- What is a Bad Credit Bridging Loan?

- Can You Secure a Bridging Loan Despite Bad Credit?

- What Credit Issues are Generally Acceptable?

- Why Are Bridging Loan Lenders More Lenient with Bad Credit?

- Can You Skip the Credit Check for a Bridging Loan?

- What Will Lenders Check?

- How to Boost Your Approval Odds

- When is Bad Credit a Deal-Breaker?

- How Much Can You Borrow?

- What’s the Interest Rate?

- What About Other Costs?

- Will Bad Credit Ramp Up Costs?

- Key Takeaways

- The Bottom Line

How to Get Bad Credit Bridging Loans: A Complete Guide

Finding yourself in need of a loan with bad credit can feel like hitting a financial brick wall. Yet, in the UK’s ever-adaptable lending landscape, bad credit isn’t the end of the road.

Particularly when it comes to bridging loans, your credit score may not be the deal-breaker you fear it is.

Though a low score could add some complexity to the loan process, it’s more of a speed bump than a barricade.

This article will guide you through the nitty-gritty of bad credit bridging loans in the UK, shedding light on how these loans can serve as a lifeline for you or your business.

What is a Bad Credit Bridging Loan?

A bad credit bridging loan is a short-term loan that uses property as security. You might seek one to cover a financial gap, complete property sales, or fund home improvements.

The loan usually requires repayment within 18 months and often receives quicker approval compared to traditional mortgages.

Regardless of your credit score, the core principles of bridging loans remain unchanged. The catch? If you have bad credit, you might be facing higher interest rates.

Can You Secure a Bridging Loan Despite Bad Credit?

Yes, you can.

Bridging loans are short-term by nature and depend on a clear exit strategy for repayment. Lenders swiftly evaluate your application, focusing not just on your credit score but also on how you plan to repay the loan.

Be aware, though, that not all lenders are open to applicants with bad credit. The quality of your exit strategy also factors into the lender’s decision.

What Credit Issues are Generally Acceptable?

You might be wondering what kinds of credit issues are generally accepted by bridging loan providers. Here’s a quick rundown:

- County Court Judgements (CCJs)

- Individual Voluntary Arrangements (IVAs)

- Past Bankruptcies

- Defaults and Late Payments

- Debt Management Plans (DMPs)

- Debt Relief Orders (DROs)

- Home Repossession

- History of Payday Loans

However, remember that having a solid exit strategy is crucial regardless of your credit situation.

Why Are Bridging Loan Lenders More Lenient with Bad Credit?

The reason bridging loan lenders can afford to be more lenient is that bridging finance is a type of ‘unregulated‘ loan.

This means that the lender can tailor the loan terms to fit your specific needs, assessing your application on an individual basis.

Generally, lenders will evaluate your application based on the strength of the investment opportunity rather than solely on your credit history. Adverse credit becomes a deal-breaker only if it jeopardises your exit strategy.

Can You Skip the Credit Check for a Bridging Loan?

No, you can’t bypass a credit check when applying for a bridging loan. Lenders conduct comprehensive evaluations and a credit check is part of this process.

But remember, the lenders aren’t just eyeing your credit score; they’re also scrutinising your overall loan application, including your current income.

A well-prepared application can outweigh a low credit score, leading to loan approval.

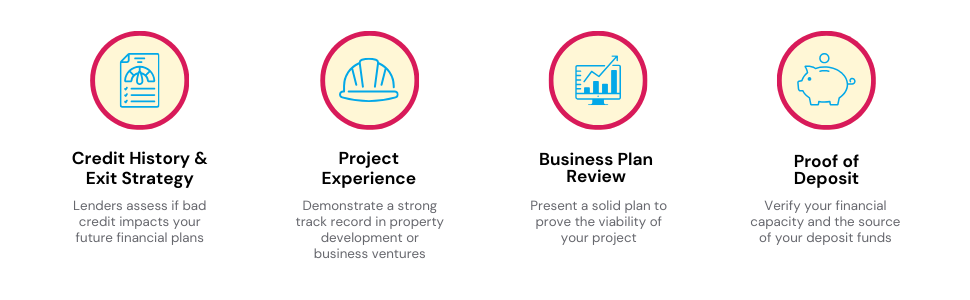

What Will Lenders Check?

