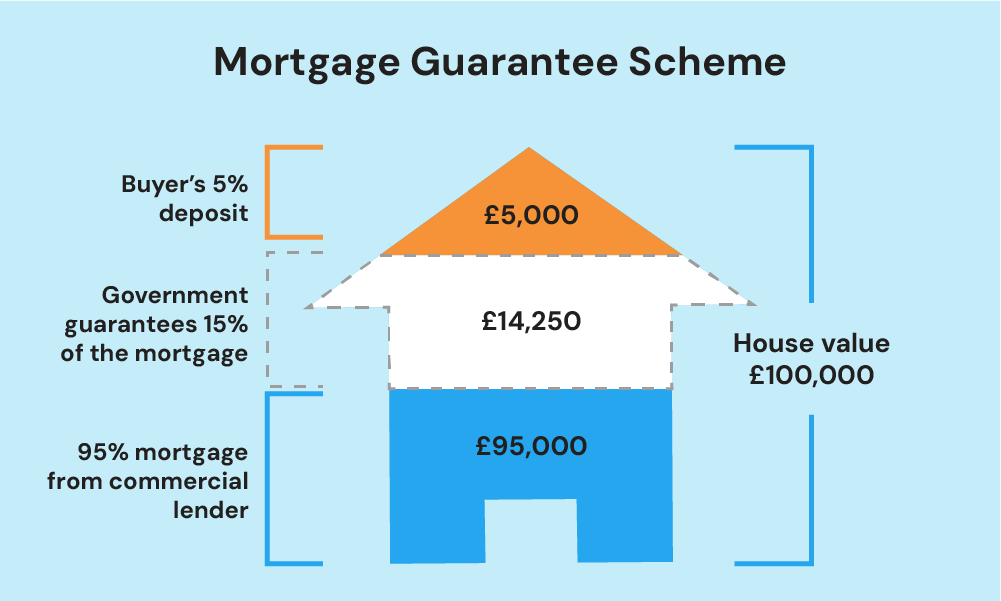

How Does the Government’s 95% Mortgage Guarantee Scheme Work?

Similar to a 95% LTV Mortgage, the Mortgage Guarantee Scheme is a big help for anyone wanting to buy their OWN home but worried about the high initial costs.

Normally, getting a good mortgage means you need to put down a big deposit—between 10% and 20%.

This scheme changes the game by helping people with smaller savings.

It started on 19th April 2021 and has been so successful that it’s now extended until 30th June 2025.

In simple terms, this scheme lets you BUY a home with just a 5% to 9% deposit. The lender gives you a mortgage for up to 95% of your home’s price.

And here’s where it gets even BETTER—the government backs part of your loan. This guarantee makes lenders MORE likely to approve your mortgage.

For example, you eyeing for a property worth £100,000. With this scheme, you save £5,000 for your deposit.

The lender loans you the other £95,000. The government then guarantees 15% of what you borrowed, which is £14,250.

This means the lender’s risk drops to £80,750, making them more comfortable lending to you.

The best part is, you don’t have to do anything extra. Your lender sorts everything out, even though they pay a fee for this guarantee.

This might make your loan a bit more expensive, possibly through higher interest rates or fees. But, it’s worth it to make your dream of owning a home come true sooner.

Which Lenders Are Offering 95% LTV Mortgages?

Here is a list of lenders in the UK that offer 95% LTV mortgages:

- HSBC UK

- Barclays

- Nationwide Building Society

- NatWest

- Santander UK

- Lloyds Bank

- Halifax

- Yorkshire Building Society (YBS)

Note that this is not an exhaustive list. Other lenders offer 95% mortgage deals in the UK.

Speaking with a trustworthy mortgage advisor can help you see more options and find lenders who are happy to lend you even with a 5% deposit.

Things To Consider Before Getting a 95% Mortgage

Before you jump in, take a moment to consider your overall budget. It’s important to look beyond the initial deposit and monthly payments. Here’s what else you should consider:

- Product fees – These are what your lender charges for the mortgage deal you choose.

- Legal fees – The cost of a solicitor or conveyancer to take care of the legal bits of buying your home.

- Valuation and survey fees – Fees for checking how much the property is worth and its condition.

- Stamp duty – This is a tax you pay when buying a house, which varies based on the purchase price and if you’re buying for the first time.

