- How Much Can I Borrow?

- How To Make the Most of Our Secured Loan Calculator?

- Secured Loans Costs Explained

- Fixed and Variable Rates in Secured Loans

- Digging Deeper: More About Secured Loans

- What is a Secured Loan?

- What Can You Use a Secured Loan For?

- What Can Serve as Collateral?

- Are You Eligible for a Secured Loan?

- Will You Get Approved?

- Affordability: Can You Pay it Back?

- What’s the Difference between Secured and Unsecured Loans?

- Why Secured Loans Are a Good Choice

- Types of Secured Loans You Can Get

- Can You Get a Secured Loan with Bad Credit?

- Think Before You Leap

Secured Loan Calculator – No Personal Details Required

If you’re sitting on a valuable asset like a home, why not put it to work for you? Secured loans can open doors to more funds, better repayment terms, and even loan approval when all other avenues fail.

But remember, there’s a flip side: you could lose your prized asset if you don’t keep up with payments. So, tread carefully and be in the know before you dive in.

The lending landscape is ever-changing, tailored to fit the needs of every individual borrower—just like you.

Intrigued? Go ahead and use our calculator to discover what your repayment options could look like.

How Much Can I Borrow?

Try out the calculator below to quickly find out your loan options. Just enter a few simple details.

You’ll get an instant estimate tailored to your financial needs.

It takes less than 30 seconds to do.

Keep in mind, this is just a starting point. For a more accurate picture, talk to a loan advisor.

To get started, simply send an enquiry. We’ll set up a free and no-obligation chat with the right loan broker who can give you the full picture of your loan options.

How To Make the Most of Our Secured Loan Calculator?

Our Secured Loan Calculator is incredibly user-friendly—no personal details are needed. Here’s how to get started:

- Input the loan amount you’re eyeing.

- Specify the term length for repayment.

- Add essential details about your financial situation, like property value and mortgage balance.

Once you’ve filled those in, the calculator instantly provides a comprehensive breakdown, showing your estimated monthly repayments, interest rates, and any initial set-up costs.

Feel free to run the numbers as many times as you’d like to find the loan amount and term that work best for you. If the calculator can’t generate a loan option based on your details, it’ll flag what might be the issue, allowing you to adjust and explore other solutions.

Points to Keep in Mind:

- Accuracy Matters. Your results are only as good as the information you put in. Make sure your details are accurate for the most reliable estimate.

- Lender Variations. While our calculator reflects general lender criteria, some lenders have unique requirements. For a more detailed understanding, speaking with an advisor could be beneficial.

- Just an Estimate. Remember, the numbers you get are only estimates, not a formal loan offer or financial advice. For precise calculations and options, it’s advisable to consult a financial advisor who specialises in secured loans.

Secured Loans Costs Explained

When you’re considering a secured loan, knowing the associated costs upfront can save you from unpleasant surprises later on. Let’s break down what you might expect:

Lender Fees

Sometimes referred to as ‘Product’, ‘Acceptance’, or ‘Administration‘ fees, these are charged by the lender to handle the logistics of setting up your loan.

These fees can vary greatly depending on the lender and loan product you choose, usually ranging from £495 to £1,995.

Broker Fees

Brokers typically charge a fee for arranging your loan, which is often a percentage of the loan amount. Be sure to check the terms carefully as the fee is added to your loan amount.

Valuation Fees

Many lenders nowadays rely on automated online property valuations, commonly known as AVM or desktop valuations, which are often free of charge.

However, if your property has undergone significant improvements, you might need a more detailed valuation by a professional surveyor. The costs for this are usually covered by the lender.

It’s essential to note that these are general costs you might encounter while taking out a secured loan. Always read your loan agreement carefully for a full breakdown of fees and charges.

Interested in knowing how these fees affect your monthly repayments? Use our secured loan calculator to get instant, detailed estimates that include all the costs.

Watch Out for Extra Costs

If you’re thinking of paying off the loan early, expect a penalty fee. Lenders charge this to make up for lost future interest. The fee varies depending on the lender, your loan type, and how long you’re locked into the fixed rate.