First off, lenders want to know if your bad credit could mess up your exit strategy. Say you plan to remortgage; they’ll dig deep to see if your credit history could stop you from getting a new mortgage.

If you’re borrowing for property development, be prepared to show a strong record or experience in the field.

And if it’s a business venture, having a solid business plan is a must. The lender will scrutinise it to gauge the project’s strength.

Last but not least, lenders will ask you to prove you’ve got enough money for the deposit. They’ll also want to know where that money came from.

How to Boost Your Approval Odds

Bad credit doesn’t have to spell disaster. There are ways to increase your approval odds:

- Putting down a hefty deposit – Starting with a deposit of 40% or more can put you in a favourable position for the best deals.

- Crafting a compelling business plan – If you’re applying for a business venture, a well-detailed business plan can demonstrate the viability of your investment.

- Showing experience in property development – Lenders are more likely to favour those who have a proven track record in property development.

- Using assets to secure the loan – Collateral can reduce the lender’s risk, potentially making better deals available to you.

When is Bad Credit a Deal-Breaker?

Sure, some credit issues are more troubling than others.

Lenders focus on how your credit might mess up your repayment or exit strategy.

Lighter issues like missed payments or no credit history are usually forgivable, especially if you’ve got a solid exit plan and a big deposit.

But watch out for red flags like:

- Recent bankruptcy

- Recent home repossession

- Active debt management schemes

- Current County Court Judgements (CCJs)

If these problems are far behind you and your exit strategy is strong, you still have a shot at approval.

How Much Can You Borrow?

Your credit score won’t limit your borrowing potential. Lenders focus squarely on your exit strategy.

If your plan stands strong and bad credit doesn’t compromise it, you can secure the loan amount you require.

Use the bridging loan calculator below for an initial estimate of your monthly repayments and total interest charges. Adjust the LTV or loan term to see its impact on your repayment plan.

[Embedded Bridging Loans Calculator/Link]

While the calculator offers a useful starting point, don’t make it your only resource. Consulting a specialist broker can confirm your calculations and steer you towards the best deal on the market.

What’s the Interest Rate?

If you’ve had some credit hiccups, don’t fret. You might qualify for a monthly interest rate as low as 0.4%. Common rates for people in your situation hover between 0.4% and 2%.

The key is your loan-to-value (LTV) ratio: The lower it is, the better your chances of snagging a low rate. So, if your LTV is 50% or less, you’re in prime territory for the lowest rates.

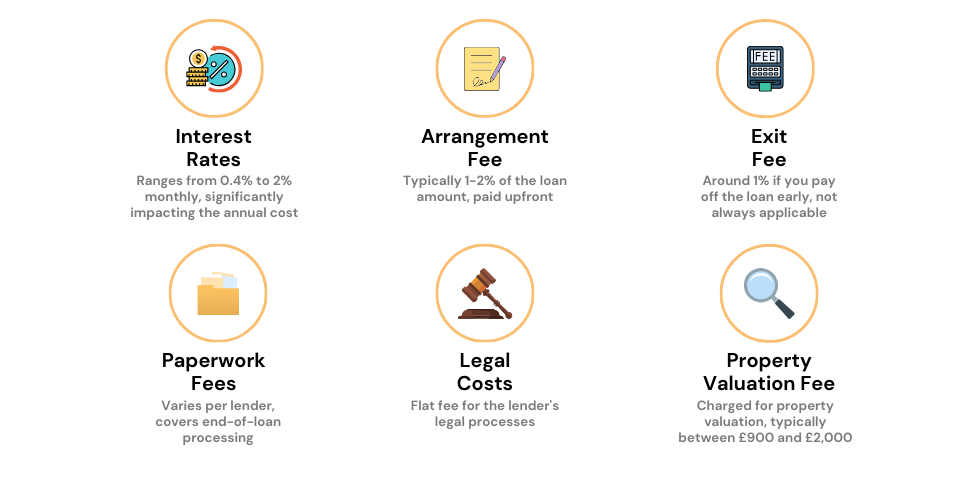

What About Other Costs?