- Removal costs – The price of moving your stuff to your new place.

Think about the future too. Your financial situation and the property market might change. Can you remortgage later for a better deal?

Being prepared for different outcomes will help keep your finances solid. Planning your budget, cutting back on non-essential spending, and thinking ahead are important for enjoying your new home without too much financial stress.

Knowing all the costs involved with a 95% LTV mortgage will help you make a smart choice that fits your long-term plans and keeps you financially secure.

Key Takeaways

- A 95% mortgage means you only need a 5% deposit, making it easier to get on the property ladder. But, lower deposits often come with higher interest rates and bigger monthly payments.

- Fixed-rate mortgages offer stability with consistent monthly payments, while variable-rate mortgages can be more flexible but come with interest rate risk.

- As a general rule of thumb, you can borrow around 4-4.5 times your annual income. But lenders will also consider your expenses, credit score, and job stability.

- To qualify for a 95% mortgage, you’ll need a steady income, a good credit score, a minimum 5% deposit, and manageable debt levels.

- The Mortgage Guarantee Scheme can make it easier to get a 95% mortgage, but it’s only available until 30 June 2025.

- Don’t forget about the extra costs like legal fees, surveys, and stamp duty when buying a home.

The Bottom Line

Now you’ve got the basics of 95% mortgages sorted, it’s time to figure out if one’s right for you.

Maybe you’re asking yourself, “Can I afford this? Is it a good idea for me? And where do I even begin?” Don’t stress—you’re not the only one with these questions!

The first step is to check your finances and think about your goals. It might feel like a lot, but it doesn’t have to be complicated.

A good mortgage broker can make things much easier for you.

They’ll explain your options in simple terms, connect you with the right lenders, and take care of the complex mortgage process.

You’ll get expert advice while saving time, stress, and money. That way, you can focus on the exciting part—planning your new home. 🎉

If that sounds like what you need, we’ve got you covered.

Get in touch, and we’ll introduce you to a trusted broker who knows how to find great deals and make the process simple for you.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Can I remortgage to a lower LTV mortgage in the future?

Absolutely. As you pay down your mortgage and if your home’s value increases, your LTV ratio will improve.

This could open the door to remortgaging to a deal with a lower interest rate and potentially lower monthly payments. It’s a smart move to regularly review your mortgage situation to see if you can make a change for the better.

What happens if I face financial difficulties after getting a 95% LTV mortgage?

First, take a deep breath. It’s important to communicate with your lender as soon as possible.

Many lenders have measures in place to help borrowers who hit a rough patch, such as modifying your payment plan or temporarily reducing your payment amount.

Remember, it’s in everyone’s best interest to keep you in your home and pay your mortgage.

Should I increase my deposit by more than 5%?

Yes, increasing your deposit by more than 5% can be a good move. Every extra 5% you put down can help.

Why? Because bigger deposits unlock access to cheaper mortgage deals.

Lenders see you as less of a risk when you put more money upfront, so they often offer lower interest rates.

This means your monthly mortgage payments could be lower, saving you money in the long run. Plus, with a bigger deposit, you might find it easier to get approved for a mortgage.

So, if you can, adding a bit more to your deposit could give you a better start on your home-buying journey.

Can my parents get me a mortgage?

No, your parents cannot directly obtain a mortgage for you. Mortgages are issued to individuals who will be responsible for the loan repayment. However, your parents can help you in several ways:

- Be a guarantor. They can act as guarantors on your mortgage, meaning they financially back you up if you default on payments. This can improve your chances of getting approved and potentially secure a better interest rate.

- Gift you money. They can ‘gift’ you a deposit, which would reduce the loan amount you need. This can potentially make you eligible for a mortgage with a smaller deposit.

- Co-borrow. They could co-borrow with you, becoming joint owners of the property and responsible for the mortgage together. This option requires careful consideration and legal advice due to shared ownership and potential future complications.

Can I offer a lower than 5% deposit for a mortgage?

Offering less than a 5% deposit is tough as lenders usually want at least 5% due to their risk rules.

But, if your parents support you, either by boosting your deposit or acting as guarantors, you might get better mortgage choices. Finding a mortgage with less than 5% deposit is rare without extra help.

This article has been fact checked

This article was created, checked, and verified by the expert team at Money Saving Guru. Trust us, you’re in good hands.