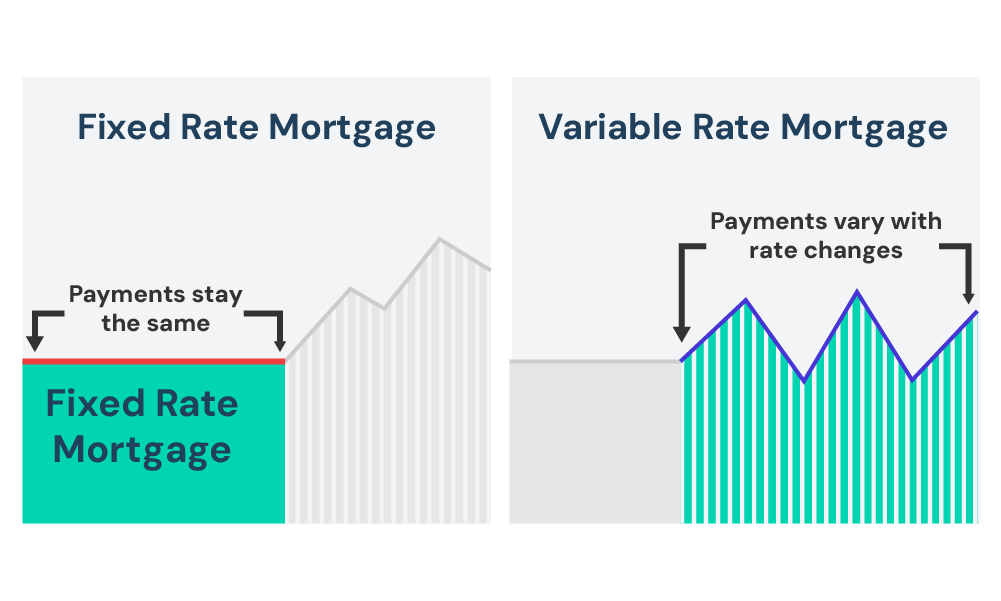

Fixed and Variable Rates in Secured Loans

In a secured loan, you’ll often start with a fixed-rate period lasting two to five years. After that, your rate switches to a variable one.

- Fixed Rates. Your monthly payments stay the same during this initial period. But remember, these rates will shift to a variable once the fixed term ends.

- Variable Rates. These rates can change at any time, usually following the Bank of England’s base rate. Your monthly payments may go up or down as a result.

Digging Deeper: More About Secured Loans

What is a Secured Loan?

A secured loan is like having a safety net for the lender. It’s “secured” because you use your home’s value to back up the loan. This makes the deal less risky for the lender, which means they might give you some benefits like:

- Loan Amounts – You can borrow from £5,000 up to £2.5 million.

- Flexible Terms – Repayment options can range from 3 to 35 years.

- Lower Interest – You get to enjoy some of the market’s lowest interest rates.

- High Loan-to-Value (LTV) – In some cases, you can borrow up to 125% of your home’s value.

What Can You Use a Secured Loan For?

If you’re wondering what you can do with all that money, you’ve got options:

- Fixing up your home or adding an extension.

- Getting money for a down payment on a second home.

- Paying off other debts.

- Injecting cash into your own business.

- School fees.

- Even buying a new car or paying a tax bill.

What Can Serve as Collateral?

Here’s what you can use as collateral for a secured loan:

- Houses

- Flats

- Bungalows

- Cottages

- Self-built homes

- Cars

- Boats

- Motorcycles

- Investment portfolios

- Stocks and bonds

- Valuable art or antiques

- Jewellery

- Farmland

- Livestock

Note: Commercial properties are generally not accepted as security for individual borrowers.

Are You Eligible for a Secured Loan?

Before you get too excited, let’s talk about eligibility. You should:

- Own a home (that you’re willing to use as collateral)

- Live in the UK or have the right to stay indefinitely

- Have some form of regular income

There are other things lenders look at, like:

- Your Age – You have to be at least 18 and not over 80 by the time the loan ends.

- Your Home’s Equity – You need enough value in your home to cover the loan.

- Your Credit Score – Don’t worry, even if it’s not perfect, you might still qualify.

- Your Other Expenses – Lenders want to know if you can make your payments on top of your other bills.

Will You Get Approved?

So, you’ve used a secured loan calculator and you like the numbers? Great! You’ve passed the first step. But remember:

- You must be a homeowner (even if you don’t have a mortgage)

- You have to be at least 18 years old

- If the home is jointly owned, both parties should be on board

- Your home’s value should cover both your existing mortgage and the new loan

An Example to Illustrate:

- Home Value: £400,000

- Current Mortgage: £250,000

You could potentially secure a second loan of up to £150,000 with good credit.

Affordability: Can You Pay it Back?

Your income will be under the spotlight here. It can be from a job, your own business, or even regular benefits.

- Employed – You should have been at your job for at least 3 months.

- Self-Employed – You’ll need to show you’ve been in business for at least a year.

What’s the Difference between Secured and Unsecured Loans?

When you need some cash, you’ve got two main choices: secured or unsecured loans.

Secured loans are tied to something you own, usually your house. This makes it easier to get the loan and might get you a better interest rate.

Unsecured loans, like credit cards or personal loans, don’t have any collateral behind them, making them riskier for the lender.

In short, secured loans are often cheaper but riskier for you, while unsecured loans are less risky for you but usually cost more.

Why Secured Loans Are a Good Choice

Secured loans offer some great benefits. Let’s dig in:

- More Money, Less Worry – You can usually borrow a lot more with a secured loan. This is excellent if you’ve got big expenses like home projects or school fees.

