- How Strict Is Leeds Building Society With Mortgages?

- How Long Does Leeds Building Society Take to Approve Mortgages?

- What Should I Do If Leeds Building Society Declines My Mortgage?

- Can I Appeal a Leeds Building Society Mortgage Rejection?

- When Should I Get Expert Advice?

- Why Does Leeds Building Society Decline Mortgage Applications?

- When to Reapply for a Mortgage After Rejection?

- The Bottom Line

Refused Mortgage by Leeds Building Society: Your Next Steps

Receiving a mortgage refusal can be a tough pill to swallow.

It can make you feel confused and let down, and you might wonder where things went wrong.

But getting turned down for a mortgage happens more often than you might think, and it’s not the end of your path to owning a home.

In this guide, we’ll explore the common reasons why Leeds Building Society may have declined your application. We’ll look at their lending criteria and how they could impact different types of applicants, especially those who may have minor credit issues.

How Strict Is Leeds Building Society With Mortgages?

Leeds Building Society checks mortgage applications carefully. They try to find a balance: they want to lend money safely but also understand that everyone’s situation is different.

But how does this affect various applicants, especially those who might not have a perfect credit history?

For applicants with minor credit issues, Leeds Building Society can sometimes be more accommodating than you think.

They understand that a one-off late payment a few years ago shouldn’t overshadow your current financial stability.

But they are more careful if your credit problems are bigger. They need to make sure that lending money to you is a safe choice for both you and them.

Basically, Leeds Building Society is strict, but they also try to be fair to different kinds of people applying for mortgages. Knowing this can help you make your application match what they’re looking for, which could improve your chances of getting the mortgage.

How Long Does Leeds Building Society Take to Approve Mortgages?

When you apply for a mortgage with Leeds Building Society, the time it takes to get approval can vary. Generally, the process takes between 3 to 6 weeks.

However, this timeframe isn’t set in stone and can change based on several factors.

Firstly, your credit history plays a significant role. A straightforward, clear credit history can speed up the process.

On the other hand, if there are complexities or issues in your credit report, it might take longer for the Society to assess the risks and make a decision.

Secondly, the complexity of your application matters. Standard applications, where everything is clear-cut and well-documented, tend to move faster through the approval stages.

More complex cases, like those involving self-employment or unique property types, might require additional time for thorough evaluation.

What Should I Do If Leeds Building Society Declines My Mortgage?

If Leeds Building Society declines your mortgage application, the first thing to do is pause and take a breath.

It’s natural to feel disheartened, but rushing into another application isn’t always the best move. This could impact your credit score and might not address the reasons for the initial decline.

The most important step is to understand why your application was declined. Leeds Building Society will provide reasons for their decision, and it’s crucial to take these on board.

Knowing exactly what went wrong can help you make the necessary adjustments, whether it’s improving your credit score, saving a larger deposit, or rectifying errors in your application.

Can I Appeal a Leeds Building Society Mortgage Rejection?

Yes, you can appeal a Leeds Building Society mortgage rejection. But it’s important to know the right way to do it.

First, find out why they turned you down. If you think they made a mistake or didn’t have the latest information, or if you have new information that could make them change their mind, then challenging their decision could be a good idea.

To challenge it, you should talk to the Leeds Building Society. Tell them about your situation and give them any new papers that help your case.

Make sure to be clear and to the point when you talk to them. But remember, challenging their decision doesn’t always mean they’ll change their mind. Sometimes, it might be better to get advice from a good mortgage advisor or look at other lenders.

When Should I Get Expert Advice?

Getting expert mortgage advice is crucial in certain situations, especially if you’ve experienced a mortgage rejection from Leeds Building Society.

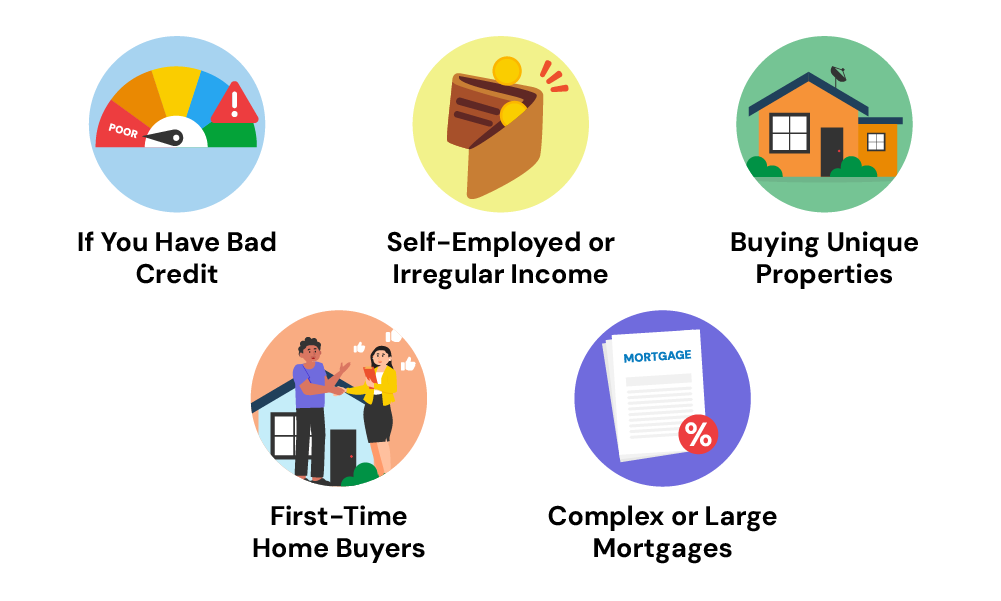

Here’s when you should consider consulting a mortgage broker:

If You Have Bad Credit

A mortgage broker can be a great help if your credit history isn’t perfect. They know lenders who are more flexible with credit issues and can advise you on improving your credit for future applications.

