- What Does a £6 Million+ Mortgage Mean in the UK?

- What Are the Key Criteria for Qualifying at £6 Million+?

- Where Can You Get £6 Million+ Mortgage Lenders?

- How Much Deposit Is Required?

- How Much Income Should I Have?

- How Do You Apply for a £6 Million Mortgage?

- What Could Your Repayment Costs Be on £6 Million?

- What Are Interest Rates & Fees on £6 Million Mortgages?

- Why Is It Hard to Secure a £6 Million or More Mortgage?

- The Bottom Line

Can You Get a £6 Million Mortgage or More in the UK?

Dreaming of owning a jaw-dropping luxury home? Let’s talk about big money.

Most homes in the UK cost under a million pounds, but luxury properties are in a league of their own—we’re talking mansions and one-of-a-kind homes with price tags in the millions.

If you’re aiming for a house like this, you’ll likely need a massive mortgage, around £6 million or more.

Getting a loan that big isn’t easy. It takes serious cash and the right lender who specialises in high-value properties.

This guide will help you understand the process, the hurdles, and how to secure that dream mortgage for your dream home.

What Does a £6 Million+ Mortgage Mean in the UK?

Any loan over £500,000 is already considered a “large mortgage.” But when you’re talking about £6 million or more, you’re in the realm of ultra-luxury homes.

These mortgages are for people who want to buy the most expensive and exclusive properties in the UK.

Not many lenders offer loans this big.

Usually, you’ll need to go to private banks or lenders who specialise in high-value properties. These lenders know the risks and have the expertise to handle these huge deals.

Because so much money is at stake, you’ll face stricter checks, bigger deposits, higher interest rates, and fewer lenders to choose from.

To get approved, your application needs to be top-notch.

What Are the Key Criteria for Qualifying at £6 Million+?

Getting a mortgage this big isn’t easy. Lenders want to see proof that you’re wealthy and financially stable. Here’s what they’ll look at:

- Your Money. You’ll need to show you have a lot of accessible cash or assets that can be easily turned into cash. Things like houses or art collections don’t count as much because they’re harder to sell.

- Your Income. Lenders want to see that you’ve had a steady income of at least £1 million a year for several years. This could come from businesses, investments, or trust funds.

- Your Credit. Your credit history needs to be spotless. Even one missed payment could hurt your chances.

- Your Other Debts. Lenders will check how much debt you already have. They’ll want to see that your other loans won’t make it hard to pay back this mortgage. To check where you currently stand, use our debt-to-income ratio calculator.

- Your Job. Having a steady job or reliable income source is a big plus. Lenders want to know your income isn’t going to disappear anytime soon.

- The Property. The type and value of the home you’re buying matters too. Lenders want to make sure the property is worth the investment.

- Your Deposit. You’ll usually need to put down a deposit of 35% to 50% of the property’s price. This shows lenders you’re serious and lowers their risk.

Where Can You Get £6 Million+ Mortgage Lenders?

Regular banks won’t cut it if you’re after a massive mortgage over £6 million. Instead, you’ll need private lenders who cater to wealthy buyers.

These lenders are more open-minded about complicated income streams and care most about whether you can pay back the loan.

To crack this exclusive market, a broker who knows their stuff about high-value mortgages is a must. They’ve got the connections and can land you deals you’d struggle to find on your own.

Specialist lenders adjust their rules based on your unique finances, which means there’s often room to negotiate.

How Much Deposit Is Required?

For a huge mortgage like £6 million or more, lenders usually ask for a deposit of 35% to 50% of the property’s price.

That’s a lot higher than what’s needed for smaller loans, but there’s a good reason for it.

Let’s do the maths.

If the property costs £6 million, you’re looking at putting down between £1.8 million and £2.4 million. This big deposit gives lenders some extra security and can even help you get a lower interest rate.

Why so much? Big loans come with big risks for lenders. A larger deposit means they’re taking on less risk, so it’s their way of staying safe.