- Easy on Your Wallet – You can take more time to pay back the loan, meaning your monthly payments are more manageable. This is different from personal loans, which usually have to be paid back quickly.

- Easier Approval with Bad Credit – Even if your credit score isn’t perfect, a secured loan might still be an option because your property backs the loan, reducing the risk for the lender.

But wait, it’s not all smooth sailing. Here’s what to watch out for:

- Losing Your Stuff – If you can’t pay back the loan, the lender can take your property. Make sure you’re confident about keeping up with payments.

- More Interest Over Time – The longer you take to pay back the loan, the more interest you’ll end up paying.

- Extra Fees – If you want to pay back your loan early, watch out for early repayment fees, which can add up.

Types of Secured Loans You Can Get

Before you jump in, know your options:

- Homeowner Loans – Your home acts as a safety net but beware, if you can’t keep up with payments, you risk losing it.

- Logbook Loans – Your car is the collateral, and the lender will hold ownership until you’ve fully paid off the loan. Make sure to read the terms carefully.

- Mortgages – These are mainly for buying properties. You’ll need to pay a deposit upfront and cover the rest with the loan. Remember, missed payments could result in losing your home.

- Second-Charge Mortgages – These are useful for home improvements and work separately from your primary mortgage. They use your home’s equity as leverage, so be cautious.

- Bridging Loans – These are handy when you’re moving homes. They let you place a deposit on your new place while you’re waiting to sell your current one.

- Debt Consolidation Loans – These allow you to combine various debts into a single payment, often with a lower interest rate. It’s a good way to simplify your finances.

- Guarantor Loans – In this case, someone vouches for you, promising to cover the repayments if you can’t. Sometimes, they might even pledge their home as security.

By understanding the nuances of each type of secured loan, you’ll be better equipped to make an informed choice that suits your needs. Always remember to weigh the pros and cons and think about your long-term financial stability.

Can You Get a Secured Loan with Bad Credit?

Yes, you can. If you have bad credit, you can still obtain a secured loan due to the collateral involved, usually your home.

Lenders are more willing to accommodate borrowers with a poor credit history because the risk is offset by the secured asset.

However, expect higher interest rates compared to those with good credit. Also, limitations may apply to the maximum amount you can borrow.

The loan can be used to consolidate existing debts, which can potentially improve your credit score.

Common issues like County Court Judgments, loan arrears, active payday loans, or ongoing financial arrangements often don’t disqualify you. Even past bankruptcies are usually not a hindrance.

Think Before You Leap

Before you put pen to paper, there are vital things to think about:

Can You Really Afford It?

Look beyond your current finances. Imagine your life a few years ahead, perhaps with added responsibilities like a bigger family. Will you still manage the monthly payments comfortably?

Know Your Home’s Worth

The lender will assess the value of your home and your remaining mortgage. This equity will determine how much you can borrow. More equity often means you can request a larger loan.

Be Mindful of Changing Interest Rates

Interest rates for secured loans can fluctuate. Be sure to check the Annual Percentage Rate of Charge (APRC) to get a complete picture of the loan’s cost, which includes any fees and interest.

Other Influencing Factors

Your initial interest rate might not be set in stone. It could depend on your credit score and the loan amount you request.

So, ready to make your move or still mulling it over? Take time to consider all these aspects to ensure you’re making a well-informed decision.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

How long does it take to secure a loan?

Typically, it takes up to four weeks to get a secured loan approved and funded, although expedited cases can be completed within a week.

What does Loan-to-Value (LTV) mean?

LTV tells you how much you can borrow based on your property’s value. If you have a £100,000 property and the lender offers an 80% LTV, you can borrow up to £80,000. It’s a way for lenders to measure risk.

What is Home Equity?

Equity is the value of the home you actually own. It’s calculated by subtracting any outstanding mortgage or loans from the property’s market value.

How likely am I to be accepted?

Secured loans are generally easier to get approved for if you have a stable income and some equity in your property, even if you have past credit issues.

Can I use a secured loan to consolidate debt?

Yes, consolidating multiple debts into a single secured loan is common, which can simplify your monthly repayments.

What documents are required for secured loans?

Typically, this will include:

- Three months of bank statements

- Your latest mortgage statement

- Recent payslips or tax returns (if you’re self-employed)

- Current credit card balances

- Identification (passport, driver’s license)

- Proof of address (utility bill)

Note though that this is different for every lender. So, it’s best to check with your lender or broker before you start gathering your documents.

Can I repay early for secured loans?

Yes, but note that some lenders charge early repayment fees, especially during fixed or discounted rate periods.

Are secured loans accessible for self-employed individuals?

Yes, self-employed applicants are eligible, but they must provide income proof, like tax returns or trading accounts.