- How Do Mortgages Work in Northern Ireland?

- What Makes Northern Ireland’s Mortgage Market Unique?

- Who Can Get a Mortgage in Northern Ireland?

- What Types of Mortgages Are Available in Northern Ireland?

- How Much Can You Borrow in Northern Ireland?

- How Do You Apply for a Mortgage in Northern Ireland?

- Are There Schemes for First-Time Buyers in Northern Ireland?

- What Should You Consider When Choosing a Mortgage in Northern Ireland?

- The Bottom Line

How To Get Mortgages in Northern Ireland? A Guide

When you’re eyeing that dream home in Northern Ireland, getting your head around how mortgages work is crucial.

Sure, the fundamentals are much like the rest of the UK, but the Northern Irish market has its quirks. Local lenders, unique schemes, and specific postcode rules are just the tip of the iceberg.

This guide explains how mortgages work in Northern Ireland and shows you how to get one.

How Do Mortgages Work in Northern Ireland?

Mortgages in Northern Ireland are quite similar to those in the rest of the UK. You borrow funds from a lender to buy a home and repay them over 25 to 35 years.

Your home is the collateral, meaning if you miss payments, the lender can take it back.

Here’s the twist: fewer lenders operate in Northern Ireland. This means your choices might be a bit limited.

And yes, some lenders have postcode restrictions. But don’t fret.

Specialist brokers are out there. They know the Northern Irish market inside out and can help you snag the best deals.

So, while the process might seem daunting, you’ve got experts ready to guide you every step of the way.

What Makes Northern Ireland’s Mortgage Market Unique?

To be specific, here’s what makes Northern Ireland’s mortgage market distinctive:

- Limited lender options. As discussed, fewer mortgage providers operate in Northern Ireland compared to other parts of the UK. This can impact the variety of products available to you.

- Local lenders. Some building societies and banks specifically cater to the Northern Irish market, offering tailored products.

- Postcode restrictions. Some UK-wide lenders may have restrictions on which Northern Irish postcodes they’ll lend to.

- Property types. Northern Ireland has a higher proportion of newer builds and fewer period properties than some other UK regions, which can affect lending criteria.

Understanding these unique aspects can help you navigate the mortgage application process more effectively.

Who Can Get a Mortgage in Northern Ireland?

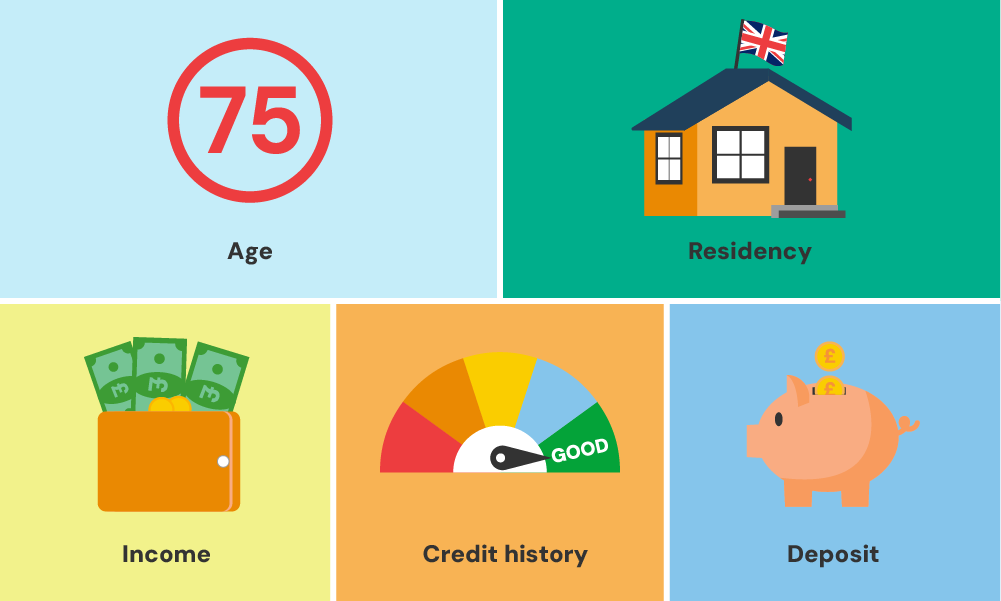

To be eligible for a mortgage in Northern Ireland, you generally need to meet the following criteria:

- Age – You must be at least 18 years old. Many lenders have upper age limits, often around 70-75 at the end of the mortgage term.