Self-Employed or Irregular Income

For those with non-standard incomes, like the self-employed, a broker can be invaluable. They understand how different lenders view varied income sources and can help you present your finances effectively.

Buying Unique Properties

If you’re eyeing a unique or unusual property, such as a listed building, expert advice can guide you to the right lenders who specialise in these properties.

If you’re new to the property market, a mortgage advisor can simplify the process for you. They can explain all your options, including helpful government schemes.

Complex or Large Mortgages

For bigger or more complex loans, like buy-to-let or mortgages involving several people, a broker’s expertise is key. They can handle the complex details to find a suitable loan for your needs.

In all these scenarios, a mortgage broker doesn’t just give advice; they also save you time and ease stress.

They tailor their approach to match your situation with a suitable lender, enhancing your chances of getting a mortgage.

Each mortgage application is unique, and getting the right advice can be crucial for success.

Why Does Leeds Building Society Decline Mortgage Applications?

Applying for a mortgage with Leeds Building Society and getting a ‘no’ can be disheartening. Often, it’s down to certain issues in your application.

Let’s go through some common reasons you might face rejection:

Your Credit History Isn’t Up to Scratch

Leeds Building Society pays close attention to your credit history. Missed payments, defaults, or County Court Judgements (CCJs) can raise red flags.

Before reapplying, it’s vital to check your credit report for mistakes and improve your credit score.

You’re Self-Employed with Inconsistent Income

For self-employed individuals, showing consistent income is key. Leeds Building Society typically wants to see at least two years of stable accounts.

However, if you’re looking to base your affordability on just the most recent year’s accounts, especially if there’s a variance in earnings, this could be problematic.

The Property You’re Buying Raises Concerns

Issues might not always be about your finances; sometimes, it’s the property itself.

Leeds Building Society might decline your application if their valuation shows the property is worth less than your offer or if it’s a certain type, like British Iron & Steel Federation construction or non-repaired prefabricated concrete. If they find major issues like structural problems, that’s another red flag.

The Source of Your Deposit Raises Eyebrows

Where your deposit comes from matters too. Leeds Building Society may hesitate if your deposit comes from an unsecured loan or sources outside the EU/EEA. They usually prefer traditional sources like savings or family gifts.

Your Main Income Is from Benefits

Relying primarily on benefits for income can be tricky when applying for a mortgage with Leeds Building Society. They often look for more traditional income sources.

Other Factors

There are other reasons too, like being on a zero-hours contract, having a stipend income, being a professional landlord, or using cryptocurrency for your deposit. Each of these could lead to a rejection.

Remember, if you’re unsure about any part of your application, speaking to a mortgage broker can be a big help. They know the ins and outs of Leeds Building Society’s criteria and can guide you through the process, improving your chances of a successful application.

When to Reapply for a Mortgage After Rejection?

If Leeds Building Society has turned down your mortgage application, you might be wondering when you should try again.

The key is to wait until you’ve properly tackled the issues that led to your initial rejection. Here’s what to consider:

Addressing Credit Issues

If your application was rejected due to credit problems, focus on improving your credit score first.

This might involve clearing outstanding debts, ensuring all bills are paid on time, and correcting any inaccuracies in your credit report.

Depending on the severity of the issues, this process could take several months or even longer.

Resolving Income or Employment Issues

For self-employed individuals or those with complex income situations, it’s important to gather more consistent and comprehensive financial records.

You may need to wait until you have at least two years of stable income documentation to reapply.

Property-related Concerns

If the rejection was due to the property you were looking to buy, you’ll need to either resolve the issues with the property or look for a different property that meets Leeds Building Society’s criteria.

Deposit Sources

If the source of your deposit was a concern, work on securing a more acceptable source of funds, such as savings or a family gift.

Remember, reapplying too soon without addressing these issues might lead to another rejection. Take your time to improve your application’s strength.

The Bottom Line

If Leeds Building Society doesn’t approve your mortgage, it’s not the end of your home-buying journey. This guide has shown why mortgages can be declined and what you can do to make things better.

We’ve covered everything from credit issues to details about your application, like the house you want to buy and where your down payment comes from.

First, you need to understand why they said no. Then, work on fixing those problems before you apply again.

This might mean making your credit score better, sorting out job or income proof, or dealing with issues about how much the property is worth.

A mortgage advisor can help you out. They can offer advice just for you, find different mortgage options, and help make your next application go more smoothly.

If Leeds Building Society turned down your mortgage, don’t lose hope. By taking the right steps and getting good advice, you can improve your chances of getting a mortgage later.

If you need expert help, reach out to us. We can put you in touch with a broker who’s qualified by the FCA and who will work with you to find a solution that’s right for your special situation, helping you move forward confidently.

Get Matched With Your Dream Mortgage Advisor...

Frequently Asked Questions

What are the deposit requirements for Leeds Building Society mortgages?

Leeds Building Society usually asks for at least 10% of the home’s price as a deposit. This might change based on how much the house costs and the type of mortgage you choose.

How much can I borrow from Leeds Building Society?

The amount Leeds Building Society will lend to you is usually based on a multiple of your income, typically around 4.5 to 4.75 times your total annual income. This can change based on your situation and how they judge your ability to pay back the loan.

How much address history is needed for a Leeds Building Society mortgage?

Leeds Building Society generally asks for at least two years of address history in the UK. This helps them assess your stability and credit history.

What does a 'Referred' mortgage status mean at Leeds Building Society?

If Leeds Building Society says your mortgage is ‘referred’, it means they’re looking at it more closely. The underwriting team checks it out. This is normal and doesn’t always mean there’s a problem. It could be because your application is complex or they need to check certain things more carefully.