When it comes to bridging loans, the interest rate isn’t the only cost you need to think about. Other fees might sneak up on you if you’re not careful. You should also plan for:

Arrangement Fees

Typically, you’ll be forking out 1-2% of the loan amount for the lender to get the ball rolling.

Here’s a perk: Some lenders allow you to add this fee to your loan amount, saving you from an upfront payment.

Exit Fees

The trend of charging exit fees is dwindling as lenders vie for your business. If an exit fee is levied, it’s usually around 1% of the loan or equal to one month’s interest.

The good news? We collaborate with lenders who usually waive this fee altogether.

Broker Fees

While many brokers will invoice you 1-1.5% of the loan for their setup services, you’ll be pleased to know we provide this service at no extra cost to you.

It’s always worth shopping around to get the most bang for your buck.

Valuation Fees

Anticipate a charge for a professional property valuation, generally carried out by a surveyor picked by your lender.

This step is crucial to determine the accurate value of the property you’re interested in.

Legal Fees

You’re on the hook for legal fees both for yourself and your lender. Usually, these costs surface towards the end of the process.

Note that a part of these fees is often payable before the loan is completed and can’t be rolled into the loan.

Will Bad Credit Ramp Up Costs?

Not necessarily.

You might face fewer options, but bad credit doesn’t always mean you’ll pay more. The rate you get depends on many factors, and your credit history may not even be a big deal.

Key Takeaways

- Bad credit isn’t an automatic disqualifier for securing a bridging loan in the UK; it’s more of a speed bump than a roadblock.

- Bridging loans requires a strong exit strategy for repayment, which holds more weight than your credit score during the application process.

- Credit issues like CCJs, IVAs, and past bankruptcies are generally acceptable; however, current issues like active debt management schemes could be deal-breakers.

- Besides interest rates, be prepared for additional costs like arrangement fees, valuation fees, and legal fees when applying for a bridging loan.

- Working with an experienced bad credit bridging finance broker improves your chances of securing the loan at optimal rates.

The Bottom Line

Sorting out a bridging loan with bad credit needn’t be a maze of confusion.

When you team up with a seasoned bad credit bridging finance broker, you not only sidestep stress and save time, but you also stand a better chance of securing approval at optimal rates.

Ready to move forward? Fill in our quick form today and we’ll connect you with a seasoned bridging loan broker for a free, no-obligation consultation.

Get Matched With Your Dream Mortgage Advisor...

Frequently asked questions

Is a bridging loan risky?

While bridging loans come with their own set of risks, you can manage these effectively with a solid exit strategy. Collaborating with an experienced bridging loan advisor can help you minimise risks and ensure you’re well-prepared.

What are some alternatives to bridging loans?

You can consider other options like residential mortgages, buy-to-let mortgages, and secured loans as alternatives to bridging loans.

How much is the minimum deposit for a bridging loan?

The minimum deposit generally varies depending on the lender and your financial situation, but it’s crucial to consult with an expert to determine the exact amount you’ll need.

What's a non-status bridging loan?

In a non-status bridging loan, the loan amount is secured against an asset, often property. The asset’s value and liquidity are key factors that lenders look at. These loans typically have high-interest rates, but your income is usually less of a concern for approval.

Is proof of income necessary for a bridging loan?

Proof of income is not always a prerequisite for a bridging loan. What lenders often focus on is the strength of your exit strategy. If that’s robust, you may not need to provide income evidence.

What if you have CCJs or defaults?

A County Court Judgement (CCJ) or defaults won’t necessarily raise your loan cost. Some lenders even offer up to 80% LTV if those issues are settled during the application process.

What about second-charge loans with bad credit?

You can get a second-charge bridging loan even with poor credit, as long as you have a solid exit strategy.

Be cautious, though. If you have recent arrears, the primary lender may not give their consent. In these cases, other options like an equitable charge might be available, albeit at higher rates.

Can I get a commercial bridging loan with bad credit?

Yes, especially if you own or invest in commercial property. The key factor is your exit strategy—it has to be rock-solid.