- Residency – You should be a UK resident with the right to live and work in the country.

- Income – You need a stable income to demonstrate you can afford the repayments. This could be from employment, self-employment, or other reliable sources.

- Credit history – A good credit score is beneficial, but some lenders specialise in helping those with poor credit.

- Deposit – Most lenders require at least a 5-10% deposit, though larger deposits often secure better rates.

Remember, meeting these basic criteria doesn’t guarantee mortgage approval. Each lender has its own specific requirements and will assess your application individually.

What Types of Mortgages Are Available in Northern Ireland?

Northern Ireland offers a variety of mortgage types to suit different needs:

- Fixed-rate mortgages – Your interest rate stays the same for a set period, usually 2-5 years.

- Variable-rate mortgages – The interest rate can change, usually in line with the Bank of England base rate.

- Tracker mortgages – The interest rate tracks a particular index, often the Bank of England base rate, plus a set percentage.

- Standard Variable Rate (SVR) mortgages – The lender’s default interest rate which can change at any time. Typically higher than other rates but with no early repayment charges.

- Discounted mortgages – This offers a discount on the lender’s standard variable rate for a set period.

- Flexible mortgages – Allow you to overpay, underpay, or even take payment holidays if needed.

- Interest-only mortgages – You only pay the interest each month, but need to repay the full loan amount at the end of the term.

- Buy-to-let mortgages – Specifically for properties you intend to rent out.

- First-time buyer mortgages – This often comes with special incentives or lower deposit requirements.

- Guarantor mortgages – Where a family member or friend guarantees the loan, making it easier for those with limited credit history to get a mortgage.

- Self-build mortgages – This is designed for those who want to build their own home. Funds are released in stages as the build progresses.

Each type has its pros and cons, so it’s worth researching thoroughly or seeking advice to find the best fit for your situation.

How Much Can You Borrow in Northern Ireland?

The amount you can borrow for a mortgage in Northern Ireland depends on several factors:

- Income multiple. Lenders typically offer 3-4.5 times your annual income, though some may go higher in certain circumstances.

- Affordability assessment. Lenders will look at your income versus outgoings to ensure you can afford the repayments.

- Deposit size. The more you can put down, the more you might be able to borrow.

- Credit score. A higher credit score could increase your borrowing potential.

- Property value. The amount you can borrow will be capped at a certain percentage of the property’s value (typically 90-95%).

To get a rough idea of how much you might be able to borrow, you can use an online mortgage calculator. However, for a more accurate figure, you’ll need to speak directly with lenders or a mortgage broker.

How Do You Apply for a Mortgage in Northern Ireland?

Applying for a mortgage in Northern Ireland involves several steps:

- Check your credit score – Ensure your credit report is accurate and take steps to improve it if necessary.

- Save for a deposit – Aim for at least 5-10% of the property value, more if possible.

- Gather necessary documents – This includes proof of identity, address, income, and outgoings.

- Get a mortgage in principle – This gives you an idea of how much you might be able to borrow.

- Find a property – Start house hunting within your budget.

- Make a full mortgage application – Once you’ve had an offer accepted on a property, submit your full application.

- Property valuation – The lender will arrange a survey of the property.

- Receive your mortgage offer – If approved, you’ll receive a formal offer detailing the terms of the mortgage.

- Complete the purchase – Your solicitor will handle the legal aspects of the purchase.

Throughout this process, it’s crucial to be honest and accurate with all information you provide. Any discrepancies could lead to your application being rejected.

Are There Schemes for First-Time Buyers in Northern Ireland?

Yes, there are several schemes designed to help first-time buyers in Northern Ireland:

- Co-Ownership – This scheme allows you to buy between 50% and 90% of a property and pay rent on the rest.

- Help to Buy: ISA – While the Help to Buy equity loan scheme isn’t available in Northern Ireland, you can still use a Help to Buy ISA if you opened one before November 30, 2019, to save for your deposit.

- Rent to Own – This scheme lets you rent a new-build home for up to three years with the option to buy it later.