Sometimes, if you’ve got an excellent financial history or a great relationship with the lender, you might be able to negotiate a smaller deposit.

But don’t count on it—it’s not common for loans this size.

Getting a mortgage this big is a massive decision. The deposit is just one piece of the puzzle, so take a close look at your finances before making the leap.

How Much Income Should I Have?

If you’re aiming for a £6 million mortgage, your income needs to be pretty hefty. Lenders use something called ‘income multiples‘ to figure out how much they’ll lend you.

Basically, they multiply your annual income by a set number to calculate the maximum loan amount.

For a mortgage this size, lenders often go up to 4 times your yearly income. So, to qualify for £6 million, you’d need to earn around £1.5 million a year.

Some lenders are a bit more generous.

If your finances are rock solid, they might stretch to 5 or even 6 times your income. This means you could qualify with an annual income of £1 million to £1.2 million.

The bottom line? To get a £6 million mortgage, you’ll need a top-notch income to match.

How Do You Apply for a £6 Million Mortgage?

Applying for a £6 million mortgage is a bit more involved than your standard home loan. Here’s how to tackle it step by step:

- Sort Out Your Finances. Start by reviewing your money situation. Check how much you earn, your savings, and any debts you have. Gather all the important paperwork, like payslips and bank statements.

- Boost Your Credit Score. A top-notch credit score is essential for a big mortgage. Get a copy of your credit report to make sure it’s accurate. If you have any debts, pay them off to improve your score.

- Factor in Extra Costs. Don’t forget about additional expenses, like stamp duty (a tax on property purchases) and legal fees. These can add up, so make sure they’re part of your budget.

- Find the Right Lender. You’ll need to choose between traditional banks and private lenders. Each has different offers, so pick one that works best for you.

- Submit Your Application. Once you’re ready, send in your application. The lender will review your financial details and evaluate the property you’re looking to buy. They’ll then decide whether to approve the loan and outline the terms.

What Could Your Repayment Costs Be on £6 Million?

High-value mortgages, like those starting at £6 million, often have special deals with customised terms. A typical example is a 5% fixed interest rate for 5 years.

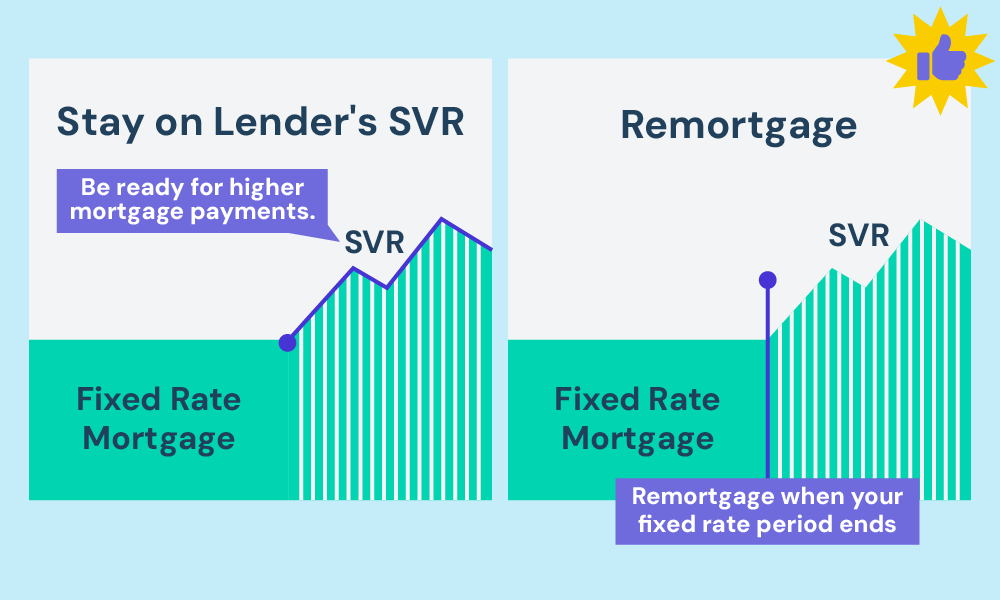

After that, the loan usually switches to the lender’s standard variable rate (SVR) or another agreed variable rate.

If the SVR is higher than the fixed rate, your monthly payments could go up.

Example Repayment Estimates at 5% Fixed Interest Over 5 Years

| Mortgage Amount | Monthly Payment | Total Paid in 5 Years |

|---|---|---|

| £6 million | £113,227 | £6,793,644 |

| £10 million | £188,712 | £11,322,740 |

| £30 million | £566,137 | £33,968,221 |

| £50 million | £943,562 | £56,613,701 |

After the fixed rate ends, you can remortgage, move to another fixed-rate deal, or stick with the lender’s variable rate.

This flexibility means you can adjust your mortgage to fit your finances as they change.

What Are Interest Rates & Fees on £6 Million Mortgages?

For £6 million mortgages, expect higher interest rates compared to standard mortgages. Usually, rates are at least one percentage point above the typical fixed and tracker rates.

With the Bank of England base rate around 5.25%, the exact rate will depend on your financial health and the mortgage type.

Aside from the interest, you need to consider the following fees:

- Arrangement Fees. The upfront fees to arrange a £6 million mortgage typically fall between 1% and 2% of the loan value. This means you might pay £60,000 to £120,000 in lender fees.

- Early Repayment Charges. If you decide to exit or refinance your mortgage in the initial period, expect significant charges, often ranging from 1% to 5% of the remaining balance.

- Solicitor and Valuation Fees. Budget for conveyancing and valuation or survey costs, usually varying from £500 to £1,150.

- Stamp Duty. For a £6 million property, stamp duty becomes a significant consideration in your budget.

- Insurance Requirements. Building insurance is crucial, with costs dependent on property specifics and coverage level. Consider life insurance linked to your mortgage.

- Broker Fees. Using a mortgage broker incurs additional costs, either as a fixed fee or a percentage of the loan.

Why Is It Hard to Secure a £6 Million or More Mortgage?

Getting a mortgage for a massive amount like £6 million isn’t a walk in the park. Here’s why it can be tricky:

- Finding the Right Lender. While applying for a big loan follows similar steps to a standard mortgage, the challenge lies in finding a lender. Big loans are seen as riskier, so fewer banks are willing to take them on.

- More Risk for Lenders. Large mortgages come with higher risks. Lenders worry about what might happen if the loan isn’t repaid, which is why many regular banks avoid offering such huge amounts.

- Specialist Lenders Needed. For loans this size, you often need to go to niche or private lenders who know how to handle these big transactions. They have the skills and experience to deal with the complexities of high-value loans.

Even though it’s tougher to get a £6 million mortgage, it’s not impossible. Knowing these hurdles means you can be better prepared to tackle them.

The Bottom Line

Mortgages over £6 million are among the most exclusive loans available, mainly aimed at wealthy individuals buying prestigious UK properties.

If you qualify, these mortgages can help you purchase luxury homes that might otherwise be out of reach. But be ready for strict requirements that reflect the loan’s high value.

Working with a mortgage broker is a smart move. They can guide you through the tricky process, help with approvals, and find tailored solutions to suit your needs.

Ready to start? Contact us today for a free, no-pressure consultation with a mortgage expert who can help make your dream home a reality.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What paperwork do I need for a £6 Million Mortgage?

When you’re going for a big mortgage like a £6 million one, you need to get all your paperwork sorted. Here’s what you should gather:

- Photo ID (passport, driver’s licence)

- Proof of address (recent utility bill, council tax statement, etc.)

- Bank statements from all current accounts over the past 12+ months

- Documentation of all assets like investment & retirement accounts

- Multiple years of personal and business tax returns

- Information on properties owned and corresponding mortgages

- Records detailing other loans, credit cards, expenses, income sources

Getting all these documents ready shows the lender how much you’re worth, where your money comes from, and that you can handle the repayments. Make sure you tick off everything the lender asks for to keep things moving smoothly.