- Mortgage Guarantee Scheme – This UK-wide scheme allows you to buy a home with a deposit as low as 5%, with the government providing a guarantee to the lender on a portion of the mortgage. It supports properties valued up to £600,000 and is available to both first-time buyers and existing homeowners. You can apply for this scheme until June 30, 2025.

These schemes can be particularly helpful if you’re struggling to save for a deposit or meet standard mortgage criteria.

What Should You Consider When Choosing a Mortgage in Northern Ireland?

When selecting a mortgage in Northern Ireland, keep these factors in mind:

- Interest rate – Compare rates from different lenders to find the best deal. Even a small difference can save you thousands over the life of the mortgage. Look at both introductory rates and the rate after any initial period ends.

- Fees – Look out for arrangement fees, valuation fees, and early repayment charges. These can add significantly to your costs. Some lenders may offer fee-free deals, but check if the interest rates are higher.

- Fixed vs. variable rates – Decide whether you want the security of fixed repayments or the potential benefits of a variable rate. Fixed rates offer stability, making it easier to budget, while variable rates might be lower initially but can fluctuate.

- Term length – A longer term means lower monthly payments but more interest overall. Consider what you can afford monthly. Shorter terms reduce total interest paid but require higher monthly payments. Find a balance that fits your financial situation.

- Overpayment options – Some mortgages allow you to pay extra, helping you clear your debt faster. Check if there are limits or penalties. Overpaying can significantly reduce the amount of interest you pay and shorten your mortgage term.

- Portability – If you might move house in the future, check if you can transfer your mortgage without incurring penalties. Portability allows you to take your current mortgage to a new property, avoiding early repayment charges.

- Insurance requirements – Some lenders may require you to take out specific insurance policies, like buildings or life insurance, as a condition of the mortgage. Ensure you factor in these costs and understand what coverage is mandatory versus optional.

- Lender reputation – Research lenders’ customer service and reliability. Reviews and ratings can provide insights into their service quality. A lender with good customer service can make the mortgage process smoother and more pleasant.

- Mortgage flexibility – Look for features like payment holidays, the ability to switch between repayment types, or options to extend the mortgage term if needed. Flexibility can give peace of mind and adaptability if your financial situation changes.

The Bottom Line

Mortgages in Northern Ireland are broadly similar to the rest of the UK, but there are some key differences to be aware of.

Local lenders and specific schemes can affect your options, so research is important whether you’re a first-time buyer or remortgaging.

A mortgage broker who specialises in the Northern Ireland market can be a big help. They can explain the different options and find the best deal for you, including exclusive offers not available to everyone.

Need a good broker? Get in touch with us. We’ll connect you with a qualified broker to guide you through your mortgage application in Northern Ireland.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

What are the interest rates for mortgages in Northern Ireland?

Interest rates for mortgages in Northern Ireland vary depending on the type of mortgage, the lender, and your financial circumstances. Typically, you’ll find rates ranging from about 2% to 5%.

To get the most accurate and competitive rate, it’s advisable to compare offers from multiple lenders or consult with a mortgage broker who understands the Northern Ireland market.

How much stamp duty do I pay in Northern Ireland?

In Northern Ireland, stamp duty rates follow the UK’s Stamp Duty Land Tax (SDLT) guidelines. As of now, the rates are:

| Property Band | SDLT Rates |

| Up to £250,000 | 0% |

| £250,001 to £925,000 | 5% |

| £925,001 to £1.5 million | 10% |

| Above £1.5 million | 12% |

First-time buyers can benefit from a reduced rate, paying no stamp duty on the first £425,000 of a property priced up to £625,000.

If you’re buying an additional property, a 3% surcharge applies on top of the standard rates.

Always check the latest government updates or consult with a professional to ensure you have the most current information.

Use this free stamp duty calculator to see how much you’ll need to pay.

Are there mortgages with no deposit in Northern Ireland?

Northern Ireland offers no-deposit mortgages, also called 100% mortgages. These let you buy a home without putting any money down upfront.

However, they often require a guarantor, typically a family member, to take responsibility for repayments if you can’t meet them.

While these mortgages can be helpful with a strong support network and stable income, they often come with higher interest rates and stricter borrowing requirements.

Before deciding, carefully consider the long-term financial impact and consult a mortgage advisor to find the best